Fillable Form Ar1075 Deduction for Tuition Paid to Post 2021

What is the fillable form AR1075 deduction for tuition paid to post?

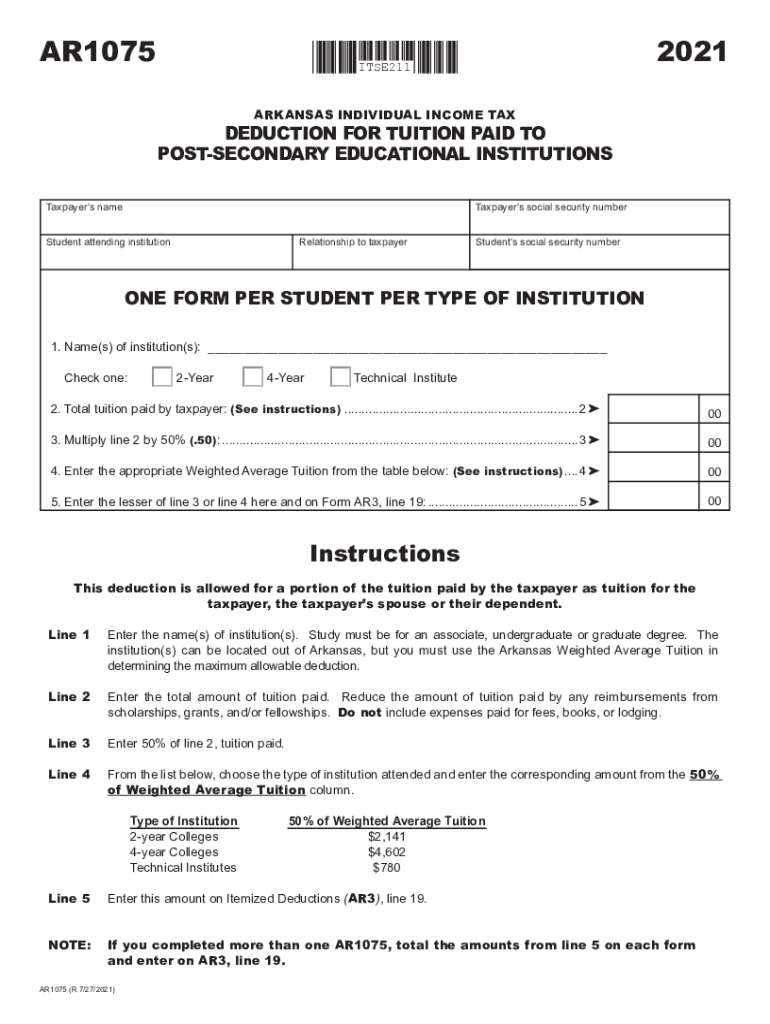

The fillable form AR1075 is a tax form used in Arkansas to claim a deduction for tuition paid for post-secondary education. This form allows eligible taxpayers to reduce their taxable income by the amount spent on tuition, making it a valuable tool for students and their families. The deduction is designed to ease the financial burden of higher education by providing tax relief to those who qualify.

How to use the fillable form AR1075 deduction for tuition paid to post

Using the fillable form AR1075 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including tuition payment receipts and any relevant financial records. Next, download the form from the appropriate state website or access it through a digital platform that supports electronic signatures. Fill out the form carefully, ensuring that all information is accurate and complete. Finally, submit the form according to the specified submission methods, which may include online filing or mailing a physical copy to the appropriate tax authority.

Steps to complete the fillable form AR1075 deduction for tuition paid to post

Completing the fillable form AR1075 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Download the AR1075 form from an official source.

- Gather all relevant documents, including proof of tuition payments.

- Fill in your personal information, including your name, address, and Social Security number.

- Input the total amount of tuition paid during the tax year.

- Review the form for accuracy and completeness.

- Sign the form electronically or by hand, as required.

- Submit the completed form through the designated method.

Legal use of the fillable form AR1075 deduction for tuition paid to post

The fillable form AR1075 is legally recognized for claiming tuition deductions under Arkansas state tax law. To ensure compliance, taxpayers must adhere to the regulations set forth by the Arkansas Department of Finance and Administration. This includes maintaining accurate records of tuition payments and understanding eligibility criteria. Proper use of the form can lead to significant tax savings, making it essential for eligible individuals to utilize this resource effectively.

Eligibility criteria for the fillable form AR1075 deduction for tuition paid to post

To qualify for the deduction using the fillable form AR1075, taxpayers must meet specific eligibility criteria. These include:

- The taxpayer must be a resident of Arkansas.

- The tuition must be paid for post-secondary education at an accredited institution.

- Eligible expenses may include tuition for college, university, or vocational training programs.

- Taxpayers must provide proof of payment and enrollment status.

Filing deadlines for the fillable form AR1075 deduction for tuition paid to post

Filing deadlines for the fillable form AR1075 are aligned with the annual tax filing schedule. Typically, taxpayers must submit their forms by April 15 of the year following the tax year in which tuition was paid. It is important to stay informed about any changes to deadlines or extensions that may be announced by the Arkansas Department of Finance and Administration, as these can impact the timely submission of the form.

Quick guide on how to complete fillable form ar1075 deduction for tuition paid to post

Complete Fillable Form Ar1075 Deduction For Tuition Paid To Post effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Fillable Form Ar1075 Deduction For Tuition Paid To Post on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Fillable Form Ar1075 Deduction For Tuition Paid To Post effortlessly

- Locate Fillable Form Ar1075 Deduction For Tuition Paid To Post and click on Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your amendments.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Fillable Form Ar1075 Deduction For Tuition Paid To Post and ensure exceptional communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form ar1075 deduction for tuition paid to post

Create this form in 5 minutes!

How to create an eSignature for the fillable form ar1075 deduction for tuition paid to post

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is ar1075 and how does it integrate with airSlate SignNow?

The ar1075 is a unique feature offered by airSlate SignNow that enhances document management and eSigning efficiency. This tool allows users to seamlessly integrate their workflows, ensuring that documents are processed quickly and securely. By leveraging ar1075, businesses can streamline their operations and improve productivity.

-

What pricing options are available for the ar1075 feature in airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that include access to the ar1075 feature. Depending on your business needs, you can choose from monthly or annual subscription options, ensuring you only pay for what you use. This cost-effective solution makes the ar1075 feature accessible to businesses of all sizes.

-

What are the key benefits of using the ar1075 feature in airSlate SignNow?

Using the ar1075 feature in airSlate SignNow provides numerous benefits, such as increased efficiency and reduced turnaround times for document signing. Additionally, it enhances security through advanced encryption methods, ensuring your documents are safe. Overall, the ar1075 feature helps businesses save time and improve customer satisfaction.

-

How does the ar1075 feature improve workflow automation?

The ar1075 feature is designed to enhance workflow automation by allowing users to set up automated processes for document routing and signing. This minimizes manual intervention and reduces the chances of errors, leading to a more streamlined operation. AirSlate SignNow's use of ar1075 means documents are handled efficiently from start to finish.

-

Can I use the ar1075 feature on mobile devices?

Yes, the ar1075 feature in airSlate SignNow is fully optimized for mobile devices. This allows users to send and eSign documents from anywhere, making it convenient for professionals on the go. The mobile compatibility of the ar1075 feature ensures you can manage your documents effectively anytime, anywhere.

-

What types of documents can I manage with the ar1075 feature?

With the ar1075 feature in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. Its versatility allows businesses to customize workflows specific to their needs, making it an effective tool for document management. This adaptability is one of the key strengths of the ar1075 feature.

-

How does the ar1075 feature ensure document security?

The ar1075 feature prioritizes document security by implementing advanced encryption protocols that protect sensitive information. Additionally, airSlate SignNow provides audit trails and authentication options to ensure that only authorized users have access to documents. This level of security gives businesses peace of mind when it comes to managing their documents.

Get more for Fillable Form Ar1075 Deduction For Tuition Paid To Post

- Louisiana tenant eviction law form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497309284 form

- Annual minutes louisiana louisiana form

- Notices resolutions simple stock ledger and certificate louisiana form

- Minutes for organizational meeting louisiana louisiana form

- Sample transmittal letter to secretary of states office to file articles of incorporation louisiana louisiana form

- Js 44 civil cover sheet federal district court louisiana form

- Lead based paint disclosure for sales transaction louisiana form

Find out other Fillable Form Ar1075 Deduction For Tuition Paid To Post

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement