Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? 2023-2026

What is the Formulario 8300 Del IRS and Why is it Important?

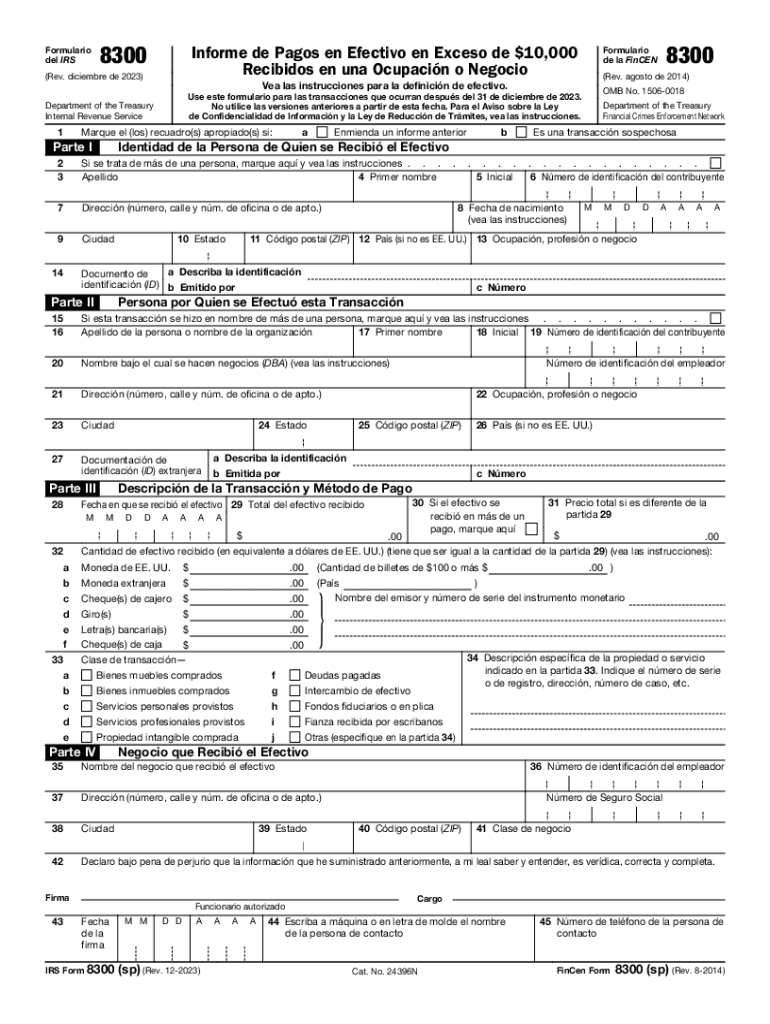

The Formulario 8300, officially known as Form 8300, is a document required by the Internal Revenue Service (IRS) for reporting cash transactions exceeding $10,000. This form is crucial for businesses and individuals who receive large sums of cash, as it helps the IRS track potential money laundering and other illicit activities. By filing this form, entities comply with federal regulations aimed at preventing financial crimes.

Understanding the importance of Form 8300 is essential for maintaining transparency in financial transactions. Failure to report cash transactions can lead to significant penalties, including fines and potential criminal charges. Therefore, ensuring accurate and timely submission of this form is vital for compliance with U.S. law.

Steps to Complete the Formulario 8300 Del IRS

Completing the Formulario 8300 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the identity of the individual or entity making the cash payment, the amount received, and the date of the transaction. Next, fill out the form by entering the required details in the appropriate fields.

After completing the form, review it for any errors or omissions. It is essential to ensure that all information is accurate, as mistakes can lead to complications. Once verified, submit the form to the IRS either electronically or by mail, depending on your preference. Keeping a copy of the submitted form for your records is also advisable.

Legal Use of the Formulario 8300 Del IRS

The legal use of Formulario 8300 is primarily to report cash transactions that exceed $10,000. This requirement is established under the Bank Secrecy Act, which mandates that businesses must report these transactions to help combat money laundering and other financial crimes. Understanding the legal implications of this form is critical for compliance.

Entities that fail to file the form when required may face severe penalties, including monetary fines and potential legal action. It is important for businesses to train employees on the proper handling of cash transactions and ensure they understand when to file Form 8300.

Filing Deadlines and Important Dates for Formulario 8300

Filing deadlines for Formulario 8300 are crucial for compliance with IRS regulations. The form must be filed within 15 days of the cash transaction exceeding $10,000. This timely submission helps avoid penalties and ensures that the IRS has the necessary information to monitor large cash transactions.

It is advisable for businesses to maintain a calendar of important dates related to Form 8300 to ensure timely filing. Keeping track of these deadlines can help prevent oversight and ensure compliance with federal regulations.

Required Documents for Formulario 8300 Del IRS

To complete the Formulario 8300, certain documents and information are required. These include identification details of the person or entity making the cash payment, such as their name, address, and taxpayer identification number. Additionally, details about the transaction itself, including the amount and date, must be accurately reported.

Having these documents ready before starting the form can streamline the process and help ensure that all necessary information is included. This preparation is essential for avoiding errors and ensuring compliance with IRS regulations.

Penalties for Non-Compliance with Formulario 8300

Non-compliance with the filing requirements of Formulario 8300 can result in significant penalties. The IRS imposes fines for failing to file the form on time, which can range from $100 to $50,000, depending on the severity of the violation. Additionally, repeated failures to comply can lead to criminal charges, including money laundering accusations.

Understanding these penalties underscores the importance of timely and accurate reporting of cash transactions. Businesses should implement processes to ensure compliance and minimize the risk of incurring fines or legal issues.

Quick guide on how to complete formulario 8300 del irs qu es y por qu es importante

Accomplish Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? effortlessly on any gadget

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? without difficulty

- Acquire Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your papers or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your preference. Alter and electronically sign Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante? to ensure excellent communication throughout any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 8300 del irs qu es y por qu es importante

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante?

The Formulario 8300 Del IRS, or IRS Form 8300, is a document that businesses must file to report cash payments exceeding $10,000. This form is important for compliance with federal laws aimed at preventing money laundering. Understanding the Formulario 8300 ensures businesses adhere to legal requirements and avoid potential penalties.

-

How can airSlate SignNow help with Formulario 8300 Del IRS?

With airSlate SignNow, you can easily create, sign, and store the Formulario 8300 Del IRS electronically. The platform streamlines the document workflow, making it simple to gather necessary signatures and retain compliance. This helps businesses manage their reporting obligations efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring you find the right fit. Whether you need basic features or advanced solutions, we provide flexibility and affordability. Investing in our service allows you to manage documents like the Formulario 8300 Del IRS with ease.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking. These tools make managing documents like the Formulario 8300 Del IRS straightforward and efficient. Our user-friendly interface ensures you can focus on your business rather than paperwork.

-

Why is it important to file the Formulario 8300 Del IRS on time?

Filing the Formulario 8300 Del IRS on time is crucial to avoid fines and penalties imposed by the IRS. Timely submission helps demonstrate your business's compliance with regulations regarding cash transactions. This diligence also builds trust with clients and stakeholders.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow can easily integrate with various CRM, accounting, and productivity tools. This connectivity allows you to manage your documents, including the Formulario 8300 Del IRS, within your existing workflows. Simplified integration enhances overall operational efficiency.

-

What benefits does eSigning provide for the Formulario 8300 Del IRS?

eSigning the Formulario 8300 Del IRS offers benefits like reduced turnaround times and enhanced security. It streamlines the signing process, allowing quick retrieval and storage of documents. Additionally, electronic signatures are legally binding, ensuring compliance with federal regulations.

Get more for Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante?

- Contract for sale and purchase of real estate with no broker for residential home sale agreement maine form

- Buyers home inspection checklist maine form

- Sellers information for appraiser provided to buyer maine

- Subcontractors agreement maine form

- Option to purchase addendum to residential lease lease or rent to own maine form

- Maine prenuptial form

- Maine prenuptial premarital agreement without financial statements maine form

- Esrd application access form 02april2015 networkofnewengland 226834089

Find out other Formulario 8300 Del IRS Qu Es Y Por Qu Es Importante?

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe