Nj Cbt 00 T 2017-2026

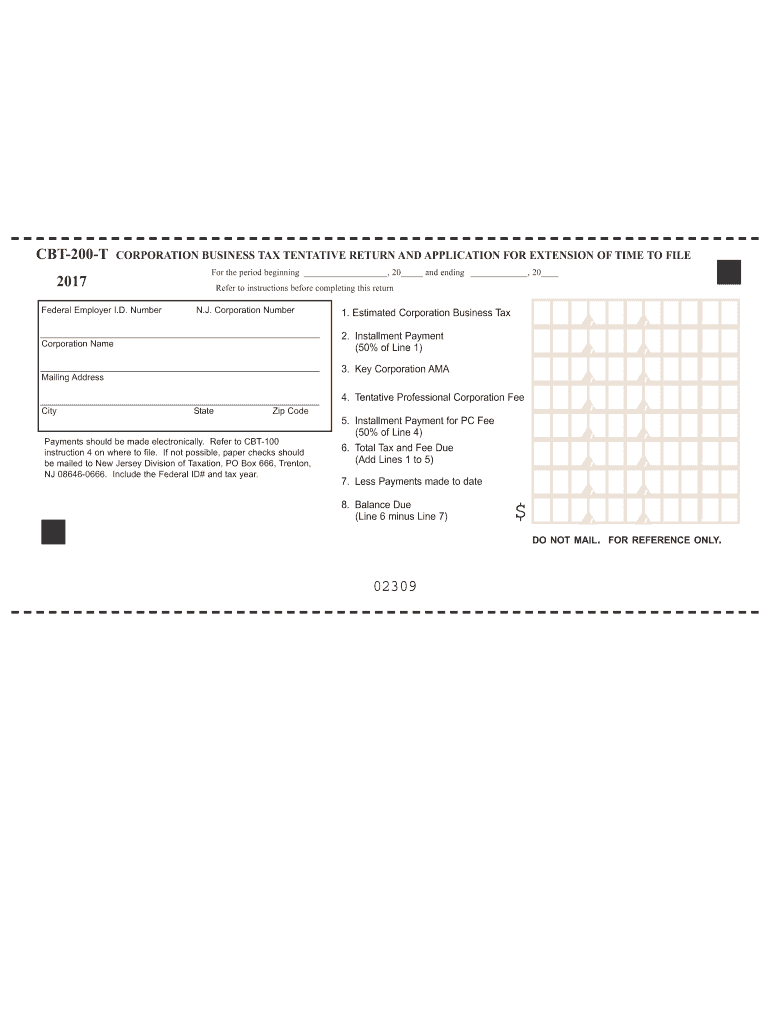

What is the 2011 CBT-200T?

The 2011 CBT-200T is a tax form used by businesses in New Jersey to report their corporate business taxes. This form is specifically designed for corporations that are subject to the New Jersey Corporation Business Tax. It allows businesses to calculate their tax liability based on their income and other relevant factors. Understanding this form is essential for compliance with state tax regulations.

Steps to Complete the 2011 CBT-200T

Completing the 2011 CBT-200T involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section with your business name, address, and federal employer identification number (EIN).

- Calculate your total income and allowable deductions as per the instructions provided with the form.

- Determine your tax liability using the appropriate tax rates outlined in the form instructions.

- Review the completed form for accuracy before signing and dating it.

Legal Use of the 2011 CBT-200T

The 2011 CBT-200T must be filed in accordance with New Jersey state tax laws. It is legally binding and must be submitted by the due date to avoid penalties. Businesses are responsible for ensuring that all information provided is accurate and complete. Misrepresentation or failure to file can lead to legal repercussions and fines.

Filing Deadlines / Important Dates

Filing deadlines for the 2011 CBT-200T typically align with the end of the corporation's fiscal year. It is crucial to file the form by the due date to avoid late fees. For most corporations, the deadline is the fifteenth day of the fourth month following the end of the tax year. Be aware of any extensions that may apply and keep track of changes in state tax regulations.

Form Submission Methods

The 2011 CBT-200T can be submitted through various methods:

- Online submission via the New Jersey Division of Taxation's website, which offers a secure portal for electronic filing.

- Mailing a printed copy of the completed form to the appropriate address provided in the form instructions.

- In-person submission at designated tax offices, which may offer assistance for businesses needing help with the form.

Required Documents

To complete the 2011 CBT-200T, businesses should prepare the following documents:

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits claimed.

- Previous tax returns, if applicable, to ensure consistency and accuracy.

- Any supporting documentation required by the New Jersey Division of Taxation.

Quick guide on how to complete new jersey cbt 200 2017 2019 form

Your assistance manual on how to prepare your Nj Cbt 00 T

If you’re wondering how to finalize and send your Nj Cbt 00 T, here are some quick tips on how to simplify tax submission.

Initially, you need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document platform that enables you to modify, produce, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text entries, check boxes, and electronic signatures, and revisit to modify responses as necessary. Enhance your tax management with advanced PDF modification, electronic signing, and straightforward sharing.

Follow the instructions below to finalize your Nj Cbt 00 T in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax document; browse through versions and schedules.

- Click Get form to access your Nj Cbt 00 T in our editor.

- Complete the necessary fillable fields with your details (text, digits, check marks).

- Employ the Sign Tool to include your legally-recognized electronic signature (if required).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting paper forms can lead to additional errors and postpone refunds. It’s important to check the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct new jersey cbt 200 2017 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the new jersey cbt 200 2017 2019 form

How to generate an eSignature for your New Jersey Cbt 200 2017 2019 Form in the online mode

How to generate an electronic signature for the New Jersey Cbt 200 2017 2019 Form in Google Chrome

How to make an electronic signature for putting it on the New Jersey Cbt 200 2017 2019 Form in Gmail

How to make an eSignature for the New Jersey Cbt 200 2017 2019 Form straight from your mobile device

How to make an electronic signature for the New Jersey Cbt 200 2017 2019 Form on iOS

How to generate an electronic signature for the New Jersey Cbt 200 2017 2019 Form on Android OS

People also ask

-

What is the 2011 cbt 200t tax and how does it impact my business?

The 2011 cbt 200t tax is a corporate business tax that affects companies operating in certain jurisdictions. It's essential for businesses to understand its implications as it directly impacts financial planning and reporting. By utilizing airSlate SignNow, businesses can facilitate the secure signing of necessary tax documents efficiently.

-

How can airSlate SignNow help me with the 2011 cbt 200t tax process?

AirSlate SignNow streamlines the document signing process associated with the 2011 cbt 200t tax by allowing you to send and eSign tax documents quickly. Our user-friendly platform ensures compliance with legal requirements and maintains a secure workflow for sensitive information. This efficiency can save you time and reduce the risk of errors.

-

What are the pricing options for airSlate SignNow related to the 2011 cbt 200t tax features?

AirSlate SignNow offers various pricing plans tailored to different business needs, ensuring access to essential features for managing 2011 cbt 200t tax forms. Each plan includes customizable options for document management and eSigning capabilities, making it a cost-effective solution for businesses of any size. You can choose a plan that best fits your workflow and budget.

-

Are there specific features in airSlate SignNow that cater to the 2011 cbt 200t tax requirements?

Yes, airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking, all of which are beneficial for handling 2011 cbt 200t tax documentation. These features help ensure that your documents are legally binding and efficiently managed. Utilizing our solutions can greatly enhance your compliance efforts.

-

Can airSlate SignNow integrate with my accounting software for the 2011 cbt 200t tax?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage the 2011 cbt 200t tax documentation directly from your financial tools. This integration helps enhance workflow efficiency by allowing you to sync data and automate tasks related to tax compliance. You can ensure accuracy while reducing manual efforts.

-

Is airSlate SignNow secure for handling sensitive information like the 2011 cbt 200t tax?

Yes, security is a top priority at airSlate SignNow. Our platform ensures that all documents, including those related to the 2011 cbt 200t tax, are protected with advanced encryption and secure data storage. You can trust that your sensitive information remains confidential and complies with legal standards.

-

How does eSigning with airSlate SignNow simplify the 2011 cbt 200t tax filing process?

ESigning with airSlate SignNow simplifies the 2011 cbt 200t tax filing process by allowing for quick and secure document approvals from anywhere. This eliminates the need for physical signatures and speeds up the overall filing process. With our platform, you'll find it much easier to complete and submit your tax forms on time.

Get more for Nj Cbt 00 T

- California privacy protection opt out form pacific justice institute pacificjustice

- Administration form

- Precalculus puzzles form

- Dowel exercises printable form

- Villages of moae ku form

- Kickball player release waiver form

- Alpha sigma chapter of sigma gamma rho sorority inc form

- Application for name change and other relief nam102 form

Find out other Nj Cbt 00 T

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement