Alaska Form 6300i Incentive Credits Instructions 2019

What is the Alaska Form 6300i Incentive Credits Instructions

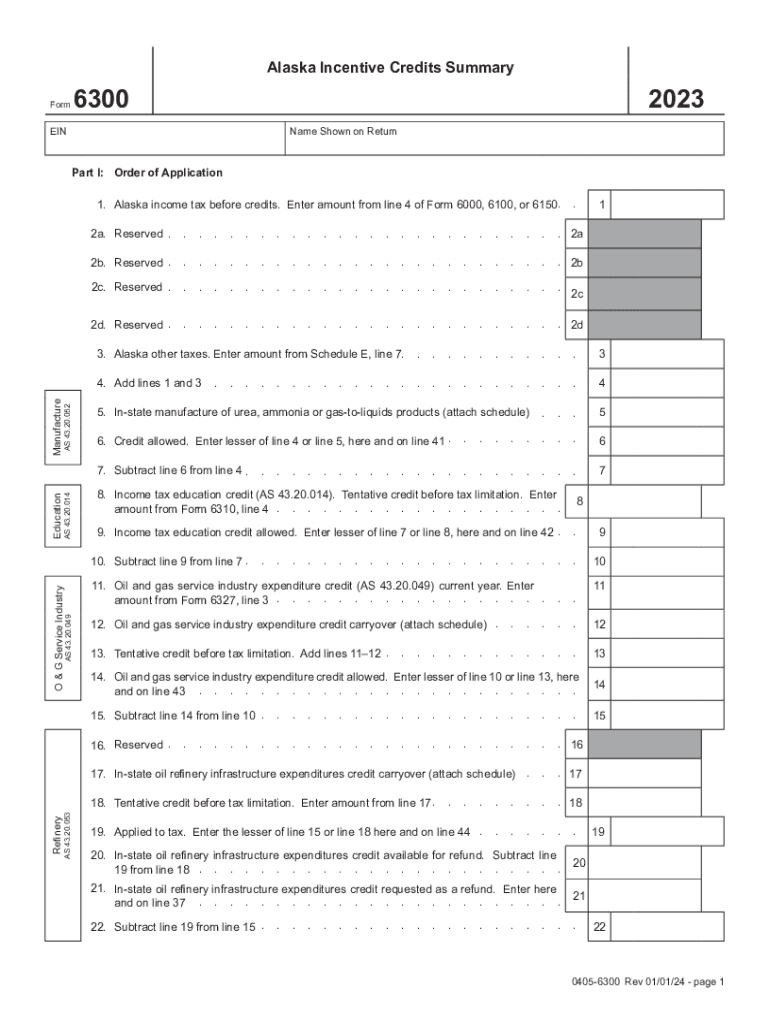

The Alaska Form 6300i Incentive Credits Instructions provide guidance for individuals and businesses seeking to claim incentive credits available under Alaska state law. These credits may include various tax incentives aimed at encouraging economic development, investment, and job creation within the state. Understanding the specific provisions of this form is essential for ensuring compliance and maximizing eligible credits.

Steps to complete the Alaska Form 6300i Incentive Credits Instructions

Completing the Alaska Form 6300i requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including financial statements and proof of eligibility for the incentive credits.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations to confirm the accuracy of the credits being claimed.

- Sign and date the form to validate the submission.

Eligibility Criteria

To qualify for the credits outlined in the Alaska Form 6300i, applicants must meet specific eligibility criteria. These may include:

- Being a registered business entity in Alaska.

- Meeting minimum investment thresholds as defined by state regulations.

- Demonstrating the creation of new jobs or retention of existing jobs.

It is important to review the detailed requirements to ensure compliance and maximize potential benefits.

Required Documents

When submitting the Alaska Form 6300i, certain documents must accompany the application to verify eligibility for the incentive credits. Commonly required documents include:

- Tax returns for the previous year.

- Financial statements, including balance sheets and income statements.

- Documentation of job creation or retention, such as payroll records.

Having these documents ready will facilitate a smoother application process.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for successfully claiming incentive credits. The Alaska Form 6300i typically has specific submission dates, which may vary depending on the type of credit being claimed. Applicants should be aware of:

- The annual filing deadline, often aligned with state tax return due dates.

- Any special deadlines for specific incentive programs.

Staying informed about these dates helps avoid penalties and ensures timely processing of claims.

Form Submission Methods

The Alaska Form 6300i can be submitted through various methods, providing flexibility for applicants. Options typically include:

- Online submission via the state’s tax portal.

- Mailing a physical copy of the completed form to the appropriate state department.

- In-person submission at designated state offices.

Choosing the most convenient method can help streamline the application process.

Quick guide on how to complete alaska form 6300i incentive credits instructions

Effortlessly Prepare Alaska Form 6300i Incentive Credits Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Alaska Form 6300i Incentive Credits Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Alaska Form 6300i Incentive Credits Instructions with ease

- Obtain Alaska Form 6300i Incentive Credits Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Alter and eSign Alaska Form 6300i Incentive Credits Instructions and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska form 6300i incentive credits instructions

Create this form in 5 minutes!

How to create an eSignature for the alaska form 6300i incentive credits instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Alaska Form 6300i Incentive Credits Instructions?

The Alaska Form 6300i Incentive Credits Instructions provide detailed guidelines on how to properly fill out the form to claim incentive credits for businesses operating in Alaska. Understanding these instructions is crucial to ensure compliance and maximize potential tax benefits. airSlate SignNow can assist in managing and eSigning these documents efficiently.

-

How does airSlate SignNow help with the Alaska Form 6300i Incentive Credits Instructions?

airSlate SignNow simplifies the process of completing the Alaska Form 6300i Incentive Credits Instructions by enabling businesses to easily fill, sign, and send documents electronically. This ensures faster processing and reduces the chances of errors. Our platform is tailored to enhance your document management experience.

-

Is there a cost associated with using airSlate SignNow for the Alaska Form 6300i Incentive Credits Instructions?

Yes, airSlate SignNow offers several pricing plans designed to fit different business needs when handling Alaska Form 6300i Incentive Credits Instructions. While there is a cost, the efficiency and time saved by using our platform often provide signNow value. You can choose a plan that suits your budget and requirements.

-

What features are included in airSlate SignNow for managing the Alaska Form 6300i Incentive Credits Instructions?

airSlate SignNow includes features such as easy document editing, customizable templates, and secure eSigning capabilities specifically for the Alaska Form 6300i Incentive Credits Instructions. Additionally, users can track document statuses and receive notifications, ensuring a smooth workflow. Our platform prioritizes user-friendliness.

-

Are there benefits to using airSlate SignNow for the Alaska Form 6300i Incentive Credits Instructions?

Using airSlate SignNow for the Alaska Form 6300i Incentive Credits Instructions offers numerous benefits, including increased efficiency, improved accuracy, and faster turnaround times. Businesses can eliminate paper-based processes, reducing errors in their submissions. Overall, this leads to better compliance and timely claims.

-

What types of integrations does airSlate SignNow offer for the Alaska Form 6300i Incentive Credits Instructions?

airSlate SignNow integrates seamlessly with various third-party applications to enhance the experience of managing the Alaska Form 6300i Incentive Credits Instructions. This includes integration with popular CRM systems, cloud storage solutions, and productivity tools. Such integrations streamline your workflow and ensure all documents are in one place.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the Alaska Form 6300i Incentive Credits Instructions?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises, when handling the Alaska Form 6300i Incentive Credits Instructions. The platform's scalability allows teams to grow and adapt their document management needs as their business evolves. Everyone can benefit from our services.

Get more for Alaska Form 6300i Incentive Credits Instructions

- Workers comp formsdepartment of labor

- In all cases coming before the labor commission in which attorneys have been employed the commission is form

- To recover any costs expenses and attorneys fees expended in collection form

- Full text of ampquotatalogue of copyright entries published by form

- Form 205 revised 122006 state of utah labor commission

- Ssa poms si 00830541 uniformed services ampampampndash

- Po box 146610 salt lake city ut 84114 6610 form

- Liability limits for each person and each occurrence including umbrella or excess insurance form

Find out other Alaska Form 6300i Incentive Credits Instructions

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself