Relief Provided from Failure to Pay Additions to Tax 2023

What is the Relief Provided From Failure to Pay Additions To Tax

The Relief Provided From Failure to Pay Additions To Tax is a provision that allows taxpayers in Missouri to mitigate penalties associated with late payments on their income tax returns. This relief is particularly relevant for individuals and businesses that may face financial hardships or unforeseen circumstances that prevent timely payment. Understanding this relief can help taxpayers avoid excessive penalties and manage their tax obligations more effectively.

How to Use the Relief Provided From Failure to Pay Additions To Tax

To utilize the relief from failure to pay additions to tax, taxpayers must first determine their eligibility based on specific criteria set by the Missouri Department of Revenue. This involves reviewing their tax situation and any applicable financial hardships. Once eligibility is established, taxpayers can formally request relief by submitting the necessary documentation along with their Missouri income tax return. This process ensures that the request is considered and processed appropriately.

Filing Deadlines / Important Dates

Taxpayers should be aware of key filing deadlines to ensure compliance and eligibility for relief. For the 2024 Missouri income tax return, the standard deadline is typically April 15. However, if this date falls on a weekend or holiday, it may be extended. It is crucial to stay informed about any changes to deadlines, as late submissions can affect the ability to claim relief from penalties.

Required Documents

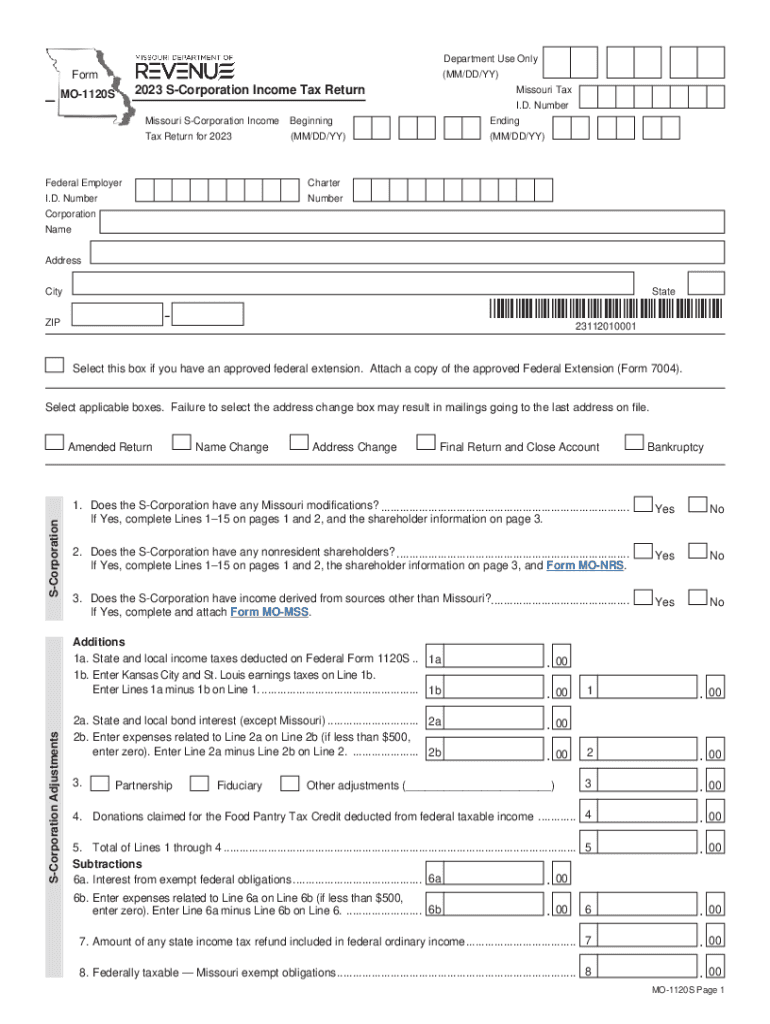

When applying for relief from failure to pay additions to tax, specific documents must be submitted. These may include:

- A completed Missouri income tax return form.

- Documentation supporting the claim of financial hardship, such as income statements or proof of unexpected expenses.

- Any correspondence from the Missouri Department of Revenue regarding previous tax obligations.

Having these documents ready can streamline the application process and facilitate a timely response from tax authorities.

Penalties for Non-Compliance

Failing to comply with Missouri tax regulations can result in significant penalties. Taxpayers who do not file their income tax returns on time or fail to pay the taxes owed may incur additional charges, including interest on unpaid amounts and failure-to-pay penalties. Understanding these potential penalties emphasizes the importance of timely filing and payment, as well as the benefits of seeking relief when necessary.

Eligibility Criteria

Eligibility for relief from failure to pay additions to tax typically hinges on several factors. Taxpayers must demonstrate that they have encountered financial difficulties that hindered their ability to pay taxes on time. Additionally, they should not have a history of repeated late payments or non-compliance. Meeting these criteria is essential for a successful application for relief.

Application Process & Approval Time

The application process for relief from failure to pay additions to tax involves several steps. Taxpayers must gather the required documentation and submit it along with their Missouri income tax return. After submission, the Missouri Department of Revenue will review the application. Approval times can vary, but taxpayers should expect to receive a response within a few weeks. Staying proactive and following up can help ensure that the application is processed efficiently.

Quick guide on how to complete relief provided from failure to pay additions to tax

Effortlessly Prepare Relief Provided From Failure to Pay Additions To Tax on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage Relief Provided From Failure to Pay Additions To Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Relief Provided From Failure to Pay Additions To Tax with Ease

- Find Relief Provided From Failure to Pay Additions To Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Relief Provided From Failure to Pay Additions To Tax to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct relief provided from failure to pay additions to tax

Create this form in 5 minutes!

How to create an eSignature for the relief provided from failure to pay additions to tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Missouri income tax return?

A Missouri income tax return is a document that taxpayers in Missouri file with the state to report their income and calculate their tax liability. It includes details about your earned income, deductions, credits, and the amount of tax owed or refunded. Understanding how to complete your Missouri income tax return is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help me with my Missouri income tax return?

airSlate SignNow streamlines the process of signing and submitting your Missouri income tax return by allowing you to eSign documents securely and easily. With our platform, you can prepare your returns with minimal hassle while ensuring that all signatures are legally binding. This simplifies the filing process and helps you manage your tax documents efficiently.

-

Is airSlate SignNow cost-effective for handling Missouri income tax returns?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals needing to manage their Missouri income tax returns. Our pricing plans are designed to accommodate varying needs, ensuring that you have access to powerful features without exceeding your budget. Investing in our eSignature solution can save you time and resources during tax season.

-

What features does airSlate SignNow offer for tax preparation?

airSlate SignNow provides a range of features to assist with tax preparation, including templates for Missouri income tax returns, secure storage for your documents, and easy access to electronic signatures. Our intuitive platform allows you to collaborate with tax professionals and ensures that your documents are accurately completed and signed. These features enhance efficiency and help eliminate errors in your tax filings.

-

Can airSlate SignNow integrate with accounting software for my Missouri income tax return?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier for you to manage your Missouri income tax return. This integration facilitates smooth data transfer between your accounting tools and our eSignature platform, reducing manual entry and helping ensure accuracy in your financial documents. It’s a perfect solution for businesses aiming to streamline their tax processes.

-

How secure is my information with airSlate SignNow when filing my Missouri income tax return?

airSlate SignNow takes security seriously and employs industry-leading encryption to safeguard your information when filing your Missouri income tax return. Our platform is designed to protect sensitive data while allowing easy access for authorized users. You can trust that your tax documents are secure while using airSlate SignNow.

-

What are the benefits of using airSlate SignNow for my Missouri income tax return?

Using airSlate SignNow for your Missouri income tax return offers numerous benefits, including efficiency, accuracy, and convenience. Our platform allows for a faster turnaround on document signing and submission while reducing the risk of errors. Additionally, you can access your documents from anywhere, making it easier to manage your tax responsibilities.

Get more for Relief Provided From Failure to Pay Additions To Tax

- Contract for deed package utah form

- Utah poa form

- Revised uniform anatomical gift act donation utah

- Employment hiring process package utah form

- Revocation of anatomical gift donation utah form

- Utah employment form 497427756

- Newly widowed individuals package utah form

- Employment interview package utah form

Find out other Relief Provided From Failure to Pay Additions To Tax

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document