Commercial Business Tax Receipt Application Davie Fl 2014

What is the Commercial Business Tax Receipt Application Davie FL

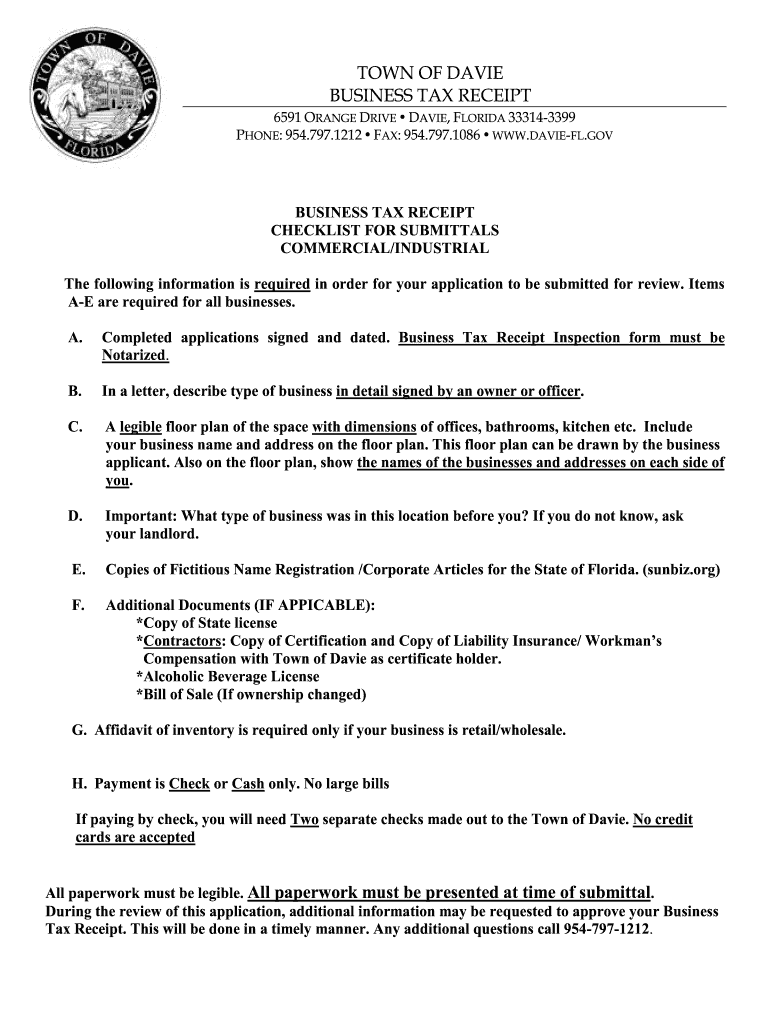

The Commercial Business Tax Receipt Application in Davie, Florida, is a crucial document for businesses operating within the city. This application serves as a license for businesses to legally operate and is required for various types of business entities, including sole proprietorships, partnerships, and corporations. Obtaining this receipt ensures compliance with local regulations and helps maintain the integrity of business operations in Davie.

How to Use the Commercial Business Tax Receipt Application Davie FL

Using the Commercial Business Tax Receipt Application involves several key steps. First, businesses must gather necessary information, including business name, address, and ownership details. Next, the application must be filled out accurately, ensuring all required fields are completed. Once the application is submitted, businesses should keep a copy for their records and monitor the status of their application to ensure timely approval.

Steps to Complete the Commercial Business Tax Receipt Application Davie FL

Completing the Commercial Business Tax Receipt Application requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including identification and proof of business location.

- Fill out the application form, ensuring all sections are completed accurately.

- Review the application for any errors or omissions before submission.

- Submit the application either online or in person, depending on the preferred method.

- Pay any required fees associated with the application process.

Legal Use of the Commercial Business Tax Receipt Application Davie FL

The legal use of the Commercial Business Tax Receipt Application is essential for businesses to operate within Davie. This document not only legitimizes a business's presence in the area but also ensures adherence to local laws and regulations. Without this receipt, businesses may face penalties or legal challenges, making it crucial to obtain and maintain compliance with this requirement.

Required Documents for the Commercial Business Tax Receipt Application Davie FL

To successfully complete the Commercial Business Tax Receipt Application, several documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID.

- Business formation documents, if applicable (e.g., Articles of Incorporation).

- Proof of business location, such as a lease agreement or property deed.

- Any additional licenses or permits required for specific business activities.

Form Submission Methods for the Commercial Business Tax Receipt Application Davie FL

Businesses in Davie have several options for submitting the Commercial Business Tax Receipt Application. The methods include:

- Online submission through the official Davie website, which provides a convenient and efficient way to apply.

- Mailing the completed application to the designated city office.

- In-person submission at the local government office, allowing for immediate assistance if needed.

Quick guide on how to complete commercial business tax receipt application davie fl

Prepare Commercial Business Tax Receipt Application Davie fl effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Commercial Business Tax Receipt Application Davie fl on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Commercial Business Tax Receipt Application Davie fl with ease

- Find Commercial Business Tax Receipt Application Davie fl and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Commercial Business Tax Receipt Application Davie fl and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct commercial business tax receipt application davie fl

FAQs

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Why does my boss want me to fill out the tax identification number (on the w-4 form) when it isn't my business?

As an employee, your tax ID is your social security number. An employer would submit an EIN or employer identification number. Now if she's asking you to submit as 'your own employer' she's shady boots!I would check with her to clarify because you both can be in deep trouble 'fudging' tax documents, it's serious business. If you're not the employer, you don't submit as the employer, who cares what she says? Boss or not anyone caught defrauding uncle Sam will usually end up in jail! You will be in jail because you filled out the form, and unless you did so at gun point, you will be there alone! She'll swear she knew nothing of it. Never allow anyone to make you break the law or do jail-time for their dishonesty!

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

Create this form in 5 minutes!

How to create an eSignature for the commercial business tax receipt application davie fl

How to make an electronic signature for your Commercial Business Tax Receipt Application Davie Fl online

How to create an electronic signature for the Commercial Business Tax Receipt Application Davie Fl in Google Chrome

How to make an electronic signature for putting it on the Commercial Business Tax Receipt Application Davie Fl in Gmail

How to create an eSignature for the Commercial Business Tax Receipt Application Davie Fl straight from your smart phone

How to generate an eSignature for the Commercial Business Tax Receipt Application Davie Fl on iOS devices

How to make an eSignature for the Commercial Business Tax Receipt Application Davie Fl on Android OS

People also ask

-

What is business form printing dvie fl and how can it benefit my company?

Business form printing Davie FL refers to the tailored printing of forms essential for companies to streamline their operations. By utilizing professional printing services, businesses can ensure that their forms are not only visually appealing but also functional, leading to improved efficiency and branding.

-

How much does business form printing cost in Davie FL?

The cost of business form printing in Davie FL can vary based on factors such as quantity, size, and design complexity. Generally, bulk orders can help reduce the price per form, making it a cost-effective option for businesses looking to optimize their expenditures.

-

What features should I look for in a business form printing service in Davie FL?

When selecting a business form printing service in Davie FL, consider features like customizable templates, high-quality materials, and quick turnaround times. Additionally, look for services that provide integrated designs for electronic submission and signature capabilities to streamline your workflow.

-

Can I integrate digital solutions with my business form printing in Davie FL?

Yes, many business form printing services in Davie FL offer integrations with digital solutions, including e-signature platforms. This allows for seamless transitions between printed forms and digital document management, enhancing efficiency and reducing paper waste.

-

What types of business forms can be printed in Davie FL?

Various types of business forms can be printed in Davie FL, including invoices, contracts, order forms, and more. Tailoring these forms to suit your business needs can enhance your branding and customer experience, making them more effective for your operations.

-

How can business form printing improve my customer service in Davie FL?

By utilizing professional business form printing in Davie FL, you can create more organized and user-friendly documents that facilitate clear communication with your customers. This enhanced clarity in your forms can lead to quicker response times and improved customer satisfaction.

-

Are there eco-friendly options for business form printing in Davie FL?

Absolutely! Many business form printing services in Davie FL now offer eco-friendly printing options, including recycled paper and soy-based inks. Opting for environmentally responsible printing can help your business appeal to eco-conscious consumers while maintaining quality.

Get more for Commercial Business Tax Receipt Application Davie fl

Find out other Commercial Business Tax Receipt Application Davie fl

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement