New Mexico Fid 1 Instructions 2016

What is the New Mexico Fid 1 Instructions

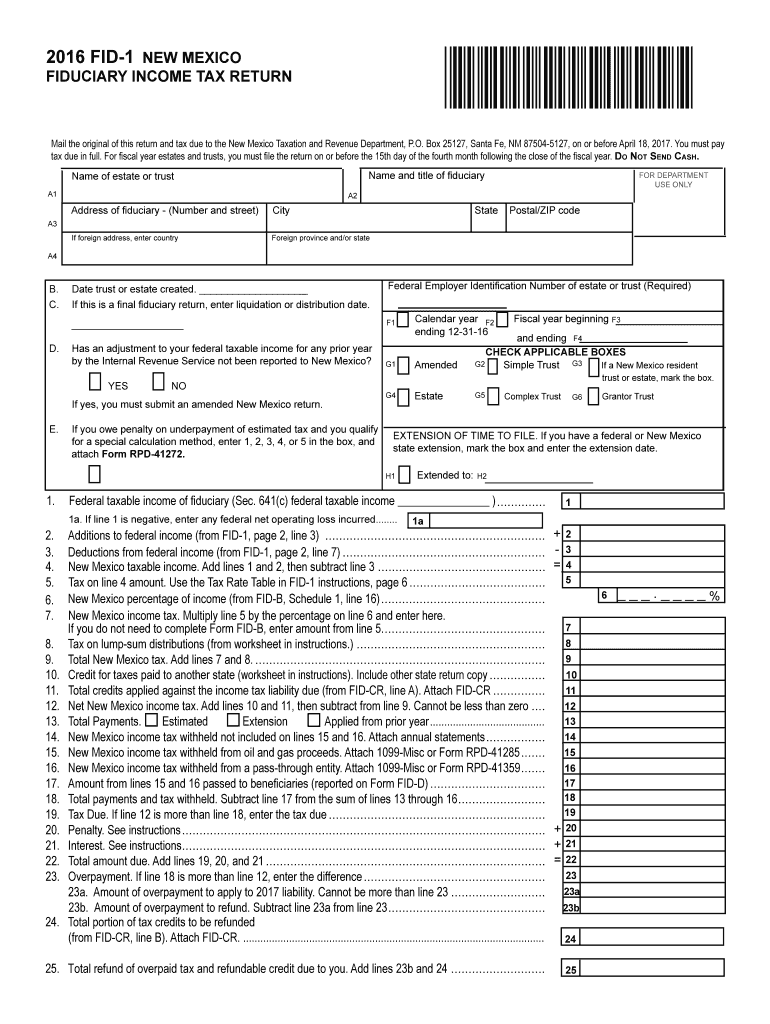

The New Mexico Fid 1 form is a crucial document used for reporting income and calculating tax obligations for individuals and businesses in New Mexico. The instructions for completing the Fid 1 form provide detailed guidance on how to accurately fill out the form, ensuring compliance with state tax laws. These instructions cover essential aspects such as eligibility criteria, required information, and specific sections of the form that need careful attention. Understanding these instructions is vital for avoiding errors that could lead to penalties or delays in processing.

Steps to Complete the New Mexico Fid 1 Instructions

Completing the New Mexico Fid 1 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements and previous tax returns. Next, carefully read through the Fid 1 instructions to understand the requirements for each section of the form. Fill out the form by entering the required information, such as income, deductions, and credits. After completing the form, review it thoroughly to check for any mistakes or missing information. Finally, submit the form either electronically or by mail, following the specified guidelines for submission.

Legal Use of the New Mexico Fid 1 Instructions

The New Mexico Fid 1 instructions are designed to comply with state tax laws and regulations. Using these instructions ensures that individuals and businesses fulfill their legal obligations regarding tax reporting. It is important to adhere to the guidelines provided to avoid legal repercussions, such as fines or audits. The instructions also clarify the legal implications of incorrect reporting and the importance of maintaining accurate records to support the information submitted on the form.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Fid 1 form are critical for taxpayers to note. Typically, the form must be submitted by April 15 of the year following the tax year being reported. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to specific circumstances, such as natural disasters or state-specific announcements. Staying informed about these dates helps prevent late submissions and associated penalties.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Fid 1 form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically using approved e-filing services, which can expedite processing times and reduce the likelihood of errors. Alternatively, the form can be printed and mailed to the appropriate tax authority. For those who prefer a personal touch, in-person submissions may be made at designated tax offices. Each submission method has its own guidelines and requirements, so it is essential to follow the instructions carefully for the chosen method.

Required Documents

When completing the New Mexico Fid 1 form, several documents are necessary to ensure accurate reporting. Taxpayers should gather income statements, such as W-2s and 1099s, to report earnings. Additionally, documentation for any deductions or credits claimed, such as receipts for business expenses or educational costs, is important. Having all required documents on hand facilitates a smoother completion process and helps ensure compliance with state tax regulations.

Quick guide on how to complete new mexico fid 1 2016 2019 form

Your assistance manual on how to prepare your New Mexico Fid 1 Instructions

If you’re curious about how to generate and submit your New Mexico Fid 1 Instructions, here are some straightforward instructions on how to make tax filing less challenging.

To get started, you simply need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax papers effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revert to amend details where necessary. Simplify your tax management with advanced PDF modifications, eSigning, and user-friendly sharing.

Follow the instructions below to complete your New Mexico Fid 1 Instructions in a few minutes:

- Create your profile and start editing PDFs in minutes.

- Utilize our directory to locate any IRS tax form; navigate through versions and schedules.

- Click Access form to open your New Mexico Fid 1 Instructions in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Make use of the Signature Tool to insert your legally-valid eSignature (if needed).

- Review your document and correct any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase return errors and postpone refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new mexico fid 1 2016 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How many empty folders would it take to fill out a brand new 1 TB hard/solid disk drive?

This was also addressed in another forum: How much space do directories consume? and I don’t think I can add much to the explanation, so here it is:According to the Wikipedia article about NTFS, all permissions are stored in the Master File Table. It's space can be seen apparently through the Disk Defragmenter, as shown on here.The size a MFT record occupies from both a folder or a file, is described in here:File and folder records are 1 KB each and are stored in the MFT, the attributes of which are written to the allocated space in the MFT. Besides file attributes, each file record contains information about the position of the file record in the MFT.When a file’s attributes can fit within the MFT file record for that file, they are called resident attributes. Attributes such as file name and time stamp are always resident. When the amount of information for a file does not fit in its MFT file record, some file attributes become nonresident. Nonresident attributes are allocated one or more clusters of disk space. A portion of the nonresident attribute remains in the MFT and points to the external clusters. NTFS creates the Attribute List attribute to describe the location of all attribute records. The table NTFS File Attribute Types lists the file attributes currently defined by NTFS.So, in NTFS, folders occupy at least 1 KB of space, unless they have very long argument and permission lists; at that point, the MFT record occupies an additional cluster in the partition, the size of which depends on how it was formatted, although for more than 2GB Microsoft in that post recommends 4KB clusters.As to why this could be important, a few years back I was developing a data logging feature as part of an IoT embedded system. The architecture was set up so that each calendar day would have it’s own folder (much like many digital cameras do to store pictures).Memory space was limited, so we had to calculate precisely how all of the memory was allocated including the system memory for the directories. The goal was to match the memory space with the battery life so that it was still capturing data until it just ran out of power.Without including the “overhead” for the folders / directories, the calculations would have been off.However, with 1TB of memory to work with, the overhead just becomes a rounding error.FYI - we recently published a review / buyers guide featuring the Seagate as the top pick: Best 1TB Portable External Hard Drive for under $50

Create this form in 5 minutes!

How to create an eSignature for the new mexico fid 1 2016 2019 form

How to create an eSignature for the New Mexico Fid 1 2016 2019 Form in the online mode

How to create an eSignature for your New Mexico Fid 1 2016 2019 Form in Google Chrome

How to create an eSignature for signing the New Mexico Fid 1 2016 2019 Form in Gmail

How to create an eSignature for the New Mexico Fid 1 2016 2019 Form straight from your smartphone

How to make an eSignature for the New Mexico Fid 1 2016 2019 Form on iOS devices

How to create an electronic signature for the New Mexico Fid 1 2016 2019 Form on Android

People also ask

-

What is nm fid 1 and how does it relate to airSlate SignNow?

NM fid 1 refers to a specific feature within airSlate SignNow that allows users to streamline their document signing processes. This feature ensures that businesses can efficiently manage their electronic signatures in compliance with legal standards, enhancing productivity and organization.

-

How much does airSlate SignNow cost when using nm fid 1?

Pricing for airSlate SignNow varies based on the plan selected, but it offers a cost-effective solution even with the powerful nm fid 1 feature. Users can choose from multiple subscription levels, ensuring a plan that meets their budget while still utilizing nm fid 1.

-

What are the key features of nm fid 1 in airSlate SignNow?

The nm fid 1 feature in airSlate SignNow includes customizable document templates, an intuitive interface, and robust security options. These features are designed to enhance user experience and ensure the safe management of electronic signatures and documents.

-

What benefits can businesses expect from using nm fid 1?

Businesses utilizing nm fid 1 in airSlate SignNow can expect increased efficiency, improved workflow automation, and enhanced document tracking. This feature helps reduce turnaround time for document signing, leading to faster completion of business transactions.

-

Is nm fid 1 compatible with other software integrations?

Yes, nm fid 1 in airSlate SignNow seamlessly integrates with various popular tools and platforms, enhancing its functionality. Users can connect airSlate SignNow with CRM systems, project management tools, and other applications to streamline workflows further.

-

How secure is the nm fid 1 feature in airSlate SignNow?

The nm fid 1 feature prioritizes security by implementing industry-standard encryption and compliance protocols. This ensures that all electronic signatures and sensitive documents are protected, giving users peace of mind while conducting business transactions.

-

Can nm fid 1 help with remote work and digital transformation?

Absolutely, nm fid 1 supports remote work by allowing teams to sign and send documents electronically from anywhere. This feature is vital for businesses undergoing digital transformation, enabling them to adapt to modern workflows effectively.

Get more for New Mexico Fid 1 Instructions

- Mms summer reading response informatrional bb mooremiddleschool

- Masshealth nonbilling provider contract for individuals form

- Float plan united states power squadrons usps form

- Cigna xolair prior authorization form

- Horse surrender form fill online printable fillable blank

- Reflective address sign order form stonyhillfire

- In the interest of safety for all students the following medication administration procedures will be followed for form

- Carrier preference form

Find out other New Mexico Fid 1 Instructions

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed