401k Contribution EnrollmentDeferral Change Form Iuec85

Understanding the 401k Contribution Enrollment and Deferral Change Form

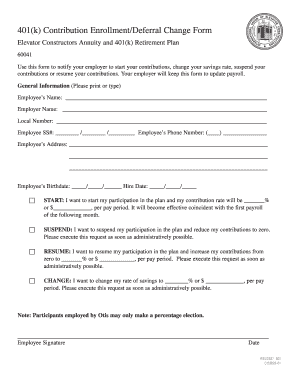

The 401k Contribution Enrollment and Deferral Change Form is a crucial document for employees participating in a 401k retirement plan. This form allows individuals to enroll in the plan or modify their contribution amounts. Understanding its purpose is essential for effective retirement planning. The form ensures that employees can adjust their contributions based on changing financial situations or retirement goals.

Steps to Complete the 401k Contribution Enrollment and Deferral Change Form

Completing the 401k Contribution Enrollment and Deferral Change Form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and employee identification number.

- Indicate your current contribution percentage or the amount you wish to change.

- Review the plan's guidelines to ensure compliance with contribution limits.

- Sign and date the form to validate your request.

After completing the form, ensure that all information is accurate to avoid processing delays.

How to Obtain the 401k Contribution Enrollment and Deferral Change Form

The 401k Contribution Enrollment and Deferral Change Form can typically be obtained through your employer's human resources department or benefits administrator. Many companies also provide the form on their internal employee portals. If you have difficulty locating it, consider reaching out directly to HR for assistance.

Legal Use of the 401k Contribution Enrollment and Deferral Change Form

This form is legally recognized as part of the employee's agreement with the employer regarding retirement savings. It must be filled out accurately to reflect the employee's intentions regarding their contributions. Misrepresentation or failure to submit the form correctly may lead to compliance issues or penalties, so it is crucial to adhere to all guidelines set forth by the employer and the IRS.

Key Elements of the 401k Contribution Enrollment and Deferral Change Form

Several key elements must be included in the 401k Contribution Enrollment and Deferral Change Form:

- Employee Information: Personal details such as name, address, and employee ID.

- Contribution Amount: The percentage or dollar amount the employee wishes to contribute.

- Effective Date: The date when the new contribution rate will take effect.

- Signature: The employee's signature is required to authorize the changes.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the 401k Contribution Enrollment and Deferral Change Form. Typically, changes to contributions must be submitted by a specific date to take effect in the upcoming pay period. Employers usually provide a schedule of important dates related to the enrollment period and contribution changes. Staying informed about these deadlines helps ensure that contributions are adjusted as intended.

Quick guide on how to complete 401k contribution enrollmentdeferral change form iuec85

Effortlessly Prepare 401k Contribution EnrollmentDeferral Change Form Iuec85 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to swiftly create, edit, and eSign your documents without delays. Manage 401k Contribution EnrollmentDeferral Change Form Iuec85 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Most Efficient Way to Edit and eSign 401k Contribution EnrollmentDeferral Change Form Iuec85 with Ease

- Obtain 401k Contribution EnrollmentDeferral Change Form Iuec85 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign 401k Contribution EnrollmentDeferral Change Form Iuec85 and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401k contribution enrollmentdeferral change form iuec85

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k form?

A 401k form is a document used by employers to provide employees with information about retirement savings plans. It typically includes details about contributions, investment options, and withdrawal procedures. Understanding your 401k form is essential for effective retirement planning.

-

How can airSlate SignNow help with 401k forms?

airSlate SignNow provides an efficient platform for sending and electronically signing 401k forms. Our solution simplifies the process, ensuring that all parties can complete their paperwork accurately and quickly. This helps streamline the onboarding process for employees starting to contribute to their 401k.

-

What pricing options are available for using airSlate SignNow for 401k forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those handling 401k forms. Whether you're a small business or a large enterprise, our pricing is designed to be cost-effective while providing essential features. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for 401k forms?

Our platform offers numerous features for managing 401k forms including secure electronic signing, document storage, and real-time tracking. This ensures that you can manage your 401k forms efficiently and with confidence. Additionally, our user-friendly interface makes it easy for employees to navigate.

-

Is airSlate SignNow secure for handling 401k forms?

Yes, airSlate SignNow prioritizes security, ensuring that all 401k forms are encrypted and stored securely. We comply with industry standards to protect sensitive information throughout the signing process. You can trust us to keep your retirement plan data safe.

-

Can I integrate airSlate SignNow with other software for 401k forms?

Absolutely! airSlate SignNow offers integrations with various software platforms that can enhance your experience with 401k forms. By connecting to HR or payroll systems, you can further automate the process and improve data accuracy across your business operations.

-

What are the benefits of using airSlate SignNow for 401k forms?

Using airSlate SignNow for your 401k forms provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our electronic signing solution helps eliminate the hassle of physical documents, making it easier for employees to complete their forms promptly. This leads to better engagement with your retirement plans.

Get more for 401k Contribution EnrollmentDeferral Change Form Iuec85

- Joint tenancy deed from individual to two individuals arizona form

- Arizona response form

- Quitclaim deed by two individuals to husband and wife arizona form

- Warranty deed from two individuals husband and wife to two individuals husband and wife arizona form

- Joint tenancy deed two individuals to husband and wife arizona form

- Deed beneficiary form

- Grant deed trust to two individuals arizona form

- Quitclaim deed from a limited liability company to husband and wife arizona form

Find out other 401k Contribution EnrollmentDeferral Change Form Iuec85

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF