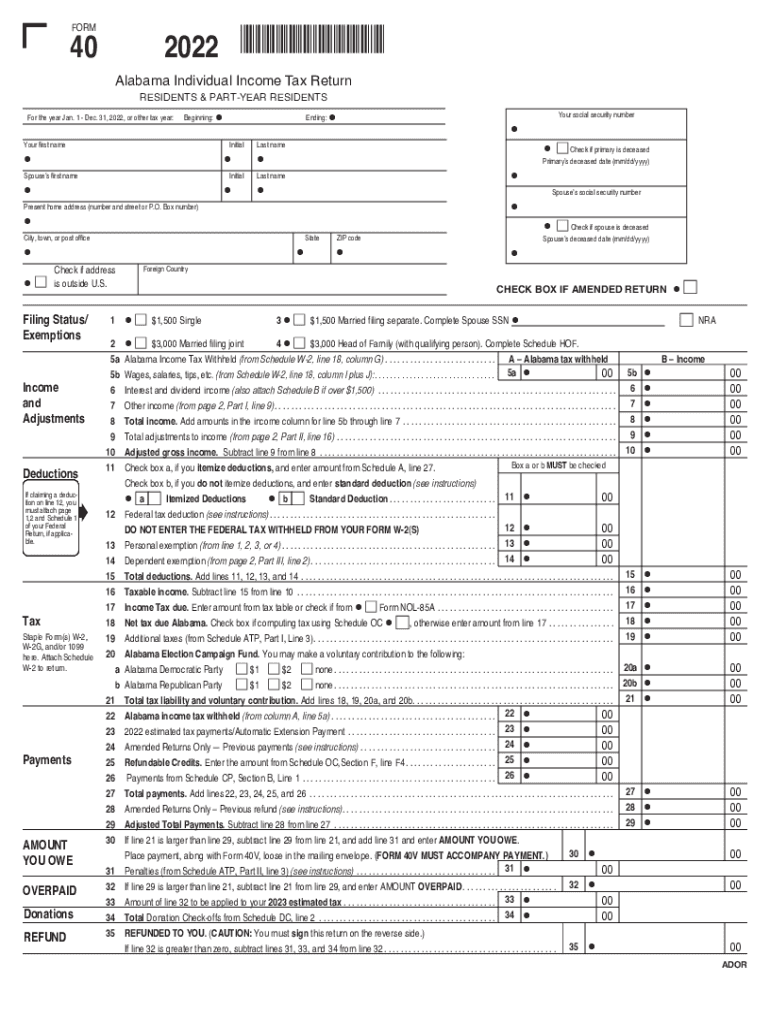

Individual Income Tax Electronic Filing Options Alabama 2022

What is the Individual Income Tax Electronic Filing Options Alabama

The Individual Income Tax Electronic Filing Options for Alabama provide taxpayers with a convenient way to file their state tax returns online. This method allows individuals to submit their Alabama state tax form 2018 electronically, which can streamline the filing process and reduce the likelihood of errors. Electronic filing is recognized by the Alabama Department of Revenue as a valid and efficient way to fulfill tax obligations.

Steps to complete the Individual Income Tax Electronic Filing Options Alabama

To successfully complete the electronic filing of the Alabama state tax form 2018, follow these steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Choose an approved e-filing software or service that supports Alabama tax forms.

- Enter your personal information, including Social Security number, address, and filing status.

- Input your income details and any deductions or credits you are eligible for.

- Review your entries for accuracy and completeness.

- Submit your completed form electronically through the software.

- Receive confirmation of your submission from the e-filing service.

Required Documents

When filing the Alabama state tax form 2018 electronically, you will need to have the following documents ready:

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income received.

- Documentation for any deductions, such as mortgage interest statements or medical expenses.

- Social Security numbers for yourself and any dependents.

- Bank account information if you wish to receive a direct deposit refund.

Legal use of the Individual Income Tax Electronic Filing Options Alabama

The electronic filing of the Alabama state tax form 2018 is legally recognized, provided it adheres to the guidelines set forth by the Alabama Department of Revenue. Electronic submissions must be made through approved e-filing software that complies with state regulations. This ensures that the submitted forms are valid and can be processed efficiently by the state.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Alabama state tax form 2018 to avoid penalties. Typically, the deadline for filing individual income tax returns is April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be available for filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Alabama have several options for submitting their state tax form 2018:

- Online: The preferred method, allowing for quick processing and confirmation.

- Mail: Paper forms can be printed and sent to the Alabama Department of Revenue, though this method may result in longer processing times.

- In-Person: Taxpayers can also visit local tax offices to submit their forms directly, though this option may require an appointment.

Quick guide on how to complete individual income tax electronic filing options alabama

Complete Individual Income Tax Electronic Filing Options Alabama effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Individual Income Tax Electronic Filing Options Alabama on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The simplest way to modify and electronically sign Individual Income Tax Electronic Filing Options Alabama without stress

- Locate Individual Income Tax Electronic Filing Options Alabama and click Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Emphasize essential parts of the documents or obscure confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or link invitation, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form navigation, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and electronically sign Individual Income Tax Electronic Filing Options Alabama while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax electronic filing options alabama

Create this form in 5 minutes!

How to create an eSignature for the individual income tax electronic filing options alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama state tax form 2018, and who needs to file it?

The Alabama state tax form 2018 is the official document used by residents of Alabama to report their income and calculate their state tax liability for that year. Individuals who earned income in Alabama during 2018 are required to file this form to remain compliant with state tax laws.

-

How can airSlate SignNow help me with my Alabama state tax form 2018?

airSlate SignNow provides a seamless solution for signing and sending documents electronically, including the Alabama state tax form 2018. With our easy-to-use interface, you can quickly get your tax documents signed and submitted, ensuring a smooth filing process.

-

Is there a cost associated with using airSlate SignNow for my Alabama state tax form 2018?

Yes, airSlate SignNow offers various pricing plans to suit your business needs. Whether you are a small business or a large enterprise, our affordable options provide excellent value for signing documents like the Alabama state tax form 2018.

-

Are there any integrations available to assist with the Alabama state tax form 2018?

Absolutely! airSlate SignNow integrates with various applications and tools, making it easier to manage and send documents, including the Alabama state tax form 2018. Our platform works seamlessly with popular software like Google Drive, Dropbox, and others.

-

What features does airSlate SignNow offer for managing the Alabama state tax form 2018?

With airSlate SignNow, you can enjoy features like electronic signatures, document templates, and secure cloud storage for your Alabama state tax form 2018. These tools streamline your workflow and enhance collaboration with tax professionals.

-

Can I track the status of my Alabama state tax form 2018 using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your documents, including the Alabama state tax form 2018, in real-time. You will receive notifications when your documents are viewed and signed, providing you with peace of mind.

-

How secure is my information when using airSlate SignNow for the Alabama state tax form 2018?

Security is a priority at airSlate SignNow. We use advanced encryption and security measures to protect your data while you manage your Alabama state tax form 2018, ensuring it remains confidential and secure throughout the process.

Get more for Individual Income Tax Electronic Filing Options Alabama

Find out other Individual Income Tax Electronic Filing Options Alabama

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document