Returns and W 2 Forms for the Most Recent Two Years and a Copy of the Total Amount of Wages You

What is the Returns And W-2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

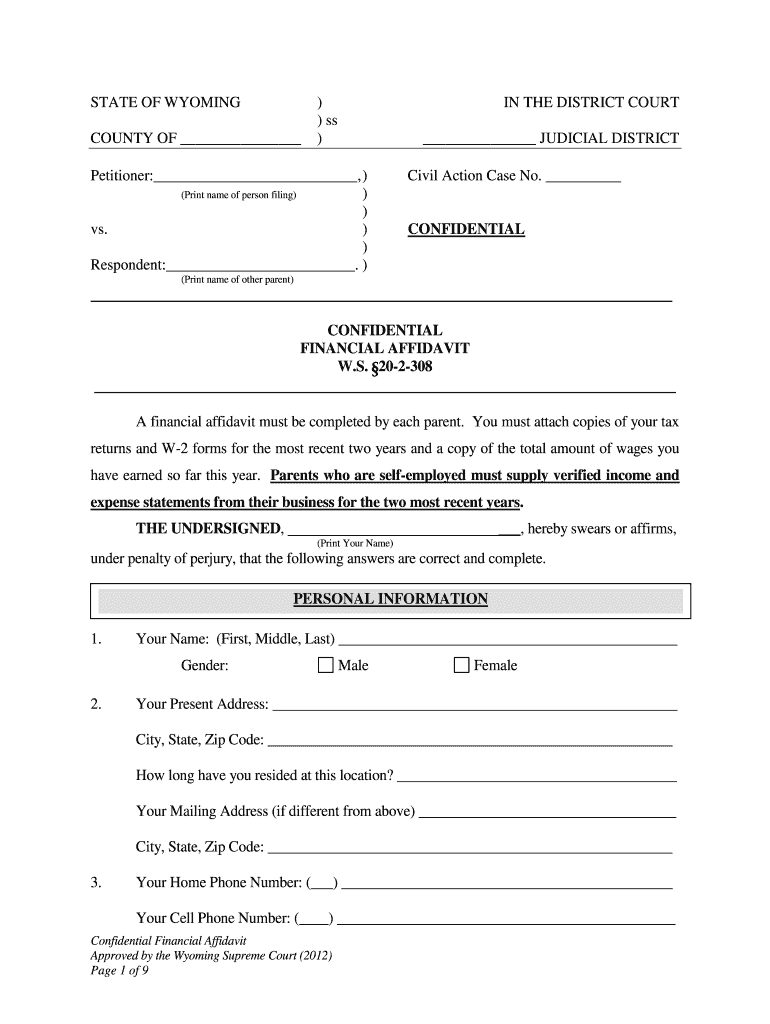

The Returns and W-2 forms for the most recent two years and a copy of the total amount of wages you represent essential tax documents in the United States. These forms provide a summary of an employee's earnings and the taxes withheld over the past two years. The W-2 form is issued by employers to report wages, tips, and other compensation paid to employees, along with the taxes withheld from those earnings. This information is crucial for individuals when filing their annual tax returns, as it helps determine their tax liability or refund status.

How to Obtain the Returns And W-2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

To obtain the Returns and W-2 forms for the most recent two years, individuals can follow several methods. First, check with your employer, as they are required to provide you with a copy of your W-2 form by January 31st each year. If you have not received it, you can request it directly from your HR or payroll department. Additionally, you can access your W-2 forms through online payroll services if your employer uses such a platform. For past years, if you cannot obtain the forms from your employer, you can request a copy from the IRS by submitting Form 4506-T, which allows you to receive a transcript of your tax return that includes W-2 information.

Steps to Complete the Returns And W-2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

Completing the Returns and W-2 forms involves several steps. First, gather all necessary documents, including your W-2 forms for the past two years and any other income statements. Next, ensure that you have your Social Security number and any relevant deductions or credits documented. When filling out the forms, carefully enter your personal information, including your name, address, and filing status. Input your total wages as reported on the W-2 forms, and calculate your total tax liability based on the IRS guidelines. Finally, review the completed forms for accuracy before submitting them to the IRS or your state tax authority.

Legal Use of the Returns And W-2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

The Returns and W-2 forms are legally binding documents that play a significant role in tax compliance in the United States. They must be completed accurately and submitted by the appropriate deadlines to avoid penalties. The IRS requires that these forms reflect true and correct information regarding income and taxes withheld. Failure to provide accurate information can result in audits, fines, or other legal consequences. Digital signatures on these forms are also accepted, provided they comply with the ESIGN Act and other relevant regulations, ensuring that the forms are legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Returns and W-2 forms are crucial for maintaining compliance with tax regulations. Typically, employers must issue W-2 forms to employees by January 31st each year. Individuals must file their federal tax returns by April 15th, unless an extension is granted. It is important to note that state tax deadlines may vary, so individuals should verify the specific dates applicable to their state. Missing these deadlines can lead to penalties and interest on unpaid taxes, so it is essential to stay informed and organized throughout the tax season.

Penalties for Non-Compliance

Non-compliance with the requirements for the Returns and W-2 forms can result in various penalties. If an employer fails to provide W-2 forms on time, they may face fines from the IRS. Additionally, individuals who do not file their tax returns or who file inaccurate information may incur penalties, including late fees and interest on unpaid taxes. In severe cases, failure to comply can lead to audits or legal action. Therefore, it is essential to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete returns and w 2 forms for the most recent two years and a copy of the total amount of wages you

Easily prepare Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You on any device

Digital document management has gained traction with both organizations and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents swiftly without any holdups. Manage Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to alter and eSign Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You effortlessly

- Find Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You?

Returns and W-2 forms for the most recent two years, along with a copy of the total amount of wages you received, are essential documents needed for accurate tax reporting and compliance. These forms summarize your annual income and withheld taxes, making them crucial for filing your tax returns.

-

How can airSlate SignNow help manage Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You?

airSlate SignNow enables businesses to easily collect, sign, and manage Returns and W-2 forms for the most recent two years. With our secure platform, you can ensure that these important documents are organized and easily accessible for tax season.

-

Are there any additional fees associated with retrieving Returns And W 2 Forms For The Most Recent Two Years?

No, airSlate SignNow offers a transparent pricing model that allows users to retrieve Returns and W-2 forms for the most recent two years without hidden fees. Our cost-effective solution ensures you only pay for the features you need.

-

What features does airSlate SignNow offer for handling Returns And W 2 Forms For The Most Recent Two Years?

Our platform provides features such as electronic signatures, document templates, and cloud storage to streamline the management of Returns and W-2 forms for the most recent two years. These tools save you time and enhance document security.

-

Can I integrate airSlate SignNow with other accounting software for managing Returns And W 2 Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance software. This allows you to manage Returns and W-2 forms for the most recent two years alongside your financial documentation, ensuring everything is in one place.

-

What benefits does airSlate SignNow provide for businesses handling Returns And W 2 Forms?

By using airSlate SignNow, businesses benefit from enhanced efficiency and security when handling Returns and W-2 forms for the most recent two years. Our platform minimizes paper usage and streamlines the signing process, making your tax paperwork hassle-free.

-

Is it easy to retrieve Returns And W 2 Forms For The Most Recent Two Years using airSlate SignNow?

Absolutely! airSlate SignNow makes it extremely easy to retrieve Returns and W-2 forms for the most recent two years via a user-friendly interface. You can quickly access and manage your documents without any technical barriers.

Get more for Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

- Dl 329s form

- Zero income questionnaire form

- California barbering cosmetology renewal form

- Application to add a child to an existing child support assessment cs065 form

- Hoa waiver form

- Chicago police driver exchange form

- Mental health act forms regulation alberta queens printer

- Contract for demolition form

Find out other Returns And W 2 Forms For The Most Recent Two Years And A Copy Of The Total Amount Of Wages You

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors