SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group Form

Understanding the Hardship Withdrawal Instructions

The hardship withdrawal instructions provided by CUNA Mutual Group are designed to help individuals access their 401(k) funds in times of financial need. This process allows participants to withdraw money from their retirement accounts under specific circumstances, such as medical expenses, purchasing a primary residence, or preventing eviction. Understanding these instructions is crucial for ensuring compliance with IRS regulations and maximizing the benefits of your retirement savings.

Steps to Complete the Hardship Withdrawal Process

Completing the hardship withdrawal process involves several key steps:

- Review eligibility criteria to confirm that your situation qualifies for a hardship withdrawal.

- Gather necessary documentation that supports your request, such as bills or eviction notices.

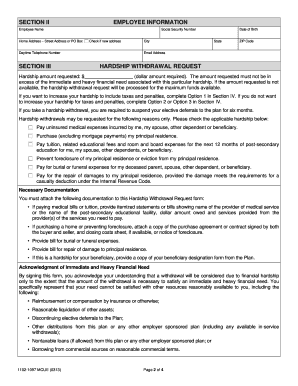

- Fill out the hardship withdrawal request form accurately, ensuring all required fields are completed.

- Submit the form along with any supporting documents to CUNA Mutual Group through the designated submission method.

- Await confirmation of your request and any additional instructions from CUNA Mutual Group.

Required Documents for Hardship Withdrawal

To successfully process a hardship withdrawal request, specific documents are required. These may include:

- Proof of financial hardship, such as medical bills or eviction notices.

- A completed hardship withdrawal request form.

- Any additional documentation as specified by CUNA Mutual Group.

Ensuring that all documents are accurate and complete can expedite the approval process.

Eligibility Criteria for Hardship Withdrawals

Eligibility for a hardship withdrawal from a CUNA Mutual 401(k) account is determined by specific criteria set forth by the IRS and CUNA Mutual Group. Generally, eligible circumstances include:

- Unreimbursed medical expenses.

- Costs related to purchasing a primary home.

- Tuition and educational fees for the upcoming academic period.

- Preventing eviction or foreclosure.

It is essential to review these criteria carefully to ensure your situation qualifies for a withdrawal.

IRS Guidelines on Hardship Withdrawals

The IRS provides guidelines that govern hardship withdrawals from retirement accounts. Key points include:

- Withdrawals must be made for immediate and pressing financial needs.

- Participants must exhaust all other options, such as loans from their 401(k) before applying for a hardship withdrawal.

- Withdrawn amounts are subject to income tax and may incur penalties if the participant is under age fifty-nine and a half.

Familiarizing yourself with these guidelines can help in understanding the implications of a hardship withdrawal.

Form Submission Methods

Submitting your hardship withdrawal request can be done through various methods. CUNA Mutual Group typically offers:

- Online submission through their secure portal.

- Mailing the completed form and documents to their processing center.

- In-person submission at designated locations, if applicable.

Choosing the appropriate submission method can affect the speed of processing your request.

Quick guide on how to complete section i hardship withdrawal instructions cuna mutual group

Complete SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group with ease

- Obtain SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section i hardship withdrawal instructions cuna mutual group

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for a CUNA Mutual 401k withdrawal?

To initiate a CUNA Mutual 401k withdrawal, you'll need to fill out the appropriate withdrawal forms provided by CUNA Mutual. Ensure you have all necessary documentation and meet any eligibility criteria. Once submitted, your request will be reviewed, and you’ll receive confirmation regarding your withdrawal status.

-

Are there penalties associated with CUNA Mutual 401k withdrawals?

Yes, there may be penalties for early withdrawals from your CUNA Mutual 401k if you are under the age of 59½. Additionally, taxes may apply, so it’s important to consult a financial advisor to understand the implications of your specific withdrawal situation.

-

What are the tax implications of a CUNA Mutual 401k withdrawal?

A CUNA Mutual 401k withdrawal may be subject to federal income taxes, and in some cases, state taxes may apply as well. If the withdrawal is made before the age of 59½, an additional 10% early withdrawal penalty may also be applicable. It’s essential to consider consulting a tax professional for tailored advice.

-

Can I withdraw funds from my CUNA Mutual 401k while still employed?

In many cases, you can access your CUNA Mutual 401k funds even while still employed, but it depends on your plan's specific rules. Some plans allow in-service withdrawals, while others do not. Be sure to check with your plan administrator for details about your eligibility.

-

How long does it take to process a CUNA Mutual 401k withdrawal?

The processing time for a CUNA Mutual 401k withdrawal can vary, but generally, it takes about 5 to 10 business days after all required paperwork is submitted. Ensure that you provide accurate and complete information to avoid delays in processing your request.

-

What documents do I need for a CUNA Mutual 401k withdrawal?

To complete a CUNA Mutual 401k withdrawal, you'll typically need to provide your account information, personal identification, and any specific forms related to your withdrawal request. Additional documentation may be required based on the type of withdrawal you are requesting.

-

Is there a minimum withdrawal amount for CUNA Mutual 401k?

Yes, CUNA Mutual may have a minimum withdrawal amount established for 401k withdrawals. This ensures that processing fees do not exceed the withdrawal amount. Check your specific plan details or contact customer support for information regarding minimum amounts.

Get more for SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group

- South african contract law wikipedia form

- Floor joist layout shall form

- This paving contract contract effective as of the date of the last party to form

- This site work contract contract effective as of the date of the last party form

- This siding contract contract effective as of the date of the last party to form

- Is foresight 2020 employers confront new laws taking form

- License agreement for private connection to town drainage form

- Stand alone contract v134 illinoisgov form

Find out other SECTION I HARDSHIP WITHDRAWAL INSTRUCTIONS CUNA Mutual Group

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online