Rp 305 R 2019

What is the NYS RP 305 R?

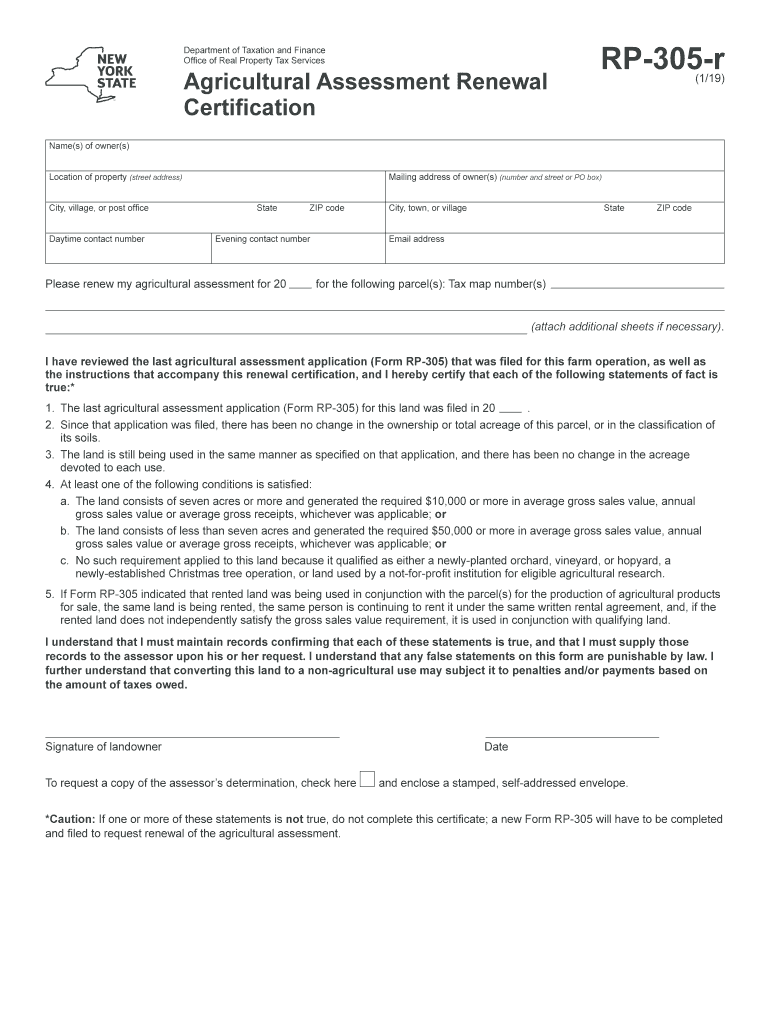

The NYS RP 305 R is a form used in New York State for property tax purposes. Specifically, it serves as a request for an agricultural assessment, allowing eligible landowners to apply for a reduction in property taxes based on agricultural use. This form is essential for farmers and landowners who wish to benefit from the agricultural exemptions provided by the state. Understanding the purpose and function of the RP 305 R is crucial for those involved in agricultural activities, as it can significantly impact their tax liabilities.

How to Use the NYS RP 305 R

Using the NYS RP 305 R involves several straightforward steps. First, ensure that you meet the eligibility criteria for agricultural assessment. Next, download the form from the New York State Department of Taxation and Finance website or obtain a physical copy from your local tax office. Fill out the form accurately, providing all required information, such as property details and proof of agricultural use. Once completed, submit the form to your local assessor's office by the designated deadline to ensure your application is processed in time for tax assessment.

Steps to Complete the NYS RP 305 R

Completing the NYS RP 305 R requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documentation, including proof of agricultural use, such as receipts or farm records.

- Download the RP 305 R form and review the instructions carefully.

- Fill in your personal information, property details, and any relevant agricultural data.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form to your local assessor's office by the specified deadline.

Legal Use of the NYS RP 305 R

The NYS RP 305 R must be used in compliance with New York State laws governing agricultural assessments. This form is legally binding and must be filled out truthfully. Misrepresentation or failure to comply with the requirements can lead to penalties, including the denial of the agricultural assessment. It is advisable to keep copies of submitted forms and any supporting documents for your records in case of future inquiries or audits.

Required Documents for the NYS RP 305 R

When submitting the NYS RP 305 R, certain documents are required to support your application. These may include:

- Proof of agricultural use, such as sales receipts, contracts, or leases.

- Documentation of property ownership, like a deed or tax bill.

- Any additional forms or affidavits as specified in the RP 305 R instructions.

Having these documents ready will facilitate a smoother application process and help ensure that your request for agricultural assessment is approved.

Filing Deadlines for the NYS RP 305 R

It is important to be aware of the filing deadlines for the NYS RP 305 R to avoid missing the opportunity for tax relief. Typically, the form must be submitted by a specific date, often in the spring, to be considered for the upcoming tax year. Check with your local tax assessor's office for the exact deadline, as it may vary by county. Timely submission is crucial to ensure that your application is processed and that you receive the appropriate tax benefits.

Quick guide on how to complete form rp 470517application for real property tax exemption for

Your assistance manual on how to prepare your Rp 305 R

If you’re curious about how to finish and submit your Rp 305 R, here are a few brief instructions on how to simplify tax declaration.

To begin, you just need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to revise information when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Rp 305 R in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore versions and schedules.

- Click Get form to access your Rp 305 R in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Please be aware that paper filing can increase return errors and delay refunds. Of course, before electronically filing your taxes, check the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form rp 470517application for real property tax exemption for

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the form rp 470517application for real property tax exemption for

How to create an electronic signature for the Form Rp 470517application For Real Property Tax Exemption For in the online mode

How to generate an eSignature for your Form Rp 470517application For Real Property Tax Exemption For in Chrome

How to create an eSignature for putting it on the Form Rp 470517application For Real Property Tax Exemption For in Gmail

How to create an electronic signature for the Form Rp 470517application For Real Property Tax Exemption For straight from your smart phone

How to generate an electronic signature for the Form Rp 470517application For Real Property Tax Exemption For on iOS

How to create an electronic signature for the Form Rp 470517application For Real Property Tax Exemption For on Android devices

People also ask

-

What is the nys rp 305 form and how can airSlate SignNow help?

The nys rp 305 form is essential for property tax exemption applications in New York State. With airSlate SignNow, you can easily eSign and send the nys rp 305 form, ensuring a smooth submission process that's compliant with state regulations.

-

What features does airSlate SignNow offer for managing nys rp 305 documents?

airSlate SignNow provides a range of features for managing nys rp 305 documents, including customizable templates, secure cloud storage, and real-time collaboration. These features enable you to streamline the eSigning process and enhance document management.

-

How much does it cost to use airSlate SignNow for nys rp 305 forms?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, ensuring cost-effectiveness when handling nys rp 305 forms. You can evaluate the pricing options on our website and choose the plan that best fits your needs.

-

Can I integrate airSlate SignNow with other applications for handling nys rp 305?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to manage nys rp 305 and other documents from a centralized location. This integration enhances productivity by allowing seamless workflows across your favorite tools.

-

What are the benefits of using airSlate SignNow for nys rp 305 completion?

Using airSlate SignNow for nys rp 305 completion offers several benefits, including time savings, efficiency, and enhanced security. You can quickly eSign documents without printing, scanning, or faxing, making the process simpler and faster.

-

Is airSlate SignNow secure for handling sensitive nys rp 305 information?

Absolutely! airSlate SignNow is committed to providing top-notch security for all documents, including nys rp 305. We use advanced encryption methods and comply with industry standards to ensure that your information is safe and secure.

-

How do I get started with airSlate SignNow for my nys rp 305 forms?

Getting started with airSlate SignNow for your nys rp 305 forms is simple. Just sign up for an account, explore our templates, and start eSigning your documents. Our user-friendly platform makes the process quick and straightforward.

Get more for Rp 305 R

- Iso 27031 pdf download 296347819 form

- Proviso west high school transcript request form

- American bankers life form

- Coordination of benefits ppo emblemhealth form

- Bedford high school request for transcript form aws

- Aic transcript request form

- Auctiongift in kind donation form

- Palm beach state college re evaluation form

Find out other Rp 305 R

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement