Form 8862 2012

What is the Form 8862

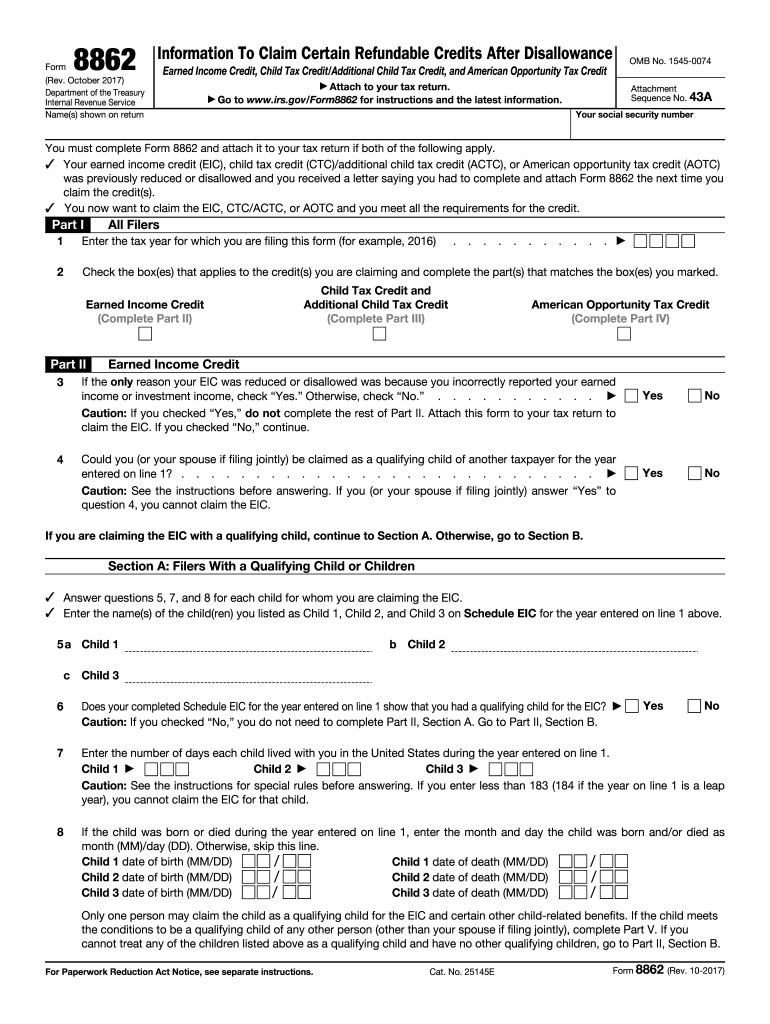

The Form 8862, officially known as the "Information to Claim Certain Credits After Disallowance," is a tax form used by individuals in the United States who have previously had their claims for certain tax credits disallowed. This form is primarily associated with the Earned Income Tax Credit (EITC), Child Tax Credit, and Additional Child Tax Credit. When a taxpayer's claim for these credits has been denied in a prior year, they must complete and submit Form 8862 to the IRS in order to re-establish their eligibility for these credits in the current tax year.

How to use the Form 8862

To effectively use Form 8862, taxpayers should first ensure they meet the eligibility criteria for the credits they are claiming. The form requires detailed information about the taxpayer's situation, including the reasons for the previous disallowance and any changes in circumstances. After completing the form, it should be attached to the taxpayer's federal income tax return. It is important to accurately fill out all sections and provide any necessary documentation to support the claims made on the form.

Steps to complete the Form 8862

Completing Form 8862 involves several key steps:

- Gather necessary documentation, including prior tax returns and any correspondence from the IRS regarding disallowed claims.

- Provide personal information such as name, address, and Social Security number.

- Indicate the tax year for which you are claiming the credits.

- Explain the circumstances that led to the disallowance of your previous claims.

- Sign and date the form, confirming the accuracy of the information provided.

Once completed, attach the form to your tax return and submit it to the IRS.

Eligibility Criteria

To qualify for the credits claimed on Form 8862, taxpayers must meet specific eligibility criteria. This includes having a valid Social Security number, being a U.S. citizen or resident alien, and meeting income thresholds set by the IRS. Additionally, the taxpayer must not have been disqualified from claiming the credits due to fraud or other disqualifying reasons. It is essential to review the IRS guidelines to ensure compliance with these criteria before submitting the form.

Filing Deadlines / Important Dates

The deadlines for filing Form 8862 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, but this does not extend the deadline for any taxes owed. It is crucial to submit Form 8862 along with the tax return by the deadline to ensure that claims for the credits are considered for the current tax year.

Form Submission Methods

Taxpayers have multiple options for submitting Form 8862. The form can be filed electronically as part of an e-filed tax return, which is often the fastest method for processing. Alternatively, taxpayers can choose to mail a paper return, including Form 8862, to the appropriate IRS address based on their location. For those opting to file in person, visiting a local IRS office may also be an option, though appointments may be necessary.

Quick guide on how to complete form 8862 2012

Effortlessly Prepare Form 8862 on Any Device

Online document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Form 8862 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign Form 8862 with Ease

- Obtain Form 8862 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8862 to ensure excellent communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 2012

Create this form in 5 minutes!

How to create an eSignature for the form 8862 2012

How to generate an eSignature for your Form 8862 2012 online

How to generate an electronic signature for your Form 8862 2012 in Chrome

How to generate an eSignature for putting it on the Form 8862 2012 in Gmail

How to make an eSignature for the Form 8862 2012 straight from your mobile device

How to create an eSignature for the Form 8862 2012 on iOS devices

How to create an electronic signature for the Form 8862 2012 on Android OS

People also ask

-

What is Form 8862 and why is it important?

Form 8862 is used by taxpayers to claim the Earned Income Tax Credit (EITC) after having previously been denied. It is essential for individuals who want to ensure they meet the eligibility requirements for the credit. Completing Form 8862 accurately can help in securing the tax benefits you deserve.

-

How can airSlate SignNow help with filling out Form 8862?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing Form 8862. With easy document uploads, eSignature capabilities, and collaboration features, you can efficiently fill out and submit your Form 8862 online without any hassle.

-

Is there a cost associated with using airSlate SignNow for Form 8862?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that provides the features necessary to manage your Form 8862 and other documents efficiently. Pricing is competitive and designed to be cost-effective for all users.

-

What features does airSlate SignNow offer to assist with tax forms like Form 8862?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning to streamline the process of submitting Form 8862. These tools enhance efficiency and ensure that your tax documents are handled securely and accurately.

-

Can I integrate airSlate SignNow with other software for Form 8862 management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, including accounting software and document management systems, to enhance the management of Form 8862. This integration allows for a more cohesive workflow and improves overall productivity.

-

What benefits does airSlate SignNow provide for businesses processing Form 8862?

Using airSlate SignNow for Form 8862 allows businesses to save time and reduce errors by automating the document workflow. The platform’s ease of use and secure signing process also enhance client satisfaction, making it an ideal choice for tax professionals.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 8862?

Yes, airSlate SignNow is committed to maintaining the highest security standards. The platform employs advanced encryption and authentication methods to protect your sensitive documents, including Form 8862, ensuring that your data remains safe throughout the signing process.

Get more for Form 8862

Find out other Form 8862

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement