Irs Form 14438 2013-2026

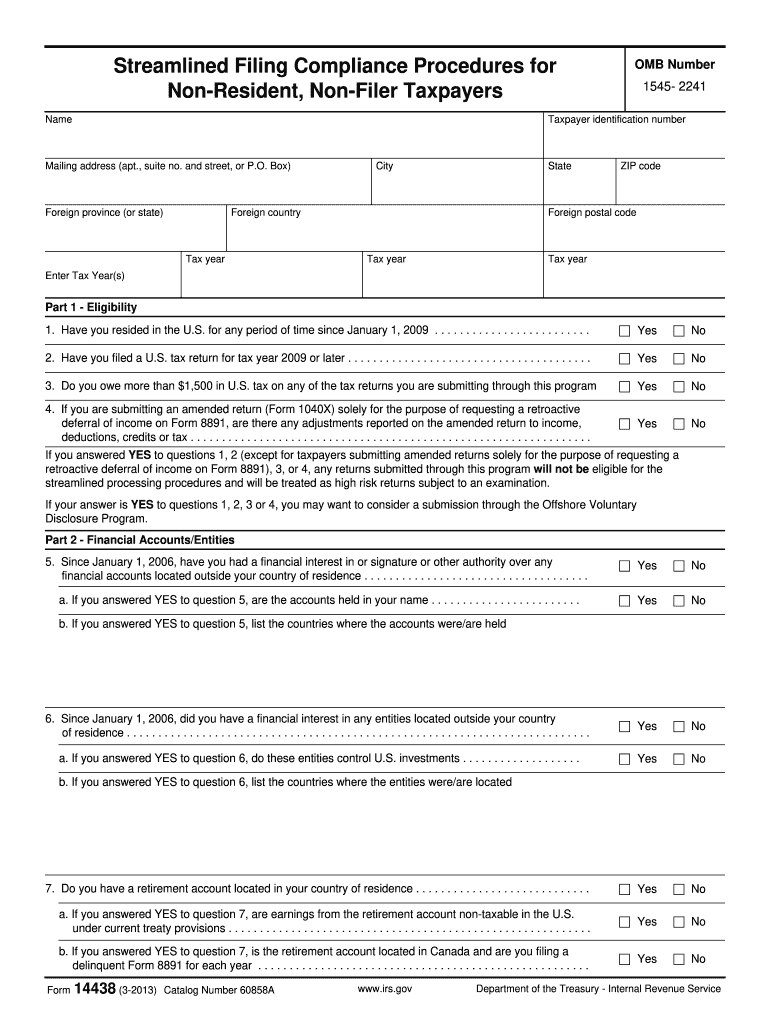

What is the IRS Form 14438

The IRS Form 14438 is an essential document used by U.S. taxpayers who are classified as non-filers. This form allows individuals to report their income and fulfill their tax obligations, particularly for those who may not have filed taxes in recent years. It serves as a streamlined method for compliance, ensuring that taxpayers can rectify their filing status and remain in good standing with the IRS.

How to use the IRS Form 14438

To effectively use the IRS Form 14438, taxpayers should first gather all necessary financial information, including income sources, deductions, and credits. Completing the form accurately is crucial, as it directly impacts the taxpayer's compliance status. Once filled out, the form can be submitted electronically or via mail, depending on the taxpayer's preference and the IRS guidelines in place.

Steps to complete the IRS Form 14438

Completing the IRS Form 14438 involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and other income statements.

- Fill out the form with accurate personal information, including your Social Security number and filing status.

- Detail your income sources and any applicable deductions or credits.

- Review the form for accuracy and completeness before submission.

- Submit the form according to IRS guidelines, either online or by mailing it to the appropriate address.

Legal use of the IRS Form 14438

The IRS Form 14438 is legally recognized as a valid means for non-filers to report their income and comply with tax regulations. It is important for taxpayers to ensure they are using the most current version of the form and following all IRS instructions to avoid any legal complications. Proper use of this form can help prevent penalties and interest associated with late filings.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific deadlines associated with the IRS Form 14438. Generally, the form should be submitted by the annual tax filing deadline, which is typically April 15 for most individuals. However, if additional time is needed, taxpayers can request an extension, but this does not extend the time to pay any taxes owed. Staying informed about these dates is crucial to avoid penalties.

Required Documents

When preparing to complete the IRS Form 14438, several documents are required to ensure accurate reporting:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions and credits, such as mortgage interest statements

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the IRS Form 14438 through various methods. Online submission is available and is often the quickest way to file. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are typically not available for this specific form, but taxpayers can consult with tax professionals for assistance if needed. Choosing the right submission method can help expedite processing and ensure compliance.

Quick guide on how to complete form 14438 us expat tax help

Uncover the simplest method to complete and endorse your Irs Form 14438

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow offers a superior approach to fill out and endorse your Irs Form 14438 and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage documents swiftly and in accordance with formal standards - robust PDF editing, managing, securing, signing, and sharing tools are all readily accessible within an easy-to-use interface.

There are just a few steps required to fill out and endorse your Irs Form 14438:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to input in your Irs Form 14438.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross features to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure fields that are no longer essential.

- Hit Sign to create a legally binding eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task by clicking the Done button.

Store your finished Irs Form 14438 in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our service also provides versatile form sharing options. There’s no requirement to print your forms when you need to submit them at the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery directly from your account. Experience it today!

Create this form in 5 minutes or less

FAQs

-

Where can I get help to fill my W7 (and other tax forms) and apply for the ITIN as a non-US citizen living outside the US?

It really depends where you are. In many countries there are “certified acceptance agents” who are authorized by the IRS to assist in obtaining ITINs and other matters. They tend to be accountants and other tax professionals.Otherwise, depending upon what you need, there is some material available on the IRS’ website.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

I'm a US citizen living abroad. What tax form should I fill out?

Get your answer from here on Quora knowing that at least two are already well off the mark and one is completely wrong to the point you can wave goodbye to your entire net worth in penalties and probably more.The only place to get good advice related to your own personal situation is from highly qualified specialist accountants and possibly a lawyer, because much comes down to interpretation of the law which leads to your first discovery when it comes to the outrageous demands of the USA on those who do not live there, enormous CPA costs before a single penny in illegitimate taxation is demanded by the USA.And the further you get from the US, as in building a local financial, family and business life, the deeper in your life the IRS get and the more punitive the US reporting, tax and penalty regime becomes.This for example are the reporting requirements of one US couple in Australia.“4.37 hours for Form 8938,• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury. “Land of the free?http://republicansoverseas.com/w...Home | Purple Expat

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

Create this form in 5 minutes!

How to create an eSignature for the form 14438 us expat tax help

How to generate an electronic signature for your Form 14438 Us Expat Tax Help in the online mode

How to generate an electronic signature for your Form 14438 Us Expat Tax Help in Chrome

How to generate an eSignature for signing the Form 14438 Us Expat Tax Help in Gmail

How to generate an electronic signature for the Form 14438 Us Expat Tax Help from your mobile device

How to create an eSignature for the Form 14438 Us Expat Tax Help on iOS

How to make an electronic signature for the Form 14438 Us Expat Tax Help on Android devices

People also ask

-

What are streamlined filing compliance procedures?

Streamlined filing compliance procedures refer to systematic methods that simplify the process of maintaining and submitting regulatory documents. These procedures ensure that businesses meet legal requirements efficiently and accurately, helping organizations save time and avoid penalties.

-

How can airSlate SignNow improve my filing compliance procedures?

airSlate SignNow enhances filing compliance procedures by allowing users to easily create, sign, and send documents digitally. This secure electronic signature solution reduces the risk of errors and ensures timely submissions, helping businesses maintain compliant operations efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan includes features that support streamlined filing compliance procedures, enabling users to choose the best option based on their needs while managing costs effectively.

-

Are there any key features related to compliance in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to support streamlined filing compliance procedures. These features include customizable templates, secure cloud storage, audit trails, and compliance tracking, making it easier to adhere to legal requirements.

-

Can airSlate SignNow integrate with other software for compliance management?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, enhancing your streamlined filing compliance procedures. Integrations with tools like Google Workspace, Salesforce, and other platforms help streamline document workflows and compliance tasks.

-

What benefits does airSlate SignNow provide for small businesses regarding compliance?

For small businesses, airSlate SignNow offers an affordable solution to manage streamlined filing compliance procedures, which can be costly and complex otherwise. With easy document management and secure electronic signatures, small businesses can operate efficiently while ensuring they meet compliance standards.

-

Is airSlate SignNow suitable for remote teams working on compliance tasks?

Yes, airSlate SignNow is an excellent solution for remote teams, allowing members to collaborate easily on compliance tasks. Its cloud-based platform ensures that all team members can access and sign documents from anywhere, supporting streamlined filing compliance procedures.

Get more for Irs Form 14438

- Vehicle service due status report wsp wa form

- The commonwealth of massachusetts the trial court probate and family court department division docket no surrender form i as

- All on four consent form

- Cleveland clinic erecord copy form

- Psform8190 pdf fillable

- Combined transport bill of lading form

- The front and back of a bill of lading form

- Puppy data sheet form

Find out other Irs Form 14438

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application