CBT 100 V State of New Jersey Nj 2012

What is the CBT 100 V State Of New Jersey Nj

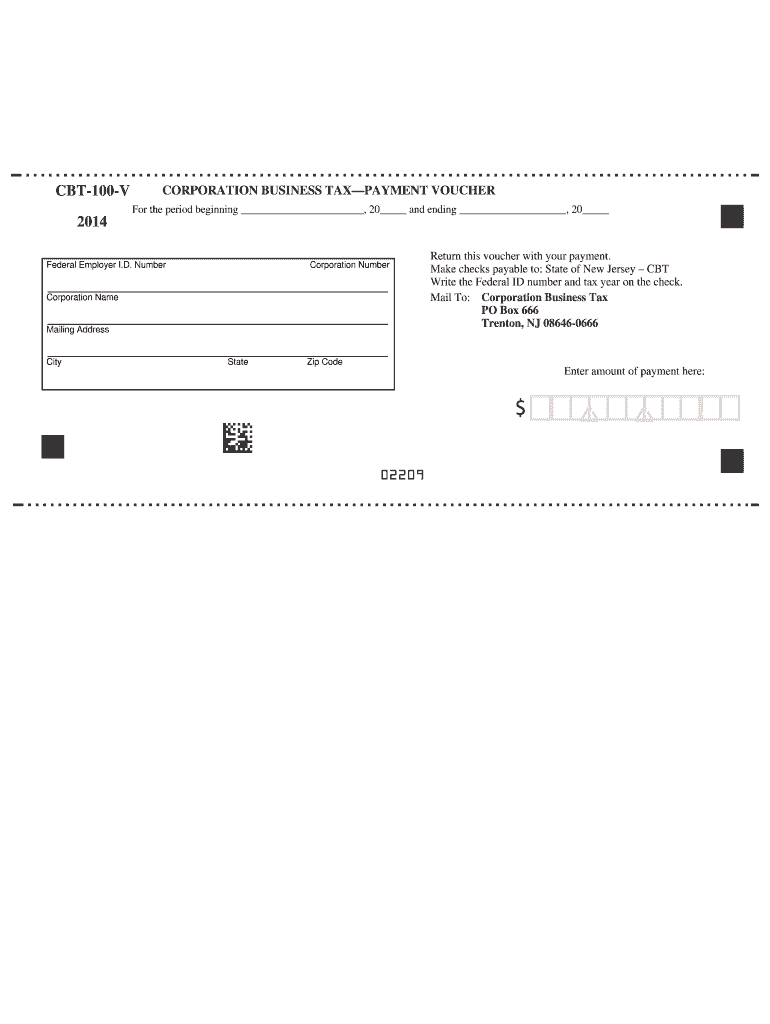

The CBT 100 V is a specific tax form used in the State of New Jersey to report corporate business taxes. This form is essential for corporations operating within the state to accurately declare their income and calculate the taxes owed. It is part of New Jersey's broader tax compliance framework, which ensures that businesses contribute fairly to state revenues. The CBT 100 V includes detailed sections where corporations must provide information about their financial performance, including revenue, deductions, and credits applicable to their business activities.

How to use the CBT 100 V State Of New Jersey Nj

Using the CBT 100 V involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your business's financial status. After completing the form, review it for any errors or omissions. Once verified, you can submit the form electronically or via traditional mail, depending on your preference and compliance requirements. Utilizing an electronic signature solution can streamline this process and enhance the security of your submission.

Steps to complete the CBT 100 V State Of New Jersey Nj

Completing the CBT 100 V requires a systematic approach to ensure compliance. Follow these steps:

- Gather necessary financial documents, including tax records and previous filings.

- Access the CBT 100 V form, available through the New Jersey Division of Taxation website.

- Fill out the form, entering details such as gross income, deductions, and credits accurately.

- Review all entries for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the designated deadline.

Legal use of the CBT 100 V State Of New Jersey Nj

The CBT 100 V is legally mandated for corporations operating in New Jersey. It serves as a formal declaration of a corporation's tax obligations and is subject to state laws and regulations. Accurate completion and timely submission of this form are crucial to avoid penalties and ensure compliance with New Jersey tax laws. The form must be filed annually, and failure to do so can result in legal repercussions, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the CBT 100 V are critical for compliance. Corporations must file their tax returns by the 15th day of the fourth month following the end of their fiscal year. For those operating on a calendar year, the deadline typically falls on April 15. It is essential to stay informed about any changes to these deadlines, as the New Jersey Division of Taxation may announce extensions or modifications, particularly in response to extraordinary circumstances.

Form Submission Methods (Online / Mail / In-Person)

The CBT 100 V can be submitted through various methods, providing flexibility for businesses. Corporations can file the form online through the New Jersey Division of Taxation's electronic filing system, which is often the most efficient option. Alternatively, businesses may choose to mail a paper copy of the form to the appropriate tax office. In-person submissions are generally not required but may be arranged in specific circumstances. Regardless of the method chosen, ensuring that the form is submitted by the deadline is crucial to avoid penalties.

Quick guide on how to complete cbt 100 v 2014 state of new jersey nj

Your assistance manual on how to prepare your CBT 100 V State Of New Jersey Nj

If you’re curious about how to finalize and submit your CBT 100 V State Of New Jersey Nj, here are a few straightforward guidelines on how to facilitate tax processing signNowly.

To begin, you simply need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and revisit to amend responses where necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing capabilities.

Follow the instructions below to complete your CBT 100 V State Of New Jersey Nj in no time:

- Establish your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Select Get form to access your CBT 100 V State Of New Jersey Nj in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing by mail can lead to return errors and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct cbt 100 v 2014 state of new jersey nj

FAQs

-

In the state of New Jersey, how long does it take to close out an estate?

I’ve spoken to a number of folks about this and three years seems to be relatively common to finish up the very last of the paper work. The amount of documentation the person left, the records, the size of the estate and family complications will make it longer or shorters depending, but 3 years seems to be not uncommon.

-

How much should I expect to pay “out the door” for a 100,000 mile service with a new set of tires included on a 2014 Honda CR-V?

I'm going to poke around in the dark here a bit to find you a ballpark.Please note that I would advise having a professional technician look at your car and make sure there are no safety issues that need attention before your maintenance.Timing belt: $600–$800Various fluid flushes $300–$500Tires: $800-$1000Spark Plugs? I'm making a huge assumption here that your coils will need replacing at the same time. $1000–$1500ish.Worst case I would guestimate you would be in the neighborhood of $4000 total. The best thing about maintenance is that you can spread it out over time.A good auto shop will read the disgust on you face and break it down on smaller chunks.My personal preference would be timing belt and coolant flush. Maybe water pump while they're there. I've seen a timing belt break at 105k and I've seen them last to 200k. Why risk it.I hope this helps

-

I am a resident of California. I interned in New Jersey last year. From what I read, all I need is two state tax forms and one non-resident form for federal taxes. Do I also need to take into account that I live in California, but I interned out-of-state? Will this alter my process to file the taxes?

Let’s see if I understand this. You live in California. You interned in New Jersey. Why are you a non-resident for the Fed? You lived in the US, you are a resident. I’m guessing you lived in New Jersey while you were an intern, so you would file a part year resident for New Jersey. If you moved from Jersey to Ca mid year then you would file as a part year resident for California also.Get someone to do this for you as you don’t seem to understandGetATMEtaxprep.com

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the cbt 100 v 2014 state of new jersey nj

How to generate an eSignature for your Cbt 100 V 2014 State Of New Jersey Nj in the online mode

How to make an electronic signature for your Cbt 100 V 2014 State Of New Jersey Nj in Google Chrome

How to make an eSignature for signing the Cbt 100 V 2014 State Of New Jersey Nj in Gmail

How to generate an eSignature for the Cbt 100 V 2014 State Of New Jersey Nj right from your mobile device

How to create an eSignature for the Cbt 100 V 2014 State Of New Jersey Nj on iOS devices

How to create an electronic signature for the Cbt 100 V 2014 State Of New Jersey Nj on Android OS

People also ask

-

What is CBT 100 V State Of New Jersey Nj and how does it relate to airSlate SignNow?

CBT 100 V State Of New Jersey Nj refers to a specific certification process required in New Jersey. airSlate SignNow can streamline your documentation needs related to this certification, allowing for efficient eSigning and management of necessary forms and agreements.

-

How can airSlate SignNow help me with CBT 100 V State Of New Jersey Nj documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to CBT 100 V State Of New Jersey Nj. With its user-friendly interface, you can quickly send, sign, and store your documents securely, ensuring compliance with state requirements.

-

What are the pricing options for airSlate SignNow if I need to manage CBT 100 V State Of New Jersey Nj documentation?

airSlate SignNow offers various pricing plans that can accommodate businesses of all sizes needing to manage CBT 100 V State Of New Jersey Nj documentation. Each plan provides access to essential features for eSigning, document storage, and workflow automation, ensuring an affordable solution for your needs.

-

Does airSlate SignNow offer features specifically for CBT 100 V State Of New Jersey Nj compliance?

Yes, airSlate SignNow includes features that support compliance with CBT 100 V State Of New Jersey Nj requirements. The platform provides secure eSigning capabilities, audit trails, and customizable templates that help ensure your documents meet state regulations.

-

Can I integrate airSlate SignNow with other software for managing CBT 100 V State Of New Jersey Nj documents?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage your CBT 100 V State Of New Jersey Nj documents alongside other business tools. This integration helps streamline your workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for CBT 100 V State Of New Jersey Nj documentation?

Using airSlate SignNow for CBT 100 V State Of New Jersey Nj documentation offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform allows you to eSign documents quickly and maintain organized records for compliance purposes.

-

How secure is airSlate SignNow for handling CBT 100 V State Of New Jersey Nj documents?

airSlate SignNow prioritizes security when handling CBT 100 V State Of New Jersey Nj documents. The platform employs advanced encryption, multi-factor authentication, and secure data storage to protect your sensitive information from unauthorized access.

Get more for CBT 100 V State Of New Jersey Nj

Find out other CBT 100 V State Of New Jersey Nj

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer