Missouri Form MO 1120S S Corporation Income Tax Return 2022

What is the Missouri Form MO 1120S S Corporation Income Tax Return

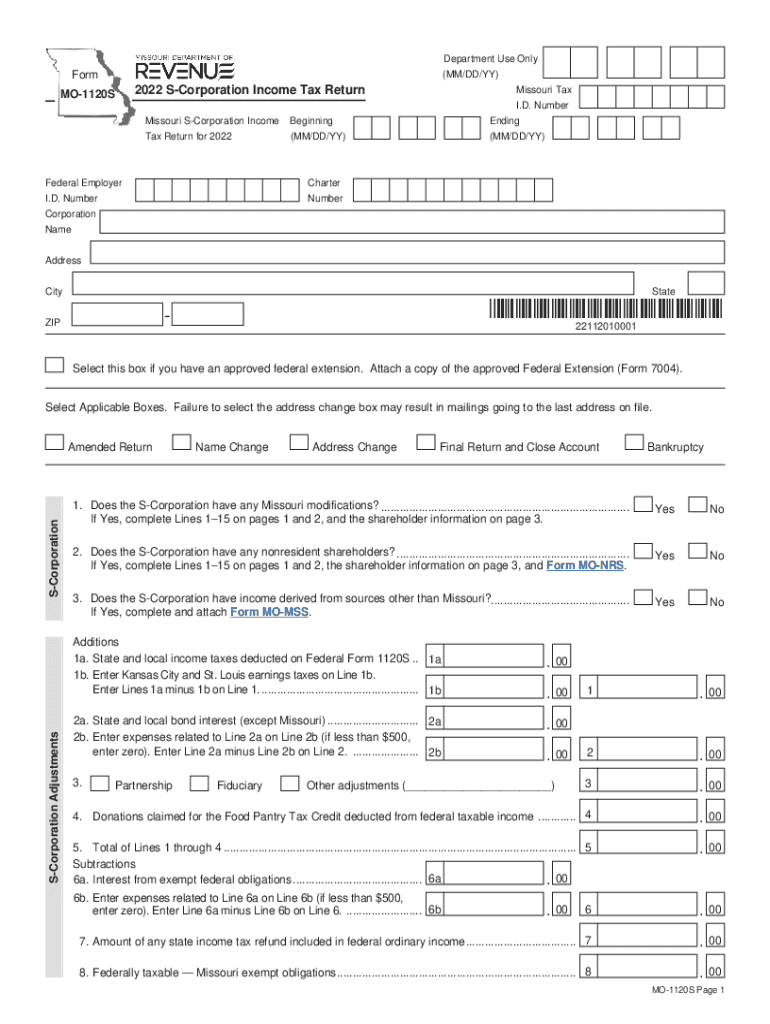

The Missouri Form MO 1120S is a tax return specifically designed for S corporations operating within the state of Missouri. This form is used to report the income, deductions, and credits of S corporations, which are unique business entities that pass corporate income, losses, and deductions to their shareholders for federal tax purposes. By completing this form, S corporations ensure compliance with Missouri tax regulations while providing necessary financial information to the state.

How to use the Missouri Form MO 1120S S Corporation Income Tax Return

To effectively use the Missouri Form MO 1120S, S corporations must gather relevant financial data, including income, expenses, and any applicable deductions. The form requires detailed reporting of both federal and state income, which may differ based on Missouri's tax laws. It is essential for businesses to accurately fill out each section, as this will impact their tax liability and compliance status. Once completed, the form must be submitted to the appropriate state tax authority.

Steps to complete the Missouri Form MO 1120S S Corporation Income Tax Return

Completing the Missouri Form MO 1120S involves several key steps:

- Gather all necessary financial documents, including profit and loss statements and balance sheets.

- Fill out the form with accurate income and expense figures, ensuring that all calculations are correct.

- Include any applicable deductions and credits that the corporation is entitled to claim.

- Review the completed form for accuracy and completeness.

- Submit the form to the Missouri Department of Revenue by the designated deadline.

Filing Deadlines / Important Dates

It is crucial for S corporations to be aware of the filing deadlines for the Missouri Form MO 1120S. Generally, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. Corporations may request an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents

When preparing the Missouri Form MO 1120S, several documents are essential to ensure accurate reporting. These include:

- Financial statements, such as income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of all business expenses and deductions.

- Any prior year tax returns for reference.

Form Submission Methods

S corporations have multiple options for submitting the Missouri Form MO 1120S. The form can be filed electronically through the Missouri Department of Revenue’s online portal, which offers a streamlined process. Alternatively, businesses can choose to mail the completed form to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Quick guide on how to complete missouri form mo 1120s s corporation income tax return

Complete Missouri Form MO 1120S S Corporation Income Tax Return effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to generate, modify, and eSign your documents rapidly without delays. Manage Missouri Form MO 1120S S Corporation Income Tax Return on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Missouri Form MO 1120S S Corporation Income Tax Return with ease

- Obtain Missouri Form MO 1120S S Corporation Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Missouri Form MO 1120S S Corporation Income Tax Return and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form mo 1120s s corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the missouri form mo 1120s s corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form MO 1120S S Corporation Income Tax Return?

The Missouri Form MO 1120S S Corporation Income Tax Return is a tax form specifically designed for S corporations operating in Missouri. It allows these businesses to report income, deductions, and credits, ensuring they comply with state tax laws. Completing this form accurately is essential for proper tax reporting and minimizing liabilities.

-

How can airSlate SignNow help with filing the Missouri Form MO 1120S S Corporation Income Tax Return?

airSlate SignNow provides a seamless platform for businesses to manage, sign, and submit the Missouri Form MO 1120S S Corporation Income Tax Return online. The user-friendly interface simplifies document preparation and ensures legal compliance. Additionally, the secure eSigning feature ensures that your tax documents are signed and submitted swiftly.

-

What features does airSlate SignNow offer for managing the Missouri Form MO 1120S S Corporation Income Tax Return?

With airSlate SignNow, you can easily prepare and store the Missouri Form MO 1120S S Corporation Income Tax Return with features like customizable templates and automatic reminders. It also offers tracking capabilities, ensuring you know when your documents have been signed and submitted. This streamlines the entire filing process, reducing potential errors.

-

Is airSlate SignNow cost-effective for filing the Missouri Form MO 1120S S Corporation Income Tax Return?

Yes, airSlate SignNow offers a cost-effective solution for filing the Missouri Form MO 1120S S Corporation Income Tax Return. By reducing the need for physical paperwork and allowing for quick, efficient electronic submissions, businesses save both time and money. The flexible pricing plans accommodate various business sizes, making it accessible for all.

-

Can airSlate SignNow integrate with accounting software when handling the Missouri Form MO 1120S S Corporation Income Tax Return?

Absolutely! airSlate SignNow integrates with popular accounting software, enhancing your ability to manage financial documents, including the Missouri Form MO 1120S S Corporation Income Tax Return. This integration allows for seamless data transfer, ensuring consistency and accuracy in your tax records, minimizing the chance of errors.

-

What are the benefits of using airSlate SignNow for the Missouri Form MO 1120S S Corporation Income Tax Return?

Using airSlate SignNow for the Missouri Form MO 1120S S Corporation Income Tax Return provides several benefits, including enhanced security, reduced paperwork, and efficient workflow management. The platform’s eSigning feature eliminates the hassles of physical document exchange, while real-time tracking keeps you updated on the status of your filings. This simplification of processes helps businesses focus more on their operations.

-

What kind of customer support does airSlate SignNow provide for Missouri Form MO 1120S S Corporation Income Tax Return users?

airSlate SignNow offers robust customer support tailored to assist users with the Missouri Form MO 1120S S Corporation Income Tax Return. Their dedicated support team is available through various channels, including chat, email, and phone, ensuring you receive timely assistance for any queries or challenges. This support helps you navigate the filing process with confidence.

Get more for Missouri Form MO 1120S S Corporation Income Tax Return

- Example 2a general nondisturbance agreement form

- Exhibit 109 sec form

- Form of senior secured revolving credit secgovhome

- 07 fee mortgage provisions from a ground lease form

- Current report filing 8 k form

- Example 1 standard provision to limit changes in a partnership form

- Interagency bank merger act application check form

- Tenants warranty of authority to enter into the lease form

Find out other Missouri Form MO 1120S S Corporation Income Tax Return

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast