Form 1040 SR 2023

What is the Form 1040 SR

The Form 1040 SR is a simplified version of the standard Form 1040, specifically designed for seniors aged sixty-five and older. This form allows older taxpayers to report their income and claim deductions in a more straightforward manner. It features larger print and a simplified layout, making it easier for seniors to read and complete. The 1040 SR can be used for various income types, including wages, pensions, and Social Security benefits.

How to obtain the Form 1040 SR

Taxpayers can obtain the Form 1040 SR through several methods. It is available for download directly from the IRS website as a PDF file, which can be printed and filled out manually. Additionally, many tax preparation software programs include the 1040 SR, allowing users to complete their tax returns digitally. Taxpayers can also request a physical copy by contacting the IRS directly or visiting a local IRS office.

Steps to complete the Form 1040 SR

Completing the Form 1040 SR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin by entering personal information, such as name, address, and Social Security number.

- Report income in the designated sections, ensuring all sources are accurately documented.

- Claim deductions and credits applicable to your situation, such as the standard deduction for seniors.

- Review the completed form for accuracy before signing and dating it.

Filing Deadlines / Important Dates

For the tax year 2017, the deadline to file the Form 1040 SR was April 17, 2018. Taxpayers who needed additional time could file for an extension, allowing them until October 15, 2018, to submit their returns. It is important to be aware of these dates to avoid penalties and interest on any unpaid taxes.

Required Documents

To successfully complete the Form 1040 SR, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for other income sources, such as freelance work or interest

- Documentation for any deductions or credits claimed, such as medical expenses or charitable contributions

- Social Security numbers for all dependents

Penalties for Non-Compliance

Failing to file the Form 1040 SR by the deadline can result in penalties and interest on any unpaid taxes. The IRS typically imposes a failure-to-file penalty, which is calculated based on the amount of tax owed and the length of time the return is late. Additionally, taxpayers who underreport their income may face further penalties, making it crucial to file accurately and on time.

Quick guide on how to complete form 1040 sr

Effortlessly Prepare Form 1040 SR on Any Device

Managing documents online has become increasingly favored by companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage Form 1040 SR on any device using airSlate SignNow applications available for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and eSign Form 1040 SR Effortlessly

- Access Form 1040 SR and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight relevant sections of the documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 1040 SR to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

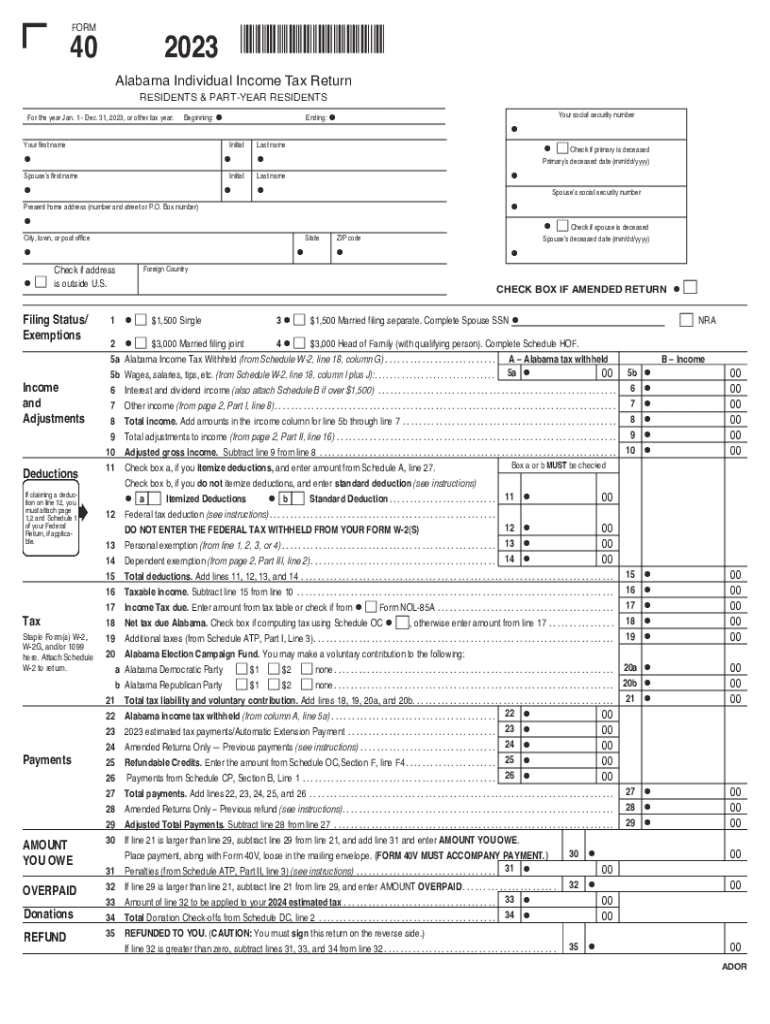

What are Alabama income tax forms 2017?

Alabama income tax forms 2017 are the official documents required for filing state income taxes in Alabama for the year 2017. These forms include 40, 40A, and various schedules that individuals and businesses must complete. It’s essential to use the correct forms to ensure compliance and accurate reporting.

-

Where can I find Alabama income tax forms 2017?

You can find Alabama income tax forms 2017 on the Alabama Department of Revenue’s official website. Additionally, airSlate SignNow offers a user-friendly platform where you can easily access and manage these forms for eSigning and submission, streamlining your tax filing process.

-

How can airSlate SignNow help with Alabama income tax forms 2017?

airSlate SignNow helps you manage Alabama income tax forms 2017 by allowing you to securely eSign and send documents. This platform simplifies the entire process of filling out and filing your tax forms, ensuring you meet deadlines effectively while reducing paperwork hassle.

-

Are there costs associated with using airSlate SignNow for Alabama income tax forms 2017?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose a plan that best suits your volume of document handling, making it a cost-effective solution for managing Alabama income tax forms 2017 and other related documents.

-

What features does airSlate SignNow offer for managing Alabama income tax forms 2017?

airSlate SignNow provides a range of features, including eSignature capabilities, document tracking, and templates specifically for Alabama income tax forms 2017. This ensures that you can easily complete, send, and receive these forms in a compliant and efficient manner.

-

Can airSlate SignNow integrate with accounting software for filling Alabama income tax forms 2017?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions. This enhances your workflow by allowing you to import data directly into Alabama income tax forms 2017, reducing manual entry and potential errors.

-

Is support available for users dealing with Alabama income tax forms 2017 on airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist users with Alabama income tax forms 2017. Whether you have questions about features, troubleshooting, or best practices, our support team is ready to help ensure a smooth experience.

Get more for Form 1040 SR

- 2 purchase and sale of electricity purchaser shall seia form

- Residential rental agreement kd properties llc form

- Application ampamp agreement for exhibit space 39th lane county form

- How to reduce legal risk when firing an employeenolo form

- 31780 working and monitoring category d erroneous irs form

- Michigan buysell agreement transnation title agency form

- Termite report provision for contract for the sale and purchase of real property form

- Explanation of rights and plea of guilty forms

Find out other Form 1040 SR

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer