Form 8862 Sp Rev December Information to Claim Earned Income Credit After Disallowance Spanish Version 2023

What is the Form 8862?

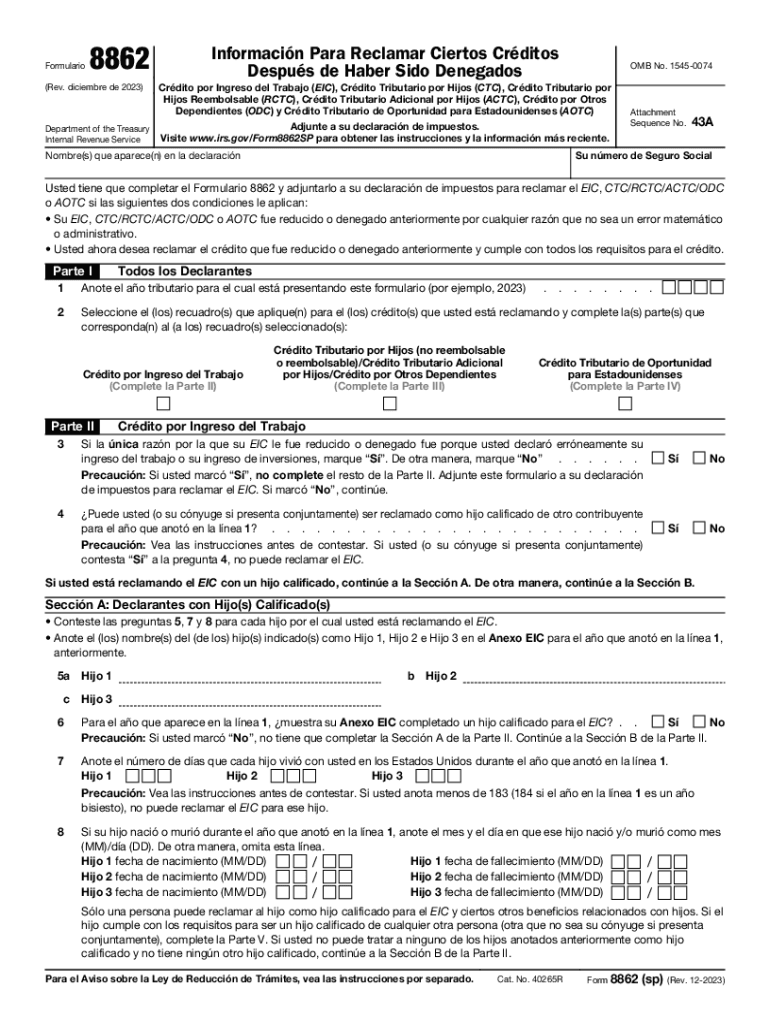

The Form 8862, officially known as the "Information to Claim Earned Income Credit After Disallowance," is a tax form used by individuals who have previously been denied the Earned Income Tax Credit (EITC) and wish to claim it again. This form is essential for taxpayers who want to demonstrate their eligibility for the EITC after a prior disallowance. It provides the IRS with necessary information to assess the taxpayer's current eligibility status for the credit.

How to Use the Form 8862

To use the Form 8862 effectively, taxpayers should first ensure they meet the eligibility criteria for the EITC. The form must be filled out completely and accurately, providing details such as personal information, income, and qualifying children. Once completed, it should be attached to the taxpayer's federal income tax return. It is important to submit the form in the same tax year in which the EITC is being claimed to avoid delays or complications in processing the return.

Steps to Complete the Form 8862

Completing the Form 8862 involves several key steps:

- Gather necessary documents, including prior tax returns and proof of income.

- Fill out personal information, ensuring accuracy in names and Social Security numbers.

- Provide details regarding qualifying children, if applicable, including their names and relationships.

- Answer questions regarding eligibility, including previous disallowances and changes in circumstances.

- Review the form for completeness before submitting it with your tax return.

Eligibility Criteria for the Form 8862

To be eligible to file the Form 8862, taxpayers must have previously been denied the EITC and must now meet the qualifications for the credit. Key eligibility criteria include having a valid Social Security number, being a U.S. citizen or resident alien, and meeting income limits based on filing status and number of qualifying children. It is crucial to ensure that all eligibility requirements are met to avoid future disallowances.

Required Documents for Filing Form 8862

When filing the Form 8862, taxpayers should have several documents ready to support their claim. These may include:

- Previous tax returns, especially those that led to the disallowance of the EITC.

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of qualifying children, which may include birth certificates or adoption papers.

- Any correspondence from the IRS regarding the previous disallowance.

IRS Guidelines for Form 8862

The IRS provides specific guidelines for completing and submitting the Form 8862. Taxpayers should refer to the IRS instructions for the form to ensure compliance with current regulations. These guidelines outline the necessary steps for filling out the form, as well as the importance of timely submission. Adhering to these guidelines can help prevent delays in processing and potential issues with claiming the EITC.

Quick guide on how to complete form 8862 sp rev december information to claim earned income credit after disallowance spanish version

Complete Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version seamlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers since you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without holdups. Handle Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version with ease

- Locate Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 sp rev december information to claim earned income credit after disallowance spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 8862 sp rev december information to claim earned income credit after disallowance spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is forma 8862 and how does it relate to airSlate SignNow?

Forma 8862 is a tax-related form that individuals use when claiming certain tax credits. airSlate SignNow simplifies the process of filling out and eSigning forma 8862, making it easier for users to manage their tax documents efficiently and securely.

-

Is airSlate SignNow suitable for filing forma 8862?

Yes, airSlate SignNow is designed to handle various forms, including forma 8862. Its user-friendly interface allows users to complete and eSign documents with ease, ensuring that you can file forma 8862 quickly and without hassle.

-

What are the key features of airSlate SignNow for managing forma 8862?

Key features of airSlate SignNow for managing forma 8862 include easy eSigning, customizable templates, and document tracking capabilities. These features ensure that you can fill out forma 8862 accurately and receive notifications when it’s signed.

-

How much does it cost to use airSlate SignNow for forma 8862?

airSlate SignNow offers cost-effective pricing plans tailored to different user needs, starting at a competitive rate. This affordability makes it accessible for individuals and businesses who frequently handle documents like forma 8862.

-

Can I integrate airSlate SignNow with other tools for handling forma 8862?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools and services, enhancing your workflow for handling forma 8862. Popular integrations include Google Workspace, Microsoft Office, and various CRM systems.

-

What are the benefits of using airSlate SignNow for forma 8862?

Using airSlate SignNow for forma 8862 offers numerous benefits, including reduced turnaround time, enhanced document security, and simplified collaboration. These advantages help users focus on filing their taxes more efficiently.

-

Is there customer support available when using airSlate SignNow for forma 8862?

Yes, airSlate SignNow provides robust customer support to assist users with any queries related to forma 8862. You can access resources like live chat, email support, and a comprehensive knowledge base.

Get more for Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

- The plaintiff files this complaint against a form

- Agreement with manager to plan events for expositions and similar events form

- Plaintiff is an adult resident of the form

- Revised 7819 page 1 of 3 united states district form

- This civil action arises from the 20 strip search of plaintiff form

- Complaint for temporary restraining order 490222918 form

- Comes now the plaintiff and sues the defendant form

- Cobb v marshall civil action no 206cv675 id wo form

Find out other Form 8862 sp Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors