Tax Forms Tax Guide LibGuides at Dean B Ellis Library 2021

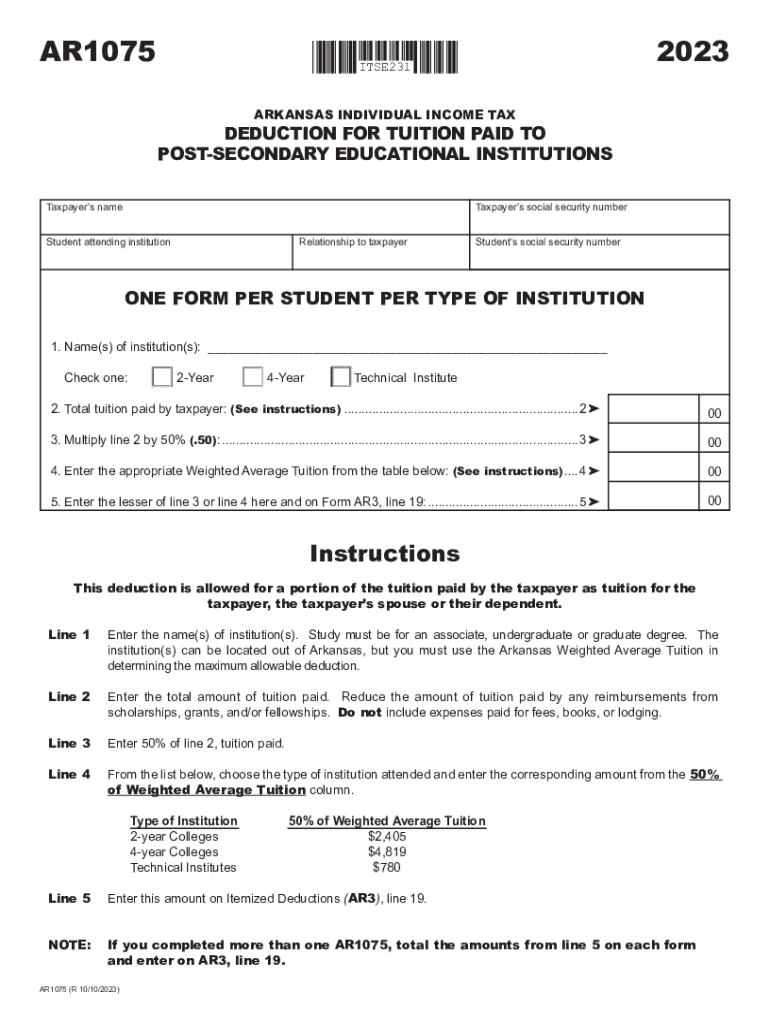

Understanding the Arkansas AR1075 Form

The Arkansas AR1075 form is a tax document used for reporting specific tax information to the state of Arkansas. This form is essential for individuals and businesses that need to comply with state tax regulations. It typically includes details about income, deductions, and credits that affect the taxpayer's overall tax liability. Understanding the purpose and requirements of the AR1075 is crucial for accurate tax filing and compliance.

Steps to Complete the Arkansas AR1075 Form

Completing the AR1075 form involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately, ensuring you include wages, interest, and any other taxable income.

- Detail any deductions or credits you are eligible for, which can reduce your tax liability.

- Review the completed form for accuracy before submission.

Key Elements of the Arkansas AR1075 Form

The AR1075 form consists of several key components that must be completed:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all income sources, including wages and investment income.

- Deductions and Credits: This section allows you to claim any eligible deductions or tax credits.

- Signature: The form must be signed and dated to validate the information provided.

Filing Deadlines for the Arkansas AR1075 Form

It is important to be aware of the filing deadlines associated with the AR1075 form. Typically, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely submission is crucial to avoid penalties and interest on unpaid taxes.

Who Issues the Arkansas AR1075 Form

The Arkansas Department of Finance and Administration is responsible for issuing the AR1075 form. This state agency oversees tax collection and compliance, ensuring that taxpayers meet their obligations. For any inquiries regarding the form or filing process, taxpayers can contact the department directly for assistance.

Penalties for Non-Compliance with the Arkansas AR1075 Form

Failing to file the AR1075 form on time or providing inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete tax forms tax guide libguides at dean b ellis library

Complete Tax Forms Tax Guide LibGuides At Dean B Ellis Library effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Forms Tax Guide LibGuides At Dean B Ellis Library on any platform using the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and electronically sign Tax Forms Tax Guide LibGuides At Dean B Ellis Library with ease

- Locate Tax Forms Tax Guide LibGuides At Dean B Ellis Library and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Forms Tax Guide LibGuides At Dean B Ellis Library to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax forms tax guide libguides at dean b ellis library

Create this form in 5 minutes!

How to create an eSignature for the tax forms tax guide libguides at dean b ellis library

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR1075 feature offered by airSlate SignNow?

The AR1075 feature in airSlate SignNow provides users with advanced document signing capabilities, enabling them to securely eSign documents from anywhere. This feature is designed to streamline the signing process, ensuring that all signatures are legally binding and compliant with relevant regulations.

-

How does airSlate SignNow's pricing compare for the AR1075 feature?

airSlate SignNow offers competitive pricing for its AR1075 feature, making it accessible for businesses of all sizes. The pricing plans are designed to provide maximum value, with options that cater to various user needs, which includes a clear breakdown of features and usage limits.

-

What are the key benefits of using the AR1075 feature in airSlate SignNow?

Using the AR1075 feature in airSlate SignNow enhances productivity by simplifying the document signing workflow. It offers secure storage and easy tracking of signed documents, which helps businesses maintain compliance and improves overall efficiency.

-

Can I integrate AR1075 with other applications?

Yes, airSlate SignNow's AR1075 feature can be seamlessly integrated with various third-party applications, enhancing your existing workflows. Whether you are using CRMs, project management tools, or other cloud storage solutions, this integration capability provides flexibility and enhances functionality.

-

Is there a mobile app for accessing the AR1075 feature?

Absolutely! airSlate SignNow provides a mobile app that allows users to access the AR1075 feature on-the-go. This mobile access ensures that you can manage, send, and eSign documents directly from your smartphone or tablet, improving convenience for busy professionals.

-

What types of documents can I sign using the AR1075 feature?

With the AR1075 feature, you can eSign a wide variety of documents, including contracts, agreements, and forms. The versatility of this feature supports diverse industries, ensuring that all document types can be signed efficiently and securely.

-

How secure is the AR1075 feature in airSlate SignNow?

The AR1075 feature emphasizes security, utilizing encryption and authentication measures to safeguard your documents. airSlate SignNow is committed to ensuring that all user data is protected throughout the signing process, maintaining trust and confidentiality.

Get more for Tax Forms Tax Guide LibGuides At Dean B Ellis Library

- University lands wind lease form

- Trec form 9 13 ampquotunimproved property contractampquot texas

- Real estate 101 promulgated contract forms wo flashcards

- Real estate 101 promulgated contract forms wo quizlet

- New home insulation addendum form

- Trec no 16 5 buyers temporary residential lease solid realty form

- All cash assumption third party conventional or seller form

- Texas promulgated contract forms slideshare

Find out other Tax Forms Tax Guide LibGuides At Dean B Ellis Library

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online