Form 8862 Sp Rev October2024 Information to Claim Earned Income Credit After Disallowance Spanish Version 2024-2026

What is the Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

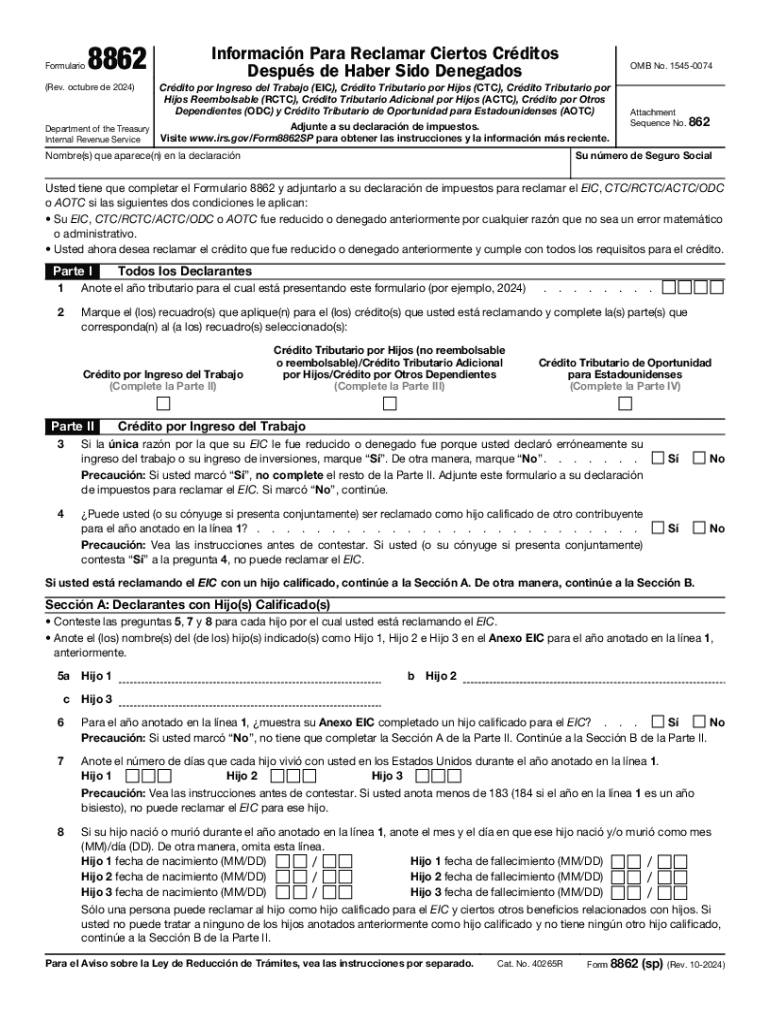

The Form 8862 sp Rev October2024 is a crucial document for individuals who have previously had their Earned Income Credit (EIC) disallowed. This form allows taxpayers to claim the EIC again after a disallowance, provided they meet specific eligibility criteria. The Spanish version of this form ensures that Spanish-speaking taxpayers can understand the requirements and process involved in reclaiming their credit. The form collects essential information about the taxpayer's situation, including income details and family structure, which helps the IRS determine eligibility for the EIC.

How to use the Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

Using the Form 8862 sp Rev October2024 involves several steps. First, ensure that you are eligible to claim the EIC again after a prior disallowance. Gather all necessary documentation, such as proof of income and identification. Complete the form accurately, providing all required information, including your Social Security number and details about your qualifying children. Once completed, you can submit the form along with your tax return, either electronically or by mail, depending on your filing method.

Steps to complete the Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

Completing the Form 8862 sp Rev October2024 involves a systematic approach:

- Review the eligibility criteria to ensure you can claim the EIC again.

- Gather required documents, such as W-2 forms and proof of residency.

- Fill out the form, providing accurate information about your income and family members.

- Double-check the form for any errors or omissions.

- Submit the form with your tax return, ensuring it is sent to the correct IRS address.

Legal use of the Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

The legal use of the Form 8862 sp Rev October2024 is essential for taxpayers who have had their EIC denied in previous years. By completing and submitting this form, you are asserting your eligibility to reclaim the credit, which is a legitimate tax benefit for low to moderate-income individuals and families. It is important to provide truthful and accurate information, as any discrepancies can lead to penalties or further disallowance of the credit.

Eligibility Criteria

To qualify for the Earned Income Credit after a disallowance, certain eligibility criteria must be met. Taxpayers must have earned income and meet specific income thresholds based on their filing status and number of dependents. Additionally, individuals must not have been convicted of fraud related to the EIC or other tax credits. Understanding these criteria is crucial for successfully completing the Form 8862 sp Rev October2024 and ensuring that you can claim the EIC again.

Required Documents

When completing the Form 8862 sp Rev October2024, it is important to have several documents on hand. These typically include:

- Proof of earned income, such as W-2 forms or pay stubs.

- Social Security numbers for you and your qualifying children.

- Documentation of residency, such as utility bills or lease agreements.

- Any previous correspondence from the IRS regarding the disallowance of your EIC.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 sp rev october2024 information to claim earned income credit after disallowance spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 8862 sp rev october2024 information to claim earned income credit after disallowance spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version?

Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version is a tax form used by individuals who have previously had their Earned Income Credit disallowed. This form allows them to claim the credit again after meeting specific requirements. It is essential for ensuring that eligible taxpayers can receive their rightful credits.

-

How can airSlate SignNow help with Form 8862 sp Rev October2024?

airSlate SignNow provides an efficient platform for completing and eSigning Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version. Our user-friendly interface simplifies the process, ensuring that you can fill out and submit your forms quickly and securely. This helps you focus on what matters most—getting your credits.

-

Is there a cost associated with using airSlate SignNow for Form 8862 sp Rev October2024?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our plans are designed to be cost-effective while providing all the necessary features to manage documents, including Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 8862 sp Rev October2024?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all tailored for Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version. These features streamline the process of preparing and submitting your tax forms, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other applications for Form 8862 sp Rev October2024?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when dealing with Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version. This allows you to connect with tools you already use, making document management and eSigning even more efficient.

-

What are the benefits of using airSlate SignNow for tax forms like Form 8862 sp Rev October2024?

Using airSlate SignNow for tax forms such as Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are handled securely while providing a straightforward process for eSigning and submission.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form 8862 sp Rev October2024?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version. Our intuitive interface guides users through the process, making it easy to complete and eSign documents without prior experience.

Get more for Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

- Dmv permit papers form

- Police trespass letters form

- Polynomials worksheet pdf form

- Care conference template form

- Aetna afa medical and stop loss employee enrollment change form 432949738

- City of cincinnati tax connect form

- Reminder from the city of perrysburg income tax division form

- Troy wh booklet lck 24 form

Find out other Form 8862 sp Rev October2024 Information To Claim Earned Income Credit After Disallowance Spanish Version

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors