Tennessee Department of Revenue Agriculture Vehicle 2020-2026

Understanding the Tennessee Vehicle Information Request

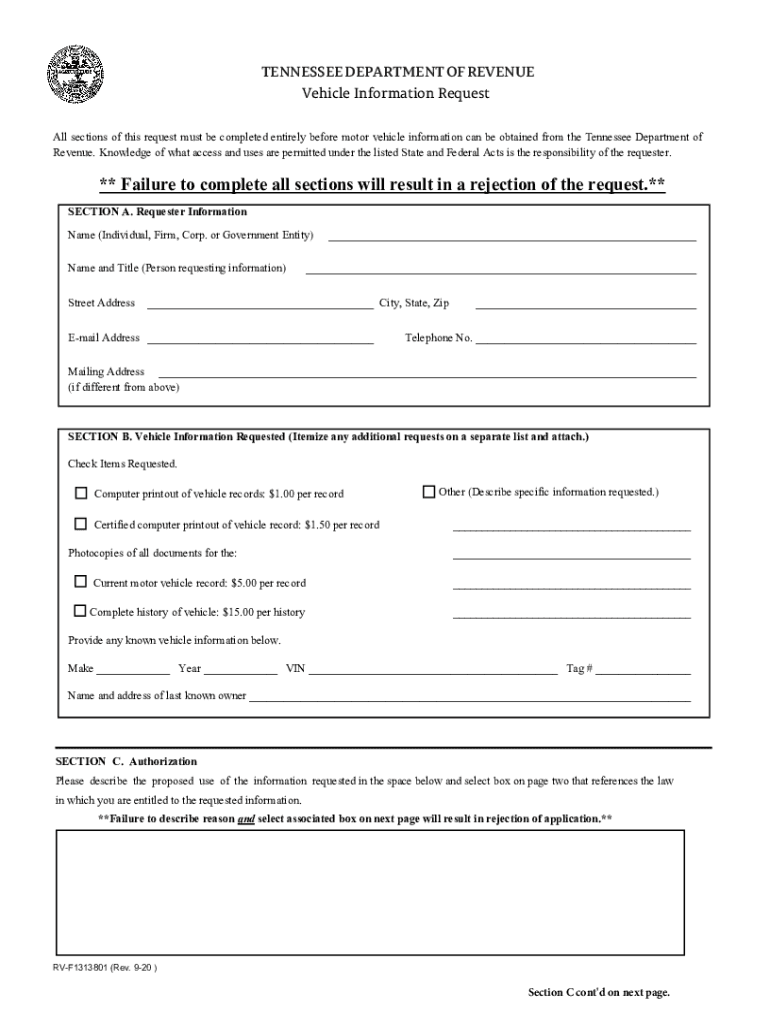

The Tennessee vehicle information request is a vital form used to obtain specific details about a vehicle registered in the state. This form is essential for individuals and businesses needing information for various reasons, such as purchasing a used vehicle, verifying ownership, or conducting background checks. The Tennessee Department of Revenue oversees this process, ensuring that all requests are handled efficiently and securely.

Steps to Complete the Tennessee Vehicle Information Request

Completing the Tennessee vehicle information request involves several key steps. First, gather necessary information about the vehicle, including the Vehicle Identification Number (VIN), license plate number, and the owner's details. Next, fill out the TN vehicle information request form accurately, ensuring all fields are completed to avoid delays. After filling out the form, submit it through the preferred method, whether online, by mail, or in person. Keep a copy of the submitted form for your records.

Required Documents for the Tennessee Vehicle Information Request

When submitting a Tennessee vehicle information request, certain documents may be necessary to support your application. Typically, you will need a valid government-issued ID, proof of your relationship to the vehicle (if applicable), and any relevant documentation that justifies your request. This may include purchase agreements or legal documents if you are acting on behalf of another party.

Form Submission Methods for the Tennessee Vehicle Information Request

The Tennessee vehicle information request can be submitted through various methods, providing flexibility for users. You can complete the request online through the Tennessee Department of Revenue's website, which offers a streamlined process for immediate access to vehicle information. Alternatively, you may choose to mail the completed form to the designated address or visit a local Department of Revenue office to submit it in person. Each method has its own processing time, so consider your urgency when choosing how to submit.

Legal Use of the Tennessee Vehicle Information Request

The legal use of the Tennessee vehicle information request is governed by state regulations. This form is intended for legitimate purposes, such as verifying ownership, conducting background checks for vehicle purchases, or fulfilling legal obligations. Misuse of the information obtained through this request can lead to penalties, including fines or legal action. It is essential to ensure that your request complies with all relevant laws and guidelines.

Key Elements of the Tennessee Vehicle Information Request

Several key elements are crucial to the Tennessee vehicle information request. These include the vehicle's VIN, the owner's name and address, and the specific information being requested, such as title history or registration details. Understanding these elements helps ensure that your request is complete and accurate, facilitating a smoother processing experience.

Examples of Using the Tennessee Vehicle Information Request

There are various scenarios where the Tennessee vehicle information request is beneficial. For instance, a potential buyer may use the form to verify the title status of a used car before making a purchase. Similarly, a dealership might request vehicle information to confirm ownership and assess the vehicle's history. Additionally, insurance companies may use this form to gather necessary details when underwriting policies for vehicles. Each of these examples highlights the form's importance in ensuring informed decisions regarding vehicle transactions.

Quick guide on how to complete tennessee department of revenue agriculture vehicle

Prepare Tennessee Department Of Revenue Agriculture Vehicle effortlessly on any device

Digital document administration has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow supplies you with all the tools required to create, adjust, and electronically sign your papers swiftly without interruptions. Handle Tennessee Department Of Revenue Agriculture Vehicle on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Tennessee Department Of Revenue Agriculture Vehicle without effort

- Locate Tennessee Department Of Revenue Agriculture Vehicle and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Identify pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and carries the same legal standing as an old-fashioned wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Tennessee Department Of Revenue Agriculture Vehicle and guarantee effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee department of revenue agriculture vehicle

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue agriculture vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tennessee vehicle information request?

A Tennessee vehicle information request is a process that allows individuals to obtain details about a vehicle registered in Tennessee. This information can include ownership history, title information, and registration status. Utilizing airSlate SignNow can streamline this process by enabling you to eSign and send any necessary documents quickly and efficiently.

-

How can airSlate SignNow help with my Tennessee vehicle information request?

airSlate SignNow provides an easy-to-use platform that simplifies the process of submitting a Tennessee vehicle information request. With our eSignature capabilities, you can securely sign documents and send them in no time. This helps to expedite your request and ensures you receive the information you need without unnecessary delays.

-

What are the costs associated with making a Tennessee vehicle information request?

The costs of a Tennessee vehicle information request may vary depending on the type of information requested. Typically, there may be a small fee associated with obtaining vehicle history reports. By utilizing airSlate SignNow, you can manage your documents and costs efficiently, ensuring a cost-effective solution to your needs.

-

Are there any benefits to using airSlate SignNow for vehicle information requests?

Yes, using airSlate SignNow for vehicle information requests offers several benefits, including faster processing times and enhanced security. Our platform ensures that your documents are protected while allowing you to complete your requests remotely. This means you can focus on other important tasks while we handle your Tennessee vehicle information request seamlessly.

-

What features does airSlate SignNow include that assist with vehicle information requests?

airSlate SignNow includes features such as eSignature, document templates, and workflow automation that can signNowly aid in managing your Tennessee vehicle information request. These features simplify the documentation process and reduce the likelihood of errors. Users can easily track the status of their requests and make adjustments as needed, all from one platform.

-

Can I integrate airSlate SignNow with other software for vehicle information requests?

Yes, airSlate SignNow offers integrations with a variety of software applications that can enhance your Tennessee vehicle information request process. Whether you are using CRM systems, email applications, or document management platforms, our solution can seamlessly connect with them. This integration capability ensures that all your vehicle-related tasks are streamlined and centralized.

-

How secure is my information when submitting a Tennessee vehicle information request through airSlate SignNow?

AirSlate SignNow takes security very seriously. Our platform uses advanced encryption methods to protect your data during the entire Tennessee vehicle information request process. Rest assured that both your personal information and any submitted documents are kept safe from unauthorized access.

Get more for Tennessee Department Of Revenue Agriculture Vehicle

- Faq does each roommate need to sign the lease form

- By laws playboy online inc sample contracts and form

- Agreement and plan of merger sohucom inc and chinaren form

- Chapter 607 statutes ampamp constitution view statutes online form

- City of alhambra california emma form

- Electronic monitoring as a jail alternative in california form

- Underwriting agreement by internet com corp law insider form

- Second amended and restated development and license form

Find out other Tennessee Department Of Revenue Agriculture Vehicle

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast