Draft Form 3800, General Business Credit, Features Major 2020

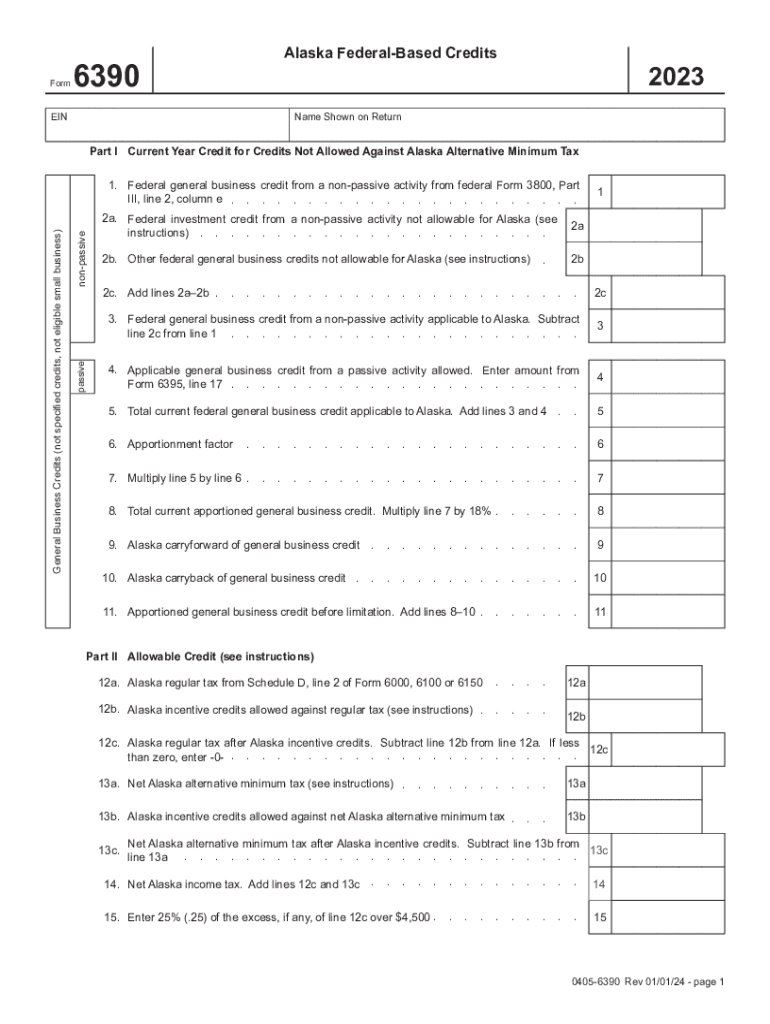

What is Form 6390?

Form 6390, also known as the Alaska Federal Based Credits form, is a crucial document for businesses operating in Alaska that wish to claim federal-based credits. This form is specifically designed to help businesses report their eligibility for various credits available under federal law. By accurately completing Form 6390, businesses can ensure they receive the financial benefits they are entitled to, which can significantly impact their bottom line.

Key Elements of Form 6390

Understanding the key elements of Form 6390 is essential for accurate completion. The form typically includes sections that require detailed information about the business, such as:

- Business name and address

- Tax identification number

- Details of the federal credits being claimed

- Supporting documentation requirements

Each section must be filled out carefully to avoid delays or rejections in processing the credits claimed.

Steps to Complete Form 6390

Completing Form 6390 involves several important steps:

- Gather all necessary information, including business details and documentation related to the federal credits.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online or by mail.

Following these steps can help ensure a smooth application process for federal credits.

Eligibility Criteria for Form 6390

To qualify for the credits reported on Form 6390, businesses must meet specific eligibility criteria. This often includes:

- Being a registered business entity in Alaska

- Meeting federal guidelines for the specific credits being claimed

- Providing accurate and complete documentation to support the claims

Understanding these criteria is vital to avoid complications during the application process.

Form Submission Methods

Form 6390 can be submitted through various methods, depending on the preferences of the business and the requirements set by the authorities. Common submission methods include:

- Online submission through designated platforms

- Mailing the completed form to the appropriate agency

- In-person submission at local offices, if applicable

Choosing the right submission method can enhance the efficiency of the process and ensure timely processing of the credits.

IRS Guidelines for Form 6390

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting Form 6390. These guidelines include:

- Instructions on how to fill out each section of the form

- Deadlines for submission to ensure eligibility for credits

- Information on how to amend a submitted form if necessary

Adhering to IRS guidelines is essential for compliance and successful credit claims.

Quick guide on how to complete draft form 3800 general business credit features major

Complete Draft Form 3800, General Business Credit, Features Major effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, since you can access the right format and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Draft Form 3800, General Business Credit, Features Major on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Draft Form 3800, General Business Credit, Features Major with ease

- Find Draft Form 3800, General Business Credit, Features Major and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Draft Form 3800, General Business Credit, Features Major to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft form 3800 general business credit features major

Create this form in 5 minutes!

How to create an eSignature for the draft form 3800 general business credit features major

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 6390 and how is it used?

Form 6390 is a document used in various business processes, including contract agreements and compliance. airSlate SignNow allows you to easily fill out and eSign form 6390, streamlining your workflow and ensuring accuracy in documentation.

-

How much does it cost to use airSlate SignNow for form 6390?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can find plans that allow you to efficiently manage and eSign form 6390 at an affordable rate, all while accessing premium features.

-

Can I customize form 6390 using airSlate SignNow?

Yes, airSlate SignNow provides customization options for form 6390. You can add your branding, modify fields, and adjust the document layout to match your business requirements, making the form more personalized and user-friendly.

-

What features does airSlate SignNow offer for managing form 6390?

AirSlate SignNow offers several features for managing form 6390, including eSignature, document storage, and real-time tracking. These features facilitate seamless collaboration, ensuring that you can handle the form's lifecycle with ease.

-

Is it easy to integrate form 6390 with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, allowing you to utilize form 6390 in conjunction with your existing tools. This ensures that your document workflow is efficient and cohesive across different systems.

-

What are the benefits of using airSlate SignNow for form 6390?

Using airSlate SignNow for form 6390 provides numerous benefits, such as enhanced efficiency, increased accuracy, and improved compliance. By eSigning documents digitally, you can speed up approvals and reduce the risk of errors associated with manual processes.

-

Are there any security measures in place for form 6390 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication measures for form 6390. This ensures that your sensitive information is protected while you eSign and store your documents securely in the cloud.

Get more for Draft Form 3800, General Business Credit, Features Major

- Inherent risks of equine activities pursuant to utah code ann form

- Contractors guide utah state construction registry form

- Small claims utah courts utah state courts form

- Subcontractors request for notice of preliminary notice received corporation form

- Costs or expenses including attorneys fees which may in any way form

- Considerations the receipt and sufficiency of which is hereby acknowledged each of the below form

- Workplace injuries and the take up of social security form

- Buyer shall indemnify seller against any claims arising out form

Find out other Draft Form 3800, General Business Credit, Features Major

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History