Form it 203 Nonresident and Part Year Resident Income Tax Return Tax Year 2024

What is the Form IT-203 Nonresident and Part Year Resident Income Tax Return?

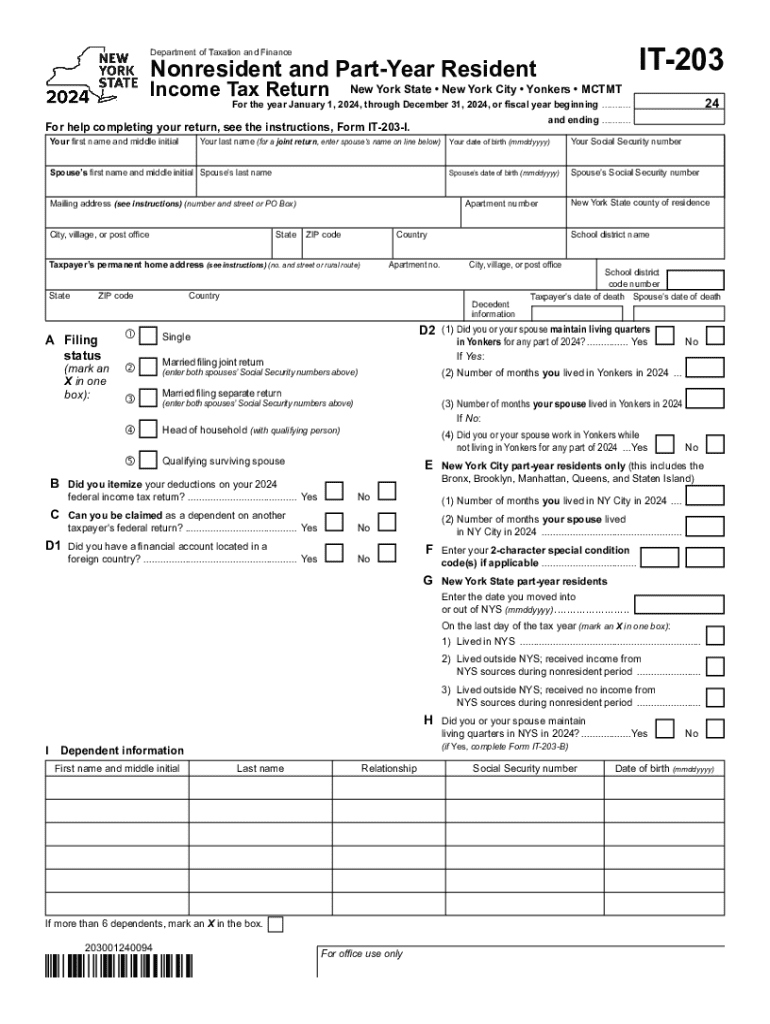

The Form IT-203 is a tax document used by nonresidents and part-year residents of New York to report income earned within the state. This form is essential for individuals who do not qualify as full-year residents but have earned income from New York sources during the tax year. The IT-203 allows taxpayers to calculate their tax liability based on the income attributable to New York State, ensuring compliance with state tax regulations.

Steps to Complete the Form IT-203 Nonresident and Part Year Resident Income Tax Return

Completing the Form IT-203 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and ensure you are eligible to file using IT-203.

- Fill out the personal information section, including your name, address, and taxpayer identification number.

- Report your income from New York sources, making sure to include all relevant income types.

- Calculate any deductions or credits you may be eligible for, which can reduce your taxable income.

- Complete the tax calculation section to determine your total tax liability.

- Sign and date the form before submitting it to the appropriate tax authority.

How to Obtain the Form IT-203 Nonresident and Part Year Resident Income Tax Return

The Form IT-203 can be obtained through several methods:

- Visit the New York State Department of Taxation and Finance website to download the form in PDF format.

- Request a physical copy by contacting the New York State Department of Taxation and Finance directly.

- Access local tax offices or libraries where printed forms may be available.

Key Elements of the Form IT-203 Nonresident and Part Year Resident Income Tax Return

Understanding the key elements of the Form IT-203 is crucial for accurate filing:

- Personal Information: Includes your name, address, and Social Security number.

- Income Reporting: Sections dedicated to detailing all income earned from New York sources.

- Deductions and Credits: Areas to claim any applicable deductions or credits that may lower your tax obligation.

- Tax Calculation: A section where you compute your total tax based on reported income and applicable rates.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form IT-203:

- The standard filing deadline for the IT-203 is typically April 15 of the year following the tax year.

- If you are unable to meet the deadline, you may request an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Eligibility Criteria for the Form IT-203 Nonresident and Part Year Resident Income Tax Return

To file the Form IT-203, you must meet specific eligibility criteria:

- You must be a nonresident or part-year resident of New York State.

- You must have earned income from New York sources during the tax year.

- Full-year residents should not use this form, as they are required to file a different tax return.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 nonresident and part year resident income tax return tax year 771988398

Create this form in 5 minutes!

How to create an eSignature for the form it 203 nonresident and part year resident income tax return tax year 771988398

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York IT 203 tax form?

The New York IT 203 tax form is used by non-residents to report income earned in New York State. It is essential for individuals who have income sourced from New York but do not reside in the state. Completing this form accurately ensures compliance with state tax laws.

-

How can airSlate SignNow help with the New York IT 203 tax form?

airSlate SignNow simplifies the process of completing and eSigning the New York IT 203 tax form. Our platform allows users to fill out the form digitally, ensuring that all necessary information is included and correctly formatted. This streamlines the submission process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the New York IT 203 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that make completing the New York IT 203 tax form easier and more efficient. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax forms like the New York IT 203?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools are designed to enhance the user experience when filling out the New York IT 203 tax form. Additionally, our platform ensures that your documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows users to easily import and export data related to the New York IT 203 tax form, making the overall tax preparation process more efficient.

-

What are the benefits of using airSlate SignNow for the New York IT 203 tax form?

Using airSlate SignNow for the New York IT 203 tax form offers numerous benefits, including time savings and enhanced accuracy. Our platform reduces the hassle of paperwork and allows for quick eSigning, which can expedite the filing process. Additionally, our user-friendly interface makes it accessible for everyone.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, including the New York IT 203 tax form, are protected. We utilize advanced encryption and security protocols to safeguard your information. You can trust that your data is safe with us.

Get more for Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year

Find out other Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free