IRS Form 8862 Walkthrough Information to Claim YouTube 2023

Understanding IRS Form 8862

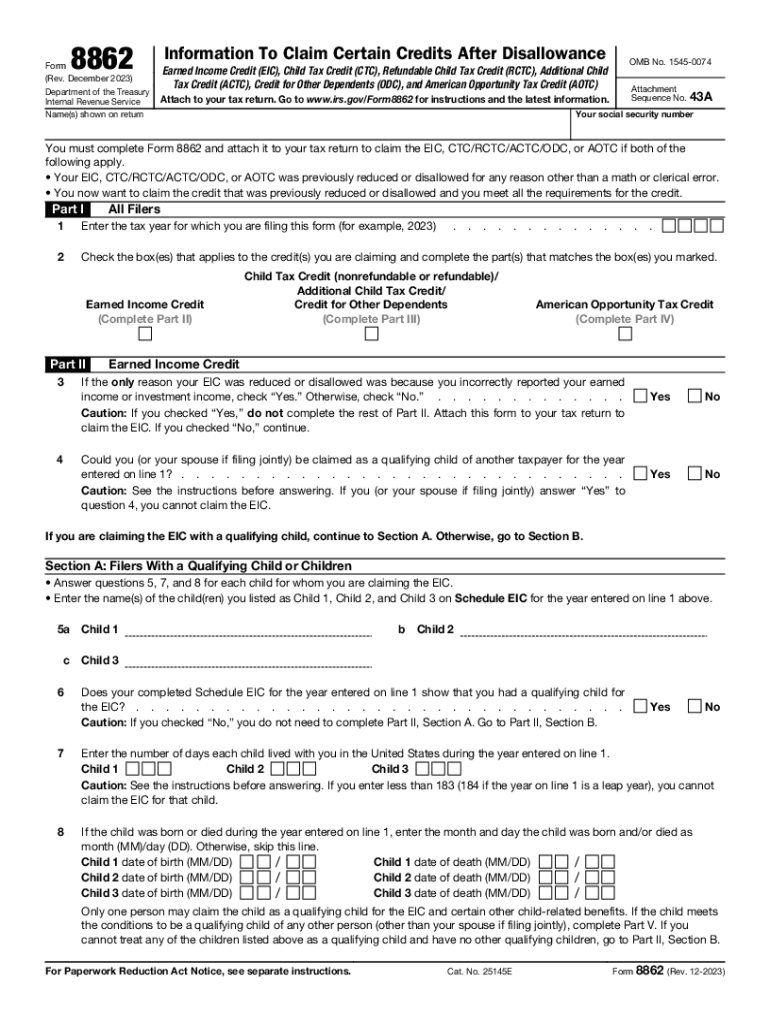

IRS Form 8862, also known as the Information to Claim Certain Credits After Disallowance, is a tax form used by individuals who have previously had their claims for certain tax credits disallowed. This form allows taxpayers to re-establish their eligibility for credits such as the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). It is essential for those who have faced disallowance in previous years to complete this form accurately to ensure they can claim these credits in the future.

Steps to Complete IRS Form 8862

Completing Form 8862 involves several key steps:

- Gather necessary documentation, including prior tax returns and any correspondence from the IRS regarding disallowed credits.

- Provide personal information, including your name, Social Security number, and filing status.

- Indicate the tax year for which you are claiming the credits.

- Answer questions regarding your eligibility for the credits you are attempting to claim.

- Sign and date the form to certify that the information provided is accurate.

Eligibility Criteria for IRS Form 8862

To be eligible to file Form 8862, you must meet specific criteria:

- You must have had your claim for a tax credit disallowed in a previous year.

- You need to demonstrate that you meet the eligibility requirements for the credit you are claiming.

- Ensure that you are not currently under audit or investigation by the IRS for the tax year in question.

Form Submission Methods for IRS Form 8862

IRS Form 8862 can be submitted in various ways:

- Electronically through tax preparation software that supports the form.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at designated IRS offices, although this may require an appointment.

Required Documents for Filing IRS Form 8862

When filing Form 8862, you will need to provide several supporting documents:

- Previous tax returns that include the disallowed credits.

- Any IRS notices regarding the disallowance of credits.

- Documentation proving your eligibility for the credits, such as income statements and proof of dependents.

Filing Deadlines for IRS Form 8862

It is important to be aware of the filing deadlines for Form 8862:

- The form must be submitted along with your tax return for the year you are claiming the credits.

- Typically, the deadline for filing your federal tax return is April 15 of the following year, unless it falls on a weekend or holiday.

- Extensions may be available, but Form 8862 must still be filed within the required timeframe to claim the credits.

Quick guide on how to complete irs form 8862 walkthrough information to claim youtube

Accomplish IRS Form 8862 Walkthrough Information To Claim YouTube effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents swiftly without interruptions. Manage IRS Form 8862 Walkthrough Information To Claim YouTube on any platform using the airSlate SignNow Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign IRS Form 8862 Walkthrough Information To Claim YouTube without hassle

- Find IRS Form 8862 Walkthrough Information To Claim YouTube and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow caters to all your document management needs in a few clicks from any device you prefer. Edit and eSign IRS Form 8862 Walkthrough Information To Claim YouTube and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8862 walkthrough information to claim youtube

Create this form in 5 minutes!

How to create an eSignature for the irs form 8862 walkthrough information to claim youtube

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8862 and who needs to file it?

Form 8862 is used to claim the Earned Income Credit (EIC) after it has been disallowed in a previous tax year. If your EIC was denied, you must complete Form 8862 to reestablish your eligibility. Filing this form correctly ensures you can receive credit in future tax returns.

-

How can airSlate SignNow help with submitting Form 8862?

AirSlate SignNow simplifies the process of sending and eSigning documents like Form 8862. With its intuitive interface, you can easily fill out and send Form 8862 for signature, ensuring a quick and hassle-free submission. This feature reduces the chances of errors and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for Form 8862?

Yes, airSlate SignNow offers flexible pricing plans depending on the features you need. Our cost-effective solution provides access to essential tools for efficiently managing documents like Form 8862. You can choose a plan that best suits your business size and requirements.

-

What features does airSlate SignNow offer for document management, including Form 8862?

AirSlate SignNow comes with robust features such as customizable templates, in-app signing, and secure storage. These features streamline the entire process for documents like Form 8862, allowing for better organization and quicker turnaround times. Our platform enhances your document management efficiency signNowly.

-

Can I integrate airSlate SignNow with other software where I store Form 8862?

Absolutely! AirSlate SignNow supports numerous integrations with popular software applications. This means you can easily link airSlate SignNow to your existing systems to manage Form 8862 and other documents seamlessly. The integration ensures your workflow remains uninterrupted and efficient.

-

How secure is my data when using airSlate SignNow for Form 8862?

Data security is a top priority for airSlate SignNow. We utilize advanced encryption and adhere to industry standards to protect your information, including any details on Form 8862. You can confidently manage your documents knowing that your data is safeguarded.

-

What benefits do I get from using airSlate SignNow for Form 8862?

Using airSlate SignNow for Form 8862 allows you to enhance productivity by reducing the time spent on paperwork. Our platform provides an easy-to-use interface and accelerates the signing process, which can lead to faster tax filings. The ability to track documents further adds to the efficiency of your workflow.

Get more for IRS Form 8862 Walkthrough Information To Claim YouTube

- Personal deed form

- Notice commencement form 497311329

- Michigan notice furnishing form

- Quitclaim deed by two individuals to llc michigan form

- Warranty deed from two individuals to llc michigan form

- Michigan lady bird deed form

- Quitclaim deed two individuals to four individuals michigan form

- Trust to individual 497311336 form

Find out other IRS Form 8862 Walkthrough Information To Claim YouTube

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online