Nj 100 2018-2026

What is the NJ CBT 100 V?

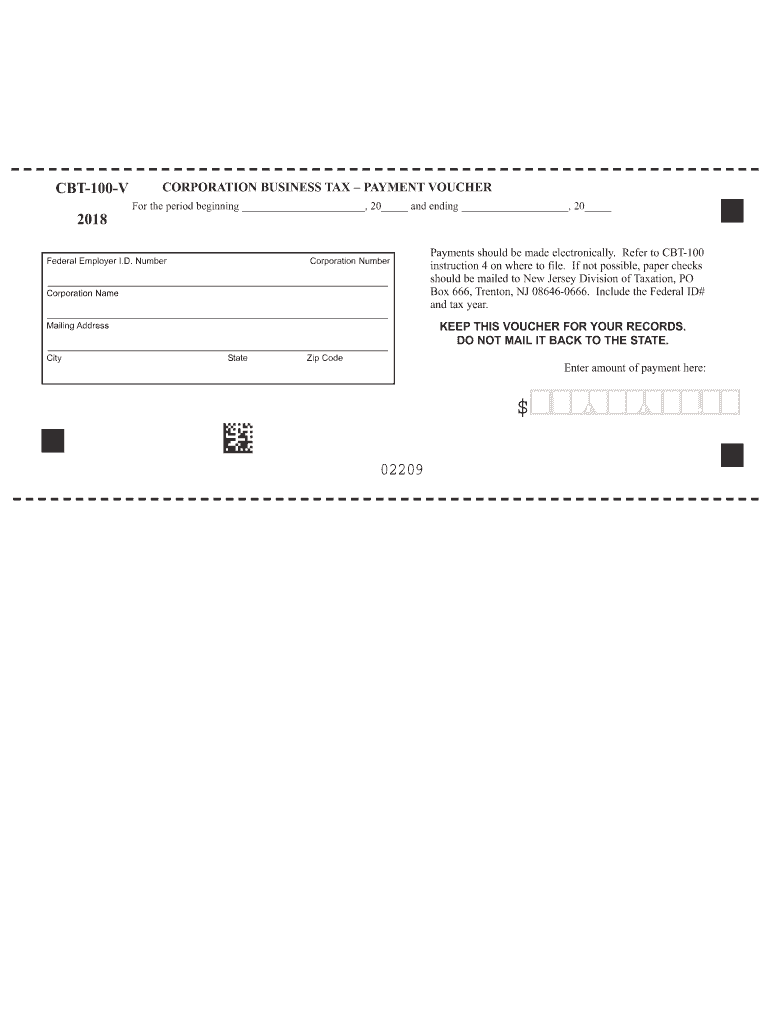

The NJ CBT 100 V is a tax form used by corporations in New Jersey to report their corporation business tax payments. It serves as a payment voucher that accompanies the submission of the CBT 100 form, which details the corporation's income, deductions, and tax liability. The CBT 100 V ensures that the payment is properly credited to the corporation's account with the New Jersey Division of Taxation.

Steps to Complete the NJ CBT 100 V

Completing the NJ CBT 100 V involves several key steps to ensure accuracy and compliance:

- Obtain the latest version of the NJ CBT 100 V form from the New Jersey Division of Taxation website.

- Fill in the required information, including the corporation's name, address, and identification number.

- Indicate the amount of payment being submitted, ensuring it matches the calculated tax due on the CBT 100 form.

- Review the form for any errors or omissions before signing and dating it.

- Submit the completed voucher along with the payment to the appropriate address provided by the New Jersey Division of Taxation.

Legal Use of the NJ CBT 100 V

The NJ CBT 100 V is legally recognized as a valid payment voucher for corporation business taxes in New Jersey. By using this form, corporations can ensure that their payments are processed correctly and in compliance with state tax laws. It is important for businesses to maintain accurate records of their submissions and payments to avoid potential penalties.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines for filing the NJ CBT 100 and submitting the accompanying CBT 100 V. The filing due date typically falls on the 15th day of the fourth month following the close of the corporation's tax year. For most corporations operating on a calendar year, this means the due date is April 15. It is crucial for businesses to stay informed about any changes to these deadlines to avoid late fees.

Form Submission Methods

The NJ CBT 100 V can be submitted through various methods to accommodate different preferences:

- Online: Corporations can file electronically through the New Jersey Division of Taxation's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the designated address provided by the state.

- In-Person: Corporations may also choose to deliver the form and payment in person at local tax offices.

Penalties for Non-Compliance

Failure to submit the NJ CBT 100 V or to pay the required tax by the deadline can result in significant penalties. Late payments may incur interest charges, and additional fines can be assessed for non-filing. It is essential for corporations to meet their tax obligations to avoid these financial repercussions and maintain good standing with the state.

Quick guide on how to complete nj 100 2018 2019 form

Your assistance manual on how to prepare your Nj 100

If you’re wondering how to complete and submit your Nj 100, below are some brief guidelines on making tax filing signNowly simpler.

To begin, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend details as necessary. Optimize your tax oversight with advanced PDF editing, eSigning, and simple sharing.

Follow the steps below to finalize your Nj 100 in a matter of minutes:

- Create your account and start editing PDFs in just a few moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to open your Nj 100 in our editor.

- Complete the necessary fillable fields with your details (text, figures, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to increased errors and delays in refunds. Be sure to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct nj 100 2018 2019 form

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the nj 100 2018 2019 form

How to generate an eSignature for the Nj 100 2018 2019 Form in the online mode

How to create an electronic signature for your Nj 100 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the Nj 100 2018 2019 Form in Gmail

How to create an electronic signature for the Nj 100 2018 2019 Form straight from your smart phone

How to create an eSignature for the Nj 100 2018 2019 Form on iOS devices

How to make an electronic signature for the Nj 100 2018 2019 Form on Android OS

People also ask

-

What is cbt 100 v and how does it work?

The cbt 100 v is an innovative electronic signature solution offered by airSlate SignNow. It allows users to securely sign and send documents online, streamlining the signing process while ensuring compliance. With its user-friendly interface, cbt 100 v makes it easy for individuals and businesses to manage their document workflows.

-

What features does cbt 100 v offer?

cbt 100 v includes features such as customizable templates, automated workflows, and advanced security options. Users can also track the status of their documents in real-time, ensuring smooth collaboration. These features make cbt 100 v an ideal choice for businesses looking to enhance their document signing process.

-

How much does the cbt 100 v cost?

cbt 100 v offers competitive pricing plans tailored to fit various business needs and budgets. Pricing depends on the selected tier, which provides different features and usage limits. For detailed pricing information and to find a plan that works for you, visit the airSlate SignNow website.

-

What are the benefits of using cbt 100 v?

Using cbt 100 v allows businesses to save time and reduce costs associated with manual document signing. It enhances productivity by automating workflows and ensures that documents are signed securely and promptly. Additionally, cbt 100 v improves customer experience by providing a seamless signing process.

-

Can cbt 100 v integrate with other tools?

Yes, cbt 100 v seamlessly integrates with a variety of popular business applications, enhancing its functionality. Whether you use CRM systems, cloud storage, or project management tools, cbt 100 v can connect with your existing software ecosystem. This integration helps streamline workflows and maintain efficiency.

-

Is cbt 100 v secure for sensitive documents?

Absolutely, cbt 100 v prioritizes the security of your documents. It employs advanced encryption technologies and complies with industry standards to protect sensitive information. You can confidently use cbt 100 v knowing that your documents are handled with care and security.

-

What types of businesses can benefit from cbt 100 v?

cbt 100 v is designed to cater to a diverse range of businesses, from startups to enterprises across multiple industries. Any organization that requires efficient document signing will find signNow value in using cbt 100 v. Its flexibility allows it to adapt to various workflows, making it suitable for any business size.

Get more for Nj 100

- Aip 4453 form

- 32j permit montana department of transportation form

- Mexico cedes land to the united states answer key form

- Mayo clinic high school internship form

- Winnipeg police alarm permit form

- Visitor confidentiality form patient privacy university of utah privacy utah

- Grant programs amp applications mary chilton dar foundation form

- Observed behavior personnel office use only bellefourche form

Find out other Nj 100

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template