Commercial Business Tax Receipt Application the Town 2022

What is the Commercial Business Tax Receipt Application The Town

The Commercial Business Tax Receipt Application is a formal document required by local authorities for businesses operating within a specific town. This application serves as a request for a tax receipt, which is necessary for legal business operations. It ensures that businesses comply with local tax regulations and helps municipalities track business activities within their jurisdiction.

How to Obtain the Commercial Business Tax Receipt Application The Town

To obtain the Commercial Business Tax Receipt Application, businesses can typically visit their town's official website or the local government office. Many municipalities provide downloadable forms online, while others may require in-person visits to collect the application. It is essential to check the specific town's requirements, as procedures may vary based on location.

Steps to Complete the Commercial Business Tax Receipt Application The Town

Completing the Commercial Business Tax Receipt Application involves several key steps:

- Gather necessary information about your business, including the business name, address, and type of entity.

- Provide details regarding ownership and management, including names and contact information.

- Complete all sections of the application accurately, ensuring that all required fields are filled out.

- Attach any required documents, such as proof of identification, business licenses, or zoning approvals.

- Review the application for accuracy before submission.

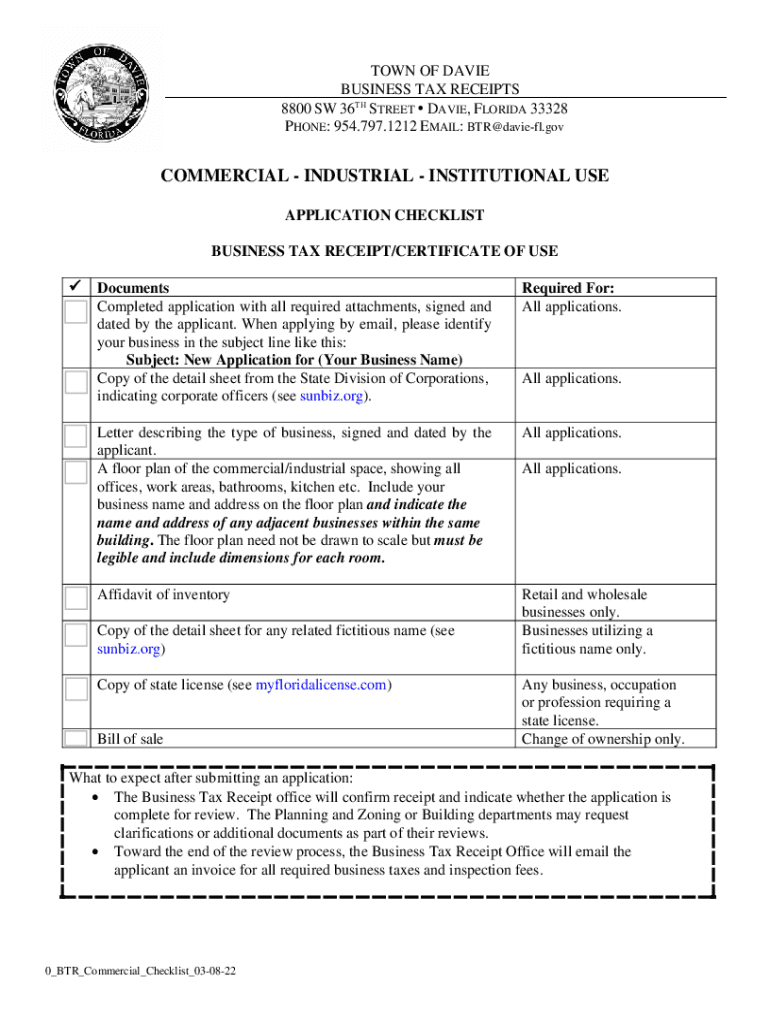

Required Documents for the Commercial Business Tax Receipt Application The Town

When submitting the Commercial Business Tax Receipt Application, several documents may be required. Commonly requested documents include:

- Proof of business registration or incorporation.

- Identification documents for business owners or partners.

- Lease agreements or property ownership documents.

- Any relevant licenses or permits specific to the business type.

Application Process & Approval Time

The application process for the Commercial Business Tax Receipt typically involves submitting the completed application form along with all required documents to the local government office. After submission, the approval time can vary based on the town's processing capabilities, but businesses can generally expect a response within a few weeks. It is advisable to follow up with the local office if there are delays beyond the expected timeframe.

Legal Use of the Commercial Business Tax Receipt Application The Town

The Commercial Business Tax Receipt Application is legally binding and ensures that businesses comply with local tax laws. It is crucial for businesses to understand that operating without a valid tax receipt can lead to penalties, fines, or legal action. Therefore, completing and submitting the application accurately is essential for maintaining compliance with local regulations.

Quick guide on how to complete commercial business tax receipt application the town

Effortlessly Prepare Commercial Business Tax Receipt Application The Town on Any Device

Digital document management has become popular with businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Commercial Business Tax Receipt Application The Town on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Commercial Business Tax Receipt Application The Town with Ease

- Acquire Commercial Business Tax Receipt Application The Town and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important parts of the documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow resolves all your document management needs in just a few clicks from any device you prefer. Modify and eSign Commercial Business Tax Receipt Application The Town to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct commercial business tax receipt application the town

Create this form in 5 minutes!

How to create an eSignature for the commercial business tax receipt application the town

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Commercial Business Tax Receipt Application The Town?

The Commercial Business Tax Receipt Application The Town is a necessary document that businesses need to operate legally within the municipality. This application provides local authorities with essential information about your business, ensuring compliance with local regulations.

-

How can airSlate SignNow help with the Commercial Business Tax Receipt Application The Town?

airSlate SignNow simplifies the process of completing and submitting the Commercial Business Tax Receipt Application The Town. Our platform allows you to easily eSign and send necessary documents securely, ensuring a hassle-free experience.

-

What are the costs associated with the Commercial Business Tax Receipt Application The Town?

The costs for the Commercial Business Tax Receipt Application The Town can vary based on local regulations and the type of business. It is essential to check with your local government for specific fees associated with the application process.

-

What features does airSlate SignNow offer for the Commercial Business Tax Receipt Application The Town?

airSlate SignNow provides features like customizable templates, eSignature capabilities, and secure document storage. These tools make the submission of the Commercial Business Tax Receipt Application The Town efficient and streamlined.

-

What are the benefits of using airSlate SignNow for the application process?

Using airSlate SignNow for the Commercial Business Tax Receipt Application The Town saves time and reduces paperwork. The platform enhances collaboration and ensures that documents are legally compliant through secure eSignatures.

-

Can I integrate airSlate SignNow with other applications for the Commercial Business Tax Receipt Application The Town?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing users to manage their workflows effectively. This ensures that your Commercial Business Tax Receipt Application The Town is part of a broader, efficient business process.

-

Is airSlate SignNow user-friendly for completing the Commercial Business Tax Receipt Application The Town?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it easy for anyone to complete the Commercial Business Tax Receipt Application The Town without extensive training. The interface guides you through each step of the application process.

Get more for Commercial Business Tax Receipt Application The Town

- Dos donts and details of fixed asset accounting wipfli llp form

- Add update or delete vendor contact office of the state form

- 7 best practices for hospitals training and development form

- Customer satisfaction how to measure it with 4 key form

- Key steps in developing an attitude survey form

- Dress codewaldorf school on the roaring fork form

- Bureau of motor vehicles request for certified records form

- Customer order no form

Find out other Commercial Business Tax Receipt Application The Town

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe