Usi Individual Retirement Arrangement Form

What is the Usi Individual Retirement Arrangement

The Usi Individual Retirement Arrangement (IRA) is a tax-advantaged account designed to help individuals save for retirement. This arrangement allows individuals to contribute a portion of their income to a retirement account, which can grow tax-deferred until withdrawal. The Usi IRA is particularly beneficial for those looking to secure their financial future, as it provides various investment options, including stocks, bonds, and mutual funds. Understanding the specifics of this arrangement is crucial for effective retirement planning.

How to use the Usi Individual Retirement Arrangement

Using the Usi Individual Retirement Arrangement involves several key steps. First, individuals must open an IRA account through a financial institution that offers this service. Once the account is established, contributions can be made, typically up to a certain annual limit set by the IRS. It is essential to choose investments wisely, as the performance of these investments will impact the overall growth of the retirement savings. Regularly reviewing and adjusting the investment strategy is also recommended to align with changing financial goals.

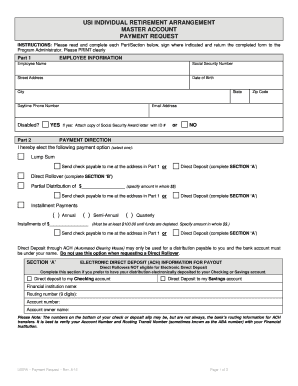

Steps to complete the Usi Individual Retirement Arrangement

Completing the Usi Individual Retirement Arrangement involves a clear process. Start by selecting a financial institution that offers IRAs. Next, fill out the necessary application forms, providing personal information and selecting the type of IRA that best suits your needs, such as a traditional or Roth IRA. After the application is submitted and approved, you can begin funding the account. Ensure that you keep track of contribution limits and deadlines to maximize tax benefits.

Eligibility Criteria

To be eligible for the Usi Individual Retirement Arrangement, individuals must meet certain criteria. Generally, anyone with earned income can contribute to an IRA, but specific rules apply depending on the type of IRA chosen. For instance, traditional IRAs have no income limits for contributions, but there are age restrictions for contributions. Roth IRAs, on the other hand, have income limits that determine eligibility for contributions. Understanding these criteria is vital for effective planning and compliance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the Usi Individual Retirement Arrangement. These guidelines outline contribution limits, withdrawal rules, and tax implications. For instance, contributions to a traditional IRA may be tax-deductible, while withdrawals during retirement are taxed as ordinary income. Conversely, contributions to a Roth IRA are made with after-tax dollars, allowing for tax-free withdrawals in retirement. Staying informed about IRS guidelines is essential for maximizing the benefits of an IRA.

Required Documents

When setting up a Usi Individual Retirement Arrangement, several documents are typically required. These may include identification documents, such as a driver's license or Social Security card, proof of income, and any previous retirement account statements if rolling over funds. Additionally, individuals may need to complete specific forms provided by the financial institution managing the IRA. Having these documents ready can streamline the application process and ensure compliance with regulatory requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Usi Individual Retirement Arrangement are crucial for individuals looking to maximize their contributions and tax benefits. Generally, contributions for a given tax year must be made by April fifteenth of the following year. Additionally, it is important to be aware of deadlines for any required distributions, especially for traditional IRAs once the account holder reaches a certain age. Keeping track of these dates ensures compliance and helps in effective retirement planning.

Quick guide on how to complete usi individual retirement arrangement

Complete Usi Individual Retirement Arrangement effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Usi Individual Retirement Arrangement on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Usi Individual Retirement Arrangement with ease

- Locate Usi Individual Retirement Arrangement and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and eSign Usi Individual Retirement Arrangement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usi individual retirement arrangement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a USI individual retirement arrangement?

A USI individual retirement arrangement (IRA) is a type of retirement savings account that offers tax advantages for retirement savings. With a USI IRA, you can invest in various assets to grow your retirement fund while benefiting from tax deductions. It's an important tool for anyone planning for a financially secure retirement.

-

What are the benefits of using a USI individual retirement arrangement?

The primary benefits of a USI individual retirement arrangement include tax-deferred growth on your investments and potential tax deductions on contributions. Additionally, you have the flexibility to choose your investment strategies, whether through stocks, bonds, or mutual funds. This allows you to tailor your retirement savings plan to meet your individual goals.

-

How is the pricing structured for a USI individual retirement arrangement?

Pricing for a USI individual retirement arrangement varies based on the financial institution you choose and the types of investments you plan to make. Typically, there may be account setup fees, annual maintenance fees, and possibly trading commissions. It's essential to compare different options to find the best fit for cost-effective retirement savings.

-

Can I transfer my existing retirement funds to a USI individual retirement arrangement?

Yes, you can transfer existing retirement funds into a USI individual retirement arrangement through a direct rollover process. This is a straightforward way to consolidate your retirement savings while still benefiting from the tax advantages of an IRA. It’s important to understand the rules and processes involved to avoid any tax penalties.

-

What features should I look for in a USI individual retirement arrangement?

When selecting a USI individual retirement arrangement, look for features such as a diverse range of investment options, low fees, and robust customer support. Additionally, an easy-to-use online platform can enhance your investment experience. Ensure that the institution you choose offers tools and resources to help you manage your retirement effectively.

-

How does a USI individual retirement arrangement differ from a traditional IRA?

The main difference between a USI individual retirement arrangement and a traditional IRA lies in the contribution limits and tax rules. While both provide tax benefits, a USI IRA may offer different investment options and flexibility. It's important to assess your retirement goals to determine which type of account better suits your needs.

-

Are there any penalties for withdrawing from a USI individual retirement arrangement early?

Yes, there are typically penalties for withdrawing funds from a USI individual retirement arrangement before signNowing age 59½. Early withdrawals may incur a 10% penalty on top of regular income tax obligations. Understanding these rules can help you better plan your retirement funding strategy.

Get more for Usi Individual Retirement Arrangement

- I have received a copy of the petition for adoption petition to terminate child legal relationship and the form

- And waive any and all notices required by law form

- What is the name of the birth mother of the child form

- Supreme court of colorado findlaw cases and codes form

- Fillable online simulation analysis and design of trust based form

- District court county form

- Fillable online drake ampampampamp co fax email print pdffiller form

- Order for publication and mailing form

Find out other Usi Individual Retirement Arrangement

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney