Transfer of Homestead Assessment Difference Reset Form Print Pcpao

What is the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

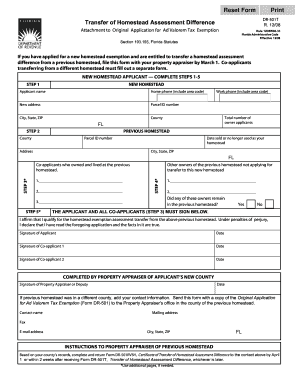

The Transfer Of Homestead Assessment Difference Reset Form Print Pcpao is a crucial document used in the United States for property tax purposes. This form allows property owners to reset the assessed value of their homestead property when there is a transfer of ownership. It is particularly relevant when a property changes hands, ensuring that the new owner can benefit from any applicable homestead exemptions. Understanding this form is essential for homeowners looking to maintain their tax benefits after a property transfer.

How to use the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

Using the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao involves several straightforward steps. First, ensure you have the most current version of the form, which can typically be obtained from your local property appraiser's office or their website. Next, fill out the required information, including property details and the names of the previous and new owners. After completing the form, submit it to the appropriate local authority, either online or by mail, depending on your jurisdiction's guidelines.

Steps to complete the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

Completing the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as the property deed and identification.

- Access the form from your local property appraiser's website or office.

- Fill in the property information, including the address and parcel number.

- Provide the names and contact information of both the previous and new property owners.

- Sign and date the form to confirm the information is accurate.

- Submit the completed form to the local property appraiser's office, ensuring you keep a copy for your records.

Key elements of the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

The Transfer Of Homestead Assessment Difference Reset Form Print Pcpao includes several key elements that are essential for its validity. These elements typically consist of:

- Property Identification: This includes the property address and parcel number.

- Owner Information: Names and contact details of both the previous and new owners.

- Signature: The form must be signed by the new owner to validate the request.

- Date of Transfer: This indicates when the ownership transfer occurred.

Eligibility Criteria

To successfully utilize the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao, certain eligibility criteria must be met. Generally, the new property owner must be eligible for homestead exemption, which often includes being a permanent resident of the property. Additionally, the property must qualify as a homestead under state law, which typically involves using the property as a primary residence. It is advisable to check local regulations to ensure compliance with all requirements.

Form Submission Methods

Submitting the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao can be done through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic submission through their official websites.

- Mail: You can print the completed form and send it via postal mail to the local property appraiser's office.

- In-Person: Submitting the form in person at the property appraiser's office can also be an option, allowing for immediate confirmation of receipt.

Quick guide on how to complete transfer of homestead assessment difference reset form print pcpao

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without hassles. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance your document-related workflows today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Select pertinent sections of the documents or redact sensitive content with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a regular handwritten signature.

- Review all details and click on the Done button to secure your modifications.

- Decide how you wish to share your form, via email, SMS, or a sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

Create this form in 5 minutes!

How to create an eSignature for the transfer of homestead assessment difference reset form print pcpao

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

The Transfer Of Homestead Assessment Difference Reset Form Print Pcpao is a document used to apply for a reset of homestead assessment differences in property taxes. This form is essential for property owners who wish to rectify their assessment records. By using this form, you can ensure accurate tax assessments based on your property's value.

-

How can airSlate SignNow help with the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

airSlate SignNow streamlines the process of completing and signing the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao. Our platform allows you to easily fill out the form online, eSign it, and send it securely. This eliminates the hassle of printing and physically mailing the documents.

-

Is there a cost associated with using airSlate SignNow for the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

Yes, there is a cost; however, airSlate SignNow offers a cost-effective solution for eSigning documents, including the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao. Our pricing plans are designed to fit various business needs, ensuring you get great value while simplifying your document management processes.

-

What features does airSlate SignNow offer for managing the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

AirSlate SignNow offers a variety of features for managing the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao, including customizable templates, audit trails, and real-time tracking. These features enhance the user experience and help ensure that your documents are completed accurately and securely.

-

Can I integrate airSlate SignNow with other platforms for the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

Yes, airSlate SignNow supports integrations with various platforms, allowing for seamless workflow when managing the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao. You can connect with CRM systems, cloud storage services, and more to streamline your document processes.

-

What are the benefits of using airSlate SignNow for the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

Using airSlate SignNow for the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao offers numerous benefits, including increased efficiency, reduced processing time, and secure electronic storage of your documents. This makes it easier to manage important tax documents while ensuring compliance with legal requirements.

-

How secure is my information when using airSlate SignNow for the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao?

AirSlate SignNow prioritizes the security of your information. Our platform utilizes state-of-the-art encryption and security protocols to protect your data when filling out and submitting the Transfer Of Homestead Assessment Difference Reset Form Print Pcpao. You can trust that your sensitive information is kept safe.

Get more for Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

- Fill out the release form rushmore tramway adventures

- Collection instruction form baycorp baycorp co

- Ttb f 500024 excise tax return ttb f 500024 excise tax return ttb form

- Bid bond request form your name contractor obligee

- Ultracool 0020 0040 5060hz binfoservb ag infoserv form

- Formulaire 4001

- Underground butcher form

- Electricity quiz answers form

Find out other Transfer Of Homestead Assessment Difference Reset Form Print Pcpao

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors