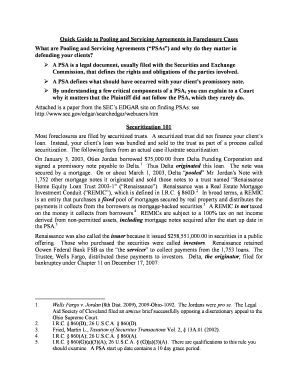

Quick Guide to Pooling and Servicing Agreements in Foreclosure Cases Form

Understanding Pooling and Servicing Agreements in Foreclosure Cases

Pooling and servicing agreements (PSAs) are essential documents in the mortgage-backed securities market. They outline the terms under which mortgage loans are pooled together and serviced. In foreclosure cases, these agreements play a critical role in determining how loans are managed and the rights of various parties involved. PSAs specify the responsibilities of the servicer, including collecting payments, managing escrow accounts, and handling defaults. Understanding these agreements is vital for homeowners facing foreclosure, as they can impact the outcome of their cases.

Key Elements of Pooling and Servicing Agreements

Several key elements define pooling and servicing agreements. These include:

- Servicer Responsibilities: The PSA outlines the servicer's duties, such as payment collection and communication with borrowers.

- Loan Pool Structure: The agreement details how loans are grouped and the criteria for inclusion in the pool.

- Default Management: Procedures for managing defaults, including foreclosure processes and loss mitigation strategies, are specified.

- Investor Rights: The rights of investors in the mortgage-backed securities are clearly defined, including how proceeds from foreclosures are distributed.

Steps to Navigate Pooling and Servicing Agreements in Foreclosure Cases

When dealing with a foreclosure case, understanding the steps involved in navigating pooling and servicing agreements can be beneficial. Here are some steps to consider:

- Review the PSA: Obtain and carefully review the pooling and servicing agreement related to your mortgage.

- Identify the Servicer: Determine who the servicer is and understand their role in managing your loan.

- Understand Your Rights: Familiarize yourself with your rights as a borrower under the PSA.

- Seek Legal Advice: Consult with a legal professional who specializes in foreclosure and mortgage law to interpret the PSA effectively.

Legal Considerations Surrounding Pooling and Servicing Agreements

Legal considerations are crucial when dealing with pooling and servicing agreements in foreclosure cases. These agreements must comply with federal and state regulations, which can vary significantly. Understanding the legal framework can help borrowers protect their rights. Key legal aspects include:

- Compliance with Regulations: Ensure that the PSA complies with the relevant laws governing mortgage servicing and foreclosure.

- Disclosure Requirements: PSAs often include specific disclosure requirements that servicers must follow, ensuring transparency for borrowers.

- Litigation Risks: Be aware of potential litigation risks associated with disputes over the terms of the PSA or servicer actions.

Examples of Pooling and Servicing Agreement Applications

Understanding how pooling and servicing agreements apply in real-world scenarios can provide valuable insights. Here are a few examples:

- Loan Modifications: PSAs can influence the process and eligibility for loan modifications during foreclosure proceedings.

- Foreclosure Sales: The agreement may dictate how proceeds from foreclosure sales are distributed among investors and servicers.

- Investor Reporting: Servicers are often required to provide regular reports to investors regarding loan performance and default rates.

Obtaining Pooling and Servicing Agreements

To obtain a pooling and servicing agreement, you may need to follow specific steps:

- Contact Your Lender: Reach out to your mortgage lender or servicer to request a copy of the PSA.

- Check Public Records: Some PSAs may be available through public records, especially if they involve publicly traded securities.

- Consult Legal Resources: Legal professionals may have access to databases that contain these agreements.

Quick guide on how to complete quick guide to pooling and servicing agreements in foreclosure cases

Complete Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases effortlessly on any device

Online document management has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to alter and eSign Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases seamlessly

- Obtain Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases and then click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your amendments.

- Select your preferred method of sharing your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases and facilitate exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quick guide to pooling and servicing agreements in foreclosure cases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases?

The Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases provides essential insights into the legal frameworks and processes involved in managing foreclosure cases. It outlines the roles of various parties and the importance of these agreements in ensuring compliance and efficiency. This guide is crucial for anyone involved in real estate or foreclosure management.

-

How can airSlate SignNow assist with the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases?

airSlate SignNow offers a streamlined platform for eSigning and managing documents related to the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases. Our solution simplifies the document workflow, ensuring that all parties can sign and access necessary agreements quickly and securely. This efficiency is vital in the fast-paced world of foreclosure management.

-

What are the pricing options for using airSlate SignNow in relation to the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases?

airSlate SignNow provides flexible pricing plans that cater to different business needs, especially for those utilizing the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases. Our plans are designed to be cost-effective, allowing businesses to choose a package that fits their budget while accessing all necessary features for document management and eSigning.

-

What features does airSlate SignNow offer for managing agreements in foreclosure cases?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases. These tools help streamline the process, reduce errors, and ensure that all documents are easily accessible and compliant with legal standards.

-

What are the benefits of using airSlate SignNow for the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases?

Using airSlate SignNow for the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases enhances efficiency and reduces turnaround times for document signing. Our platform ensures that all stakeholders can collaborate seamlessly, leading to faster resolutions in foreclosure processes. Additionally, the security features protect sensitive information throughout the transaction.

-

Can airSlate SignNow integrate with other tools for managing foreclosure cases?

Yes, airSlate SignNow offers integrations with various tools and platforms that are commonly used in managing foreclosure cases. This capability allows users to incorporate the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases into their existing workflows, enhancing productivity and ensuring that all necessary documents are synchronized across systems.

-

Is airSlate SignNow user-friendly for those unfamiliar with the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible even for those who may not be familiar with the Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases. Our intuitive interface and comprehensive support resources ensure that users can easily navigate the platform and utilize its features effectively.

Get more for Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases

Find out other Quick Guide To Pooling And Servicing Agreements In Foreclosure Cases

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed