DEATH CLAIM REQUEST INSTRUCTIONS for TAX EXEMPT MA Form

Understanding the Death Claim Request Process

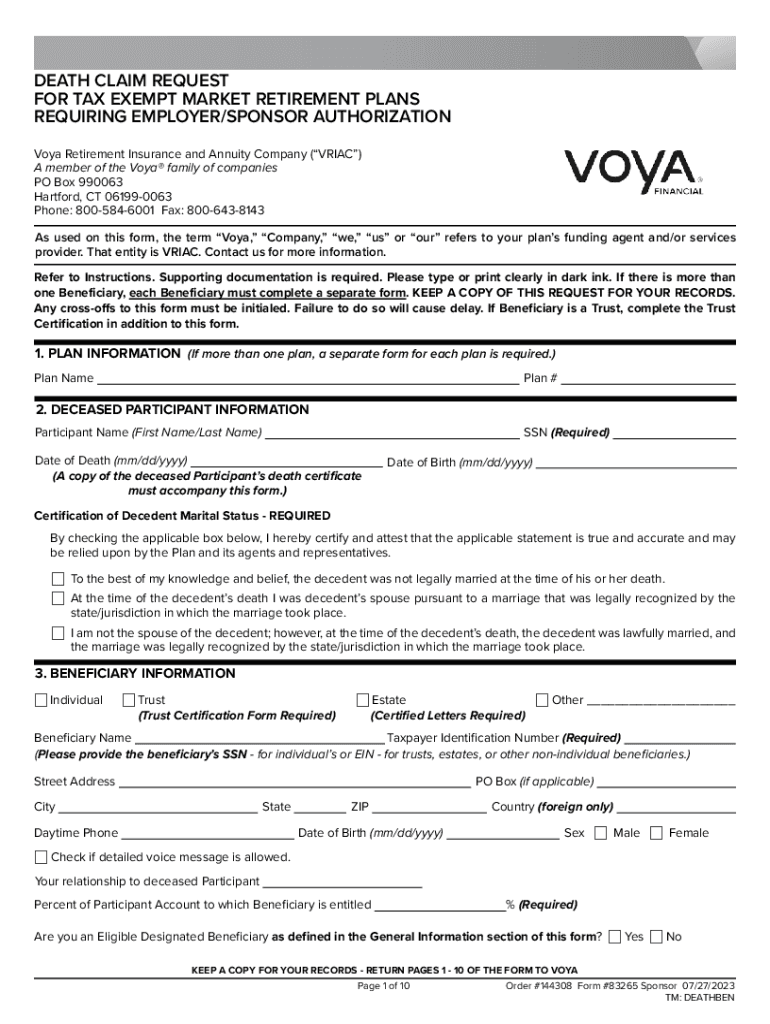

A death claim request is a formal procedure initiated by beneficiaries to claim benefits from a deceased person's insurance policy or other financial accounts. This process typically involves submitting a death claim request form, which may vary depending on the insurance provider. It is essential for beneficiaries to understand the requirements and steps involved to ensure a smooth claim process.

Key Elements of a Death Claim Request Form

When filling out a death claim request form, several key elements must be included to facilitate the processing of the claim. These typically include:

- Policy Information: Details about the deceased's insurance policy, including the policy number and type of coverage.

- Beneficiary Information: Complete contact information for the beneficiary submitting the claim.

- Death Certificate: A certified copy of the death certificate is often required to validate the claim.

- Identification: Proof of identity for the beneficiary, such as a driver's license or Social Security card.

Steps to Complete a Death Claim Request

Completing a death claim request involves several steps to ensure accuracy and compliance with the insurance provider's requirements:

- Obtain the death claim request form from the insurance provider.

- Gather necessary documents, including the death certificate and identification.

- Fill out the form completely, ensuring all required information is accurate.

- Review the completed form and documents for any errors or omissions.

- Submit the form and accompanying documents as instructed by the insurance provider.

Required Documents for Submission

To successfully submit a death claim request, certain documents are typically required. These may include:

- A certified copy of the death certificate.

- The completed death claim request form.

- Identification documents for the beneficiary.

- Any additional documentation requested by the insurance provider, such as medical records or policy statements.

Form Submission Methods

Beneficiaries can submit the death claim request form through various methods, depending on the insurance provider's policies. Common submission methods include:

- Online Submission: Many providers allow claims to be submitted electronically through their websites.

- Mail: Claims can often be sent via postal service to the designated claims department.

- In-Person: Some beneficiaries may choose to deliver the claim in person at a local office.

Eligibility Criteria for Filing a Death Claim

Eligibility to file a death claim request generally depends on the relationship to the deceased and the terms of the insurance policy. Common eligibility criteria include:

- The claimant must be a named beneficiary on the insurance policy.

- The death must have occurred while the policy was active and in good standing.

- The claimant must provide all required documentation to support the claim.

Quick guide on how to complete death claim request instructions for tax exempt ma

Complete DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA with ease

- Obtain DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the death claim request instructions for tax exempt ma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a death claim request form?

A death claim request form is an official document used to initiate the claims process following a policyholder's death. This form typically requires specific details about the deceased and their policy. By completing the death claim request form accurately, beneficiaries can expedite the claims process and ensure they receive the benefits promptly.

-

How do I complete the death claim request form?

To complete the death claim request form, gather all necessary information, including the deceased's policy details and personal identification. Fill out the form carefully, ensuring all fields are completed accurately. Once the death claim request form is filled out, submit it as directed, whether online or via mailed hard copy.

-

What information is required on the death claim request form?

The death claim request form typically requires the deceased's full name, policy number, date of birth, and date of death. Additionally, beneficiaries must provide their contact information and relationship to the deceased. Ensuring all required information is included helps prevent delays in processing the claim.

-

Are there any fees associated with submitting a death claim request form?

Generally, there are no fees associated with submitting a death claim request form. The process is designed to be straightforward and cost-effective for beneficiaries. Verify with your insurance provider to ensure there are no specific fees related to your claim submission.

-

What are the benefits of using airSlate SignNow for a death claim request form?

Using airSlate SignNow for your death claim request form simplifies the process of signing and submitting documents online. Our platform ensures that all signatures are legally binding and provides a user-friendly experience. Additionally, you can track the status of your death claim request form in real-time, keeping you informed throughout the process.

-

Can I eSign a death claim request form with airSlate SignNow?

Yes, airSlate SignNow allows you to electronically sign your death claim request form easily. Our secure platform ensures that your signatures are protected and compliant with legal standards. This makes submitting your death claim request form more efficient and accessible.

-

What integrations does airSlate SignNow offer for managing death claim request forms?

airSlate SignNow integrates seamlessly with various popular tools, such as Google Drive, Dropbox, and CRM systems. This enables users to manage and store all related documents, including the death claim request form, in one convenient location. These integrations streamline your workflow, ensuring efficient document management and submission.

Get more for DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA

- Ntroduction to small claims court unc school of government form

- Order designating exempt property aoc cv 409 form

- Lawsuitsnorth carolina judicial branch form

- Or judgment docket book amp page no form

- Writ of possession real propertynorth carolina judicial form

- Gs 45 2127 page 145 2127 upset bid on real property form

- Motion to claim form

- Chapter 7a north carolina general assembly form

Find out other DEATH CLAIM REQUEST INSTRUCTIONS FOR TAX EXEMPT MA

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy