Form 8862 En Espa Ol 2010

What is the Form 8862 En Español

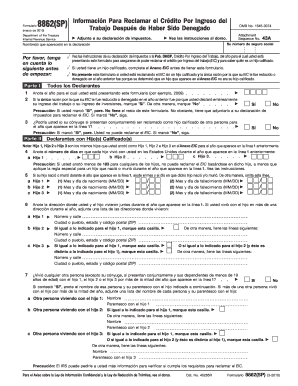

The Form 8862, or Formulario 8862, is a document used by taxpayers in the United States to claim the Earned Income Tax Credit (EITC) after having previously been denied this credit. This form is essential for those who want to re-establish their eligibility for the EITC, which can provide significant financial benefits. The Formulario 8862 en español serves the same purpose but is tailored for Spanish-speaking taxpayers, ensuring they understand the requirements and implications of the form.

Steps to complete the Form 8862 En Español

Completing the Formulario 8862 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including prior tax returns and any notices from the IRS regarding your previous EITC claims. Next, fill out the form, providing your personal information, including your Social Security number and details about your qualifying children, if applicable. It is crucial to answer all questions honestly and accurately, as any discrepancies may lead to further scrutiny from the IRS.

After completing the form, review it thoroughly for any errors or omissions. Once verified, you can submit the form along with your tax return. If you are filing electronically, ensure that your e-filing software supports the Formulario 8862. If submitting by mail, send it to the appropriate IRS address indicated in the form's instructions.

How to obtain the Form 8862 En Español

The Formulario 8862 can be obtained through several channels. It is available on the official IRS website, where you can download it in both English and Spanish. Additionally, you can request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation services also provide access to this form as part of their services, ensuring that you have the necessary resources to complete your tax filing accurately.

Legal use of the Form 8862 En Español

Using the Formulario 8862 legally requires adherence to IRS guidelines. This form is specifically designed for taxpayers who have previously been denied the EITC and wish to claim it again. To use the form legally, you must ensure that you meet all eligibility criteria, including income limits and qualifying child requirements. Misuse of the form, such as submitting it without meeting these criteria, can result in penalties or legal repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Formulario 8862. Taxpayers must submit this form if they have been denied the EITC in the past and are now eligible to claim it again. The IRS requires that the form be submitted with your tax return, and it must be completed accurately to avoid delays in processing. Familiarizing yourself with these guidelines is crucial for ensuring compliance and protecting your rights as a taxpayer.

Eligibility Criteria

To qualify for the EITC and use the Formulario 8862, taxpayers must meet specific eligibility criteria. This includes having earned income below a certain threshold, which varies based on filing status and the number of qualifying children. Additionally, you must have a valid Social Security number and cannot have been convicted of a felony related to tax fraud. Understanding these criteria is essential for successfully claiming the credit and ensuring that your form is processed without issues.

Quick guide on how to complete form 8862 en espaol

Effortlessly Prepare Form 8862 En Espa ol on Any Device

Managing documents online has become increasingly favored among businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed materials, allowing you to find the appropriate form and securely store it on the internet. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Form 8862 En Espa ol on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Modify and eSign Form 8862 En Espa ol with Ease

- Locate Form 8862 En Espa ol and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to distribute your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8862 En Espa ol to guarantee excellent communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 en espaol

Create this form in 5 minutes!

How to create an eSignature for the form 8862 en espaol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario 8862 and why is it important?

The formulario 8862, or IRS Form 8862, is a form used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a previous year. It's essential because it helps taxpayers regain access to valuable tax credits. Understanding how to properly fill out this form can ensure you receive the credits you're eligible for.

-

How can airSlate SignNow assist with the formulario 8862?

airSlate SignNow simplifies the process of completing and submitting the formulario 8862 by providing a user-friendly interface for eSigning documents. You can easily upload and share your tax forms, ensuring they are securely signed and submitted on time. This feature streamlines your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for the formulario 8862?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Users can choose from flexible subscription options that provide cost-effective solutions for handling important documents like the formulario 8862. The pricing is transparent and designed to accommodate both small and large businesses.

-

What features does airSlate SignNow offer for managing the formulario 8862?

airSlate SignNow provides several features that enhance the management of the formulario 8862, including templates, document tracking, and automated reminders for eSigning. With cloud storage, you can access your forms anytime and ensure all necessary documents are organized. These functionalities help ensure you stay compliant with IRS requirements.

-

Can I integrate airSlate SignNow with other applications for the formulario 8862?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and various CRM platforms. This allows you to automate workflows and keep all your tax-related documents organized, including the completion of formulario 8862, in one central location.

-

What are the benefits of using airSlate SignNow for my tax forms, including the formulario 8862?

Using airSlate SignNow for tax forms like the formulario 8862 saves you time and reduces the risk of errors. The eSigning process ensures your documents are legally compliant and securely stored. Additionally, the easy-to-use platform enhances collaboration, allowing multiple parties to efficiently handle tax documentation.

-

How secure is airSlate SignNow when using it for the formulario 8862?

airSlate SignNow prioritizes security by employing industry-standard encryption and compliance measures to protect sensitive tax information, including the formulario 8862. Each transaction is securely logged, enabling users to safeguard their documents with confidence. You can trust that your personal data will remain protected.

Get more for Form 8862 En Espa ol

Find out other Form 8862 En Espa ol

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online