If You Are Not Receiving Income from Any Source, We Require This Form to Be Filled Out

What is the If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out

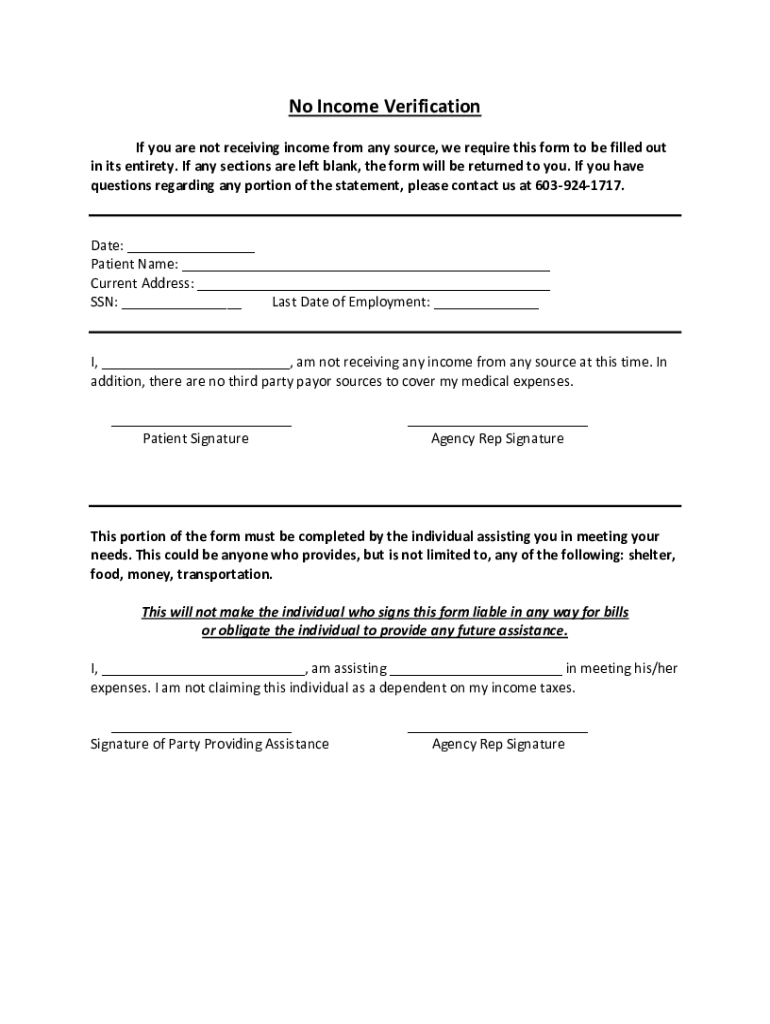

The form titled "If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out" is a document used primarily for financial reporting and compliance purposes. It is often required by various institutions, such as banks or government agencies, to confirm an individual's lack of income. This form serves as a declaration that the individual is currently not receiving income from any source, which may be necessary for eligibility assessments for certain benefits or services.

Steps to complete the If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out

Completing this form involves a few straightforward steps:

- Begin by downloading the form from the appropriate source or requesting a physical copy if needed.

- Fill in your personal information, including your name, address, and contact details.

- Clearly state that you are not receiving income from any source by checking the relevant box or providing a brief explanation.

- Sign and date the form to validate your declaration.

- Submit the completed form as instructed, whether online, by mail, or in person.

Required Documents

When filling out the form, you may need to provide supporting documentation to verify your claim of no income. Commonly required documents include:

- Identification proof, such as a driver's license or passport.

- Any previous tax returns, if applicable, to provide context regarding your income history.

- Documentation of unemployment benefits or other financial assistance, if relevant.

Form Submission Methods

You can submit the "If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out" through various methods, depending on the requirements of the requesting agency:

- Online: Many institutions allow for digital submission through their websites or secure portals.

- Mail: You can print the completed form and send it via postal service to the designated address.

- In-Person: Some organizations may require you to deliver the form directly to their office.

Eligibility Criteria

Eligibility to fill out this form typically applies to individuals who are currently not receiving any form of income. This may include:

- Unemployed individuals actively seeking work.

- Students who are not working or receiving financial support.

- Individuals on leave or those who have recently lost their jobs.

Legal use of the If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out

This form is legally binding and serves as a formal declaration of your financial status. It is important to fill it out accurately, as providing false information may lead to legal repercussions. Institutions may use this form to determine eligibility for various programs, loans, or benefits, making it essential to comply with the requirements set forth by the requesting agency.

Quick guide on how to complete if you are not receiving income from any source we require this form to be filled out

Complete If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out effortlessly on any device

Online document management has become popular among organizations and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents quickly without delays. Manage If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and eSign If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out with ease

- Locate If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, either by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Edit and eSign If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the if you are not receiving income from any source we require this form to be filled out

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if I am not receiving income from any source?

If you are facing financial difficulties and are not receiving income from any source, we require this form to be filled out. This ensures that we can better assist you and provide the necessary resources to help you through this period.

-

How do I fill out the required form for income verification?

To fill out the necessary form indicating you are not receiving income from any source, simply visit our website and access the document. Follow the prompts to complete your application accurately, as we require this form to be filled out for processing.

-

What features does airSlate SignNow offer for e-signing documents?

airSlate SignNow provides an intuitive platform for e-signing that includes templates, real-time collaboration, and secure storage options. If you are not receiving income from any source, we require this form to be filled out to facilitate any financial transactions.

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. For specific inquiries, including situations where you are not receiving income from any source, we require this form to be filled out to determine eligibility for discounts or support.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow streamlines your document management with features like automated workflows and customizable templates. If you are not receiving income from any source, we require this form to be filled out to ensure you can take advantage of our services without financial strain.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services. If you are not receiving income from any source, we require this form to be filled out to explore integration options that suit your current situation.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, utilizing encryption and compliance with industry standards. If you are not receiving income from any source, we require this form to be filled out to set up secure transactions tailored to your situation.

Get more for If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out

- Arizona mechanic lien form

- Warranty deed from individual to a trust arizona form

- Warranty deed from husband and wife to trust arizona form

- Warranty deed from husband to himself and wife arizona form

- Arizona husband wife 497296910 form

- Easement arizona form

- Arizona correction deed form

- Quitclaim deed from husband and wife to husband and wife arizona form

Find out other If You Are Not Receiving Income From Any Source, We Require This Form To Be Filled Out

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document