New Mexico Fid 1 Form 2014

What is the New Mexico Fid 1 Form

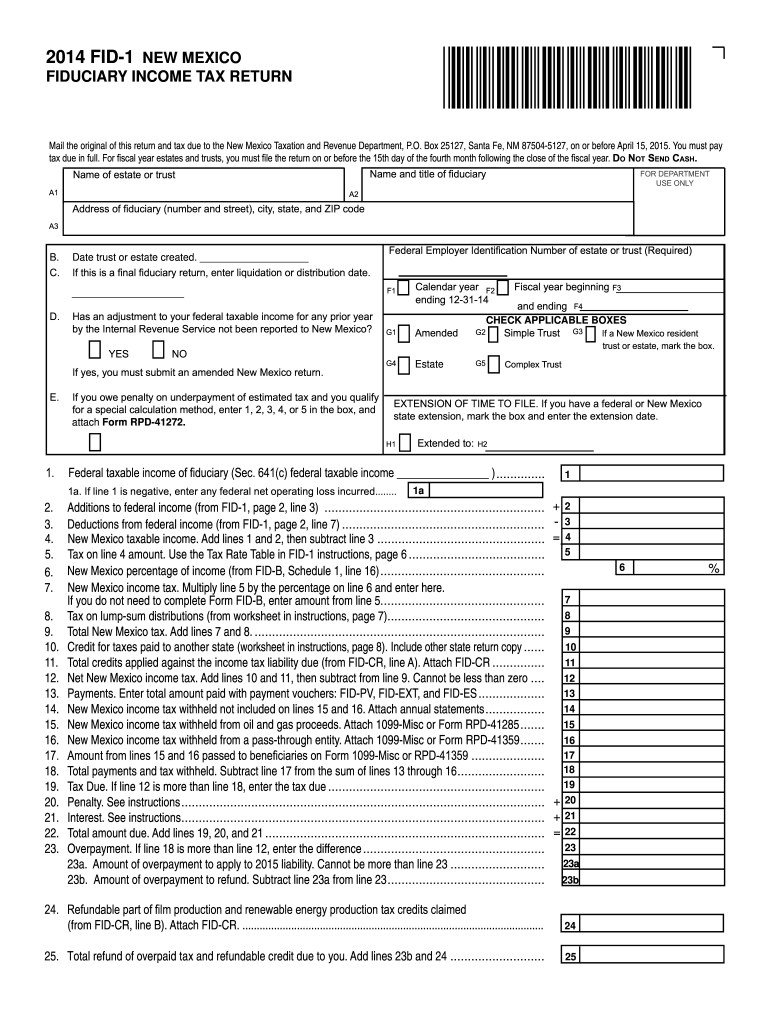

The New Mexico Fid 1 Form is a state-specific tax document used by fiduciaries to report income and calculate tax liabilities for estates and trusts. This form is essential for ensuring compliance with New Mexico tax laws and is typically required to be filed by individuals managing an estate or trust on behalf of beneficiaries. Understanding the purpose and requirements of the Fid 1 Form is crucial for fiduciaries to fulfill their legal obligations accurately.

How to use the New Mexico Fid 1 Form

Using the New Mexico Fid 1 Form involves several steps to ensure accurate completion. First, fiduciaries must gather all necessary financial information related to the estate or trust, including income, deductions, and credits. Next, the form should be filled out with precise details, reflecting the financial activities of the estate or trust during the tax year. Once completed, the form must be signed and submitted to the appropriate state tax authority, either electronically or by mail, depending on the chosen submission method.

Steps to complete the New Mexico Fid 1 Form

Completing the New Mexico Fid 1 Form requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all figures are correct and reflect the estate or trust's financial activities.

- Review the completed form for any errors or omissions.

- Sign the form, confirming that all information provided is true and accurate.

- Submit the form by the specified deadline, either online or by mailing it to the appropriate office.

Legal use of the New Mexico Fid 1 Form

The New Mexico Fid 1 Form serves a legal purpose by documenting the financial activities of estates and trusts for tax reporting. It is essential for fiduciaries to use this form correctly to avoid legal penalties and ensure compliance with state tax regulations. Filing the form accurately helps maintain transparency and accountability in managing the assets of the estate or trust, protecting the interests of the beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Fid 1 Form are critical for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the estate or trust’s tax year. For estates or trusts operating on a calendar year, this means the form is due on April 15. It is important for fiduciaries to be aware of these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Fid 1 Form can be submitted through various methods, providing flexibility for fiduciaries. The available submission options include:

- Online submission through the New Mexico Taxation and Revenue Department’s website, which allows for quick processing and confirmation.

- Mailing a completed paper form to the designated tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, which may be beneficial for those needing assistance or clarification on the filing process.

Quick guide on how to complete new mexico fid 1 2014 form

Your assistance manual on how to prepare your New Mexico Fid 1 Form

If you would like to learn how to finalize and file your New Mexico Fid 1 Form, here are some brief directions to simplify the tax declaration process.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to edit, create, and complete your tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and digital signatures, and return to modify details as needed. Enhance your tax handling with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your New Mexico Fid 1 Form in just a few minutes:

- Create your account and start processing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Retrieve form to access your New Mexico Fid 1 Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting physically may lead to increased errors and delay refunds. Moreover, before electronically filing your taxes, check the IRS site for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct new mexico fid 1 2014 form

FAQs

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the new mexico fid 1 2014 form

How to make an eSignature for the New Mexico Fid 1 2014 Form online

How to create an eSignature for the New Mexico Fid 1 2014 Form in Chrome

How to generate an eSignature for signing the New Mexico Fid 1 2014 Form in Gmail

How to generate an eSignature for the New Mexico Fid 1 2014 Form from your smartphone

How to create an eSignature for the New Mexico Fid 1 2014 Form on iOS devices

How to create an eSignature for the New Mexico Fid 1 2014 Form on Android

People also ask

-

What is the New Mexico Fid 1 Form?

The New Mexico Fid 1 Form is a vital document designed for fiduciaries in New Mexico to report and manage the financial activities of estates or trusts. It is crucial for accurate tax reporting and compliance with state regulations. Ensuring it is filled out correctly helps streamline the estate administration process.

-

How can airSlate SignNow help with the New Mexico Fid 1 Form?

airSlate SignNow simplifies the process of completing and eSigning the New Mexico Fid 1 Form. With its user-friendly interface, you can easily fill out the form, obtain necessary signatures, and store it securely. This ensures that you maintain compliance while minimizing the hassle often associated with paperwork.

-

What features does airSlate SignNow offer for the New Mexico Fid 1 Form?

airSlate SignNow includes features like automated workflows, customizable templates, and real-time notifications that enhance the signing process for the New Mexico Fid 1 Form. These tools allow for efficient document management and ensure that your fiduciary responsibilities are met seamlessly.

-

Is airSlate SignNow cost-effective for handling the New Mexico Fid 1 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the New Mexico Fid 1 Form. With affordable pricing plans tailored to the needs of businesses and individuals, you can save on printing and postage costs while ensuring your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for the New Mexico Fid 1 Form?

Absolutely! airSlate SignNow provides seamless integrations with popular applications, making it easy to import or export data related to the New Mexico Fid 1 Form. This compatibility enhances your workflow, allowing for a smoother and more efficient document management experience.

-

How secure is the airSlate SignNow platform for the New Mexico Fid 1 Form?

The airSlate SignNow platform is designed with high-tier security measures to protect your New Mexico Fid 1 Form and other sensitive documents. With encrypted data transmission and robust user authentication, you can trust that your information is kept safe throughout the signing process.

-

What types of organizations can benefit from using the New Mexico Fid 1 Form with airSlate SignNow?

Various organizations, including law firms, accounting agencies, and financial institutions, can benefit from using the New Mexico Fid 1 Form with airSlate SignNow. By streamlining the document signing process, these businesses can improve their operational efficiency and ensure that fiduciary duties are performed accurately.

Get more for New Mexico Fid 1 Form

- A guide to new york citys noise code nyc gov form

- Gentlebrook west lafayette ohio form

- Myuhealthchart form

- Termination declaration form 56925549

- Familyfriends information verbal authorization only peacehealth peacehealth

- Get a pencil youre tackling the deficit form

- Plumbing hvacpermit application requirements form

- 7 things in car mechanic simulator that will make a real form

Find out other New Mexico Fid 1 Form

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form