Claro Insurance Form

What is Claro Insurance?

Claro Insurance is a comprehensive insurance solution designed to provide coverage for various needs, including health, auto, and home insurance. It aims to offer policyholders peace of mind by ensuring that they are protected against unforeseen events. Claro Insurance is tailored to meet the specific requirements of individuals and families, making it a popular choice among consumers in the United States.

How to Obtain Claro Insurance

To obtain Claro Insurance, potential policyholders can follow a straightforward process. First, individuals should assess their insurance needs to determine the type of coverage required. Next, they can visit the Claro Insurance website or contact a local agent to get quotes. After comparing options, applicants can complete the necessary forms and provide any required documentation. Once the application is submitted, Claro Insurance will review it and provide confirmation of coverage.

Key Elements of Claro Insurance

Several key elements define Claro Insurance and its offerings. These include:

- Comprehensive Coverage: Claro Insurance provides a wide range of policies that cover health, auto, home, and more.

- Flexible Plans: Policyholders can choose from various plans that suit their specific needs and budgets.

- Customer Support: Claro Insurance offers dedicated customer service to assist clients with inquiries and claims.

- Online Management: Policyholders can manage their insurance online, making it easy to update information and file claims.

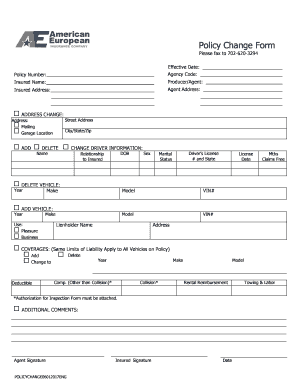

Steps to Complete the Claro Insurance Application

Completing the Claro Insurance application involves several steps to ensure a smooth process:

- Gather Information: Collect personal information, including identification, address, and financial details.

- Choose Coverage: Decide on the type and level of coverage needed based on personal requirements.

- Fill Out the Application: Complete the application form accurately, providing all necessary details.

- Submit the Application: Send the application through the preferred method, whether online, by mail, or in-person.

- Receive Confirmation: Wait for confirmation from Claro Insurance regarding the status of the application.

Legal Use of Claro Insurance

Claro Insurance operates within the legal framework established by state and federal regulations. It is essential for policyholders to understand the terms and conditions of their insurance policies, as well as their rights and responsibilities. Compliance with these legal requirements ensures that individuals can effectively utilize their coverage and file claims when necessary.

Required Documents for Claro Insurance

When applying for Claro Insurance, specific documents are typically required to process the application efficiently. These may include:

- Proof of identity (e.g., driver's license, passport)

- Social Security number or taxpayer identification number

- Financial documents (e.g., pay stubs, bank statements)

- Previous insurance information, if applicable

Quick guide on how to complete claro insurance

Complete Claro Insurance smoothly on any gadget

Digital document handling has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hiccups. Manage Claro Insurance on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Claro Insurance effortlessly

- Locate Claro Insurance and click Get Form to begin.

- Use the features we provide to finalize your document.

- Select critical parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to keep your modifications.

- Choose how you wish to share your form, via email, text (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from a device of your preference. Modify and eSign Claro Insurance and ensure outstanding communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claro insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is claro insurance and how can it benefit my business?

Claro insurance provides comprehensive coverage options that are tailored for businesses. By choosing claro insurance, you can protect your assets, ensure employee safety, and gain peace of mind. With various plans available, businesses can find the right coverage that suits their specific needs.

-

How much does claro insurance cost?

The pricing for claro insurance varies based on the coverage options and the specific needs of your business. Factors such as the size of your company and the type of coverage required will influence the overall cost. It's best to consult with an insurance advisor to get a personalized quote that ensures you're only paying for what you need.

-

What features are included with claro insurance?

Claro insurance typically includes essential features such as liability coverage, property protection, and business interruption coverage. Moreover, claro insurance plans often offer additional options like coverage for employee injuries and equipment breakdowns. Understanding these features can help you choose the best plan for your business operations.

-

Can claro insurance be integrated with airSlate SignNow?

Yes, claro insurance can be seamlessly integrated with airSlate SignNow for efficient document management. This integration allows you to send, sign, and store insurance-related documents securely, ensuring a streamlined workflow for your business. Using these tools together enhances efficiency and reduces paperwork hassles.

-

What are the benefits of using claro insurance?

The benefits of claro insurance include robust financial protection against unforeseen events, customized coverage options to suit your unique business needs, and access to dedicated support teams. Furthermore, claro insurance can improve business credibility and attract potential clients by demonstrating your commitment to safety and risk management.

-

How does claro insurance differ from other insurance providers?

Claro insurance stands out by offering flexible plans that can adapt to the changing needs of businesses. Unlike many insurance providers, claro insurance focuses on small to medium-sized enterprises, ensuring they receive personalized service and competitive pricing. Additionally, claro insurance is known for its user-friendly policy management options.

-

Is claro insurance suitable for small businesses?

Yes, claro insurance is specifically designed to cater to the needs of small businesses. It offers affordable coverage options that are essential for startups and small enterprises. With claro insurance, small business owners can find the right mix of protection and cost-effectiveness, making it a practical choice.

Get more for Claro Insurance

- Nevada quitclaim deed from corporation to llc form

- Nevada grant bargain sale deed form

- Nevada quitclaim deed from husband and wife to husband and wife form

- Grant deed form 481377477

- Nevada quitclaim deed individual to trust form

- Nevada deed trust form

- Deed real estate nevada form

- Deed real estate 481377481 form

Find out other Claro Insurance

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document