Tax Tables Department of Finance and Administration 2021

Understanding the AR4 Form

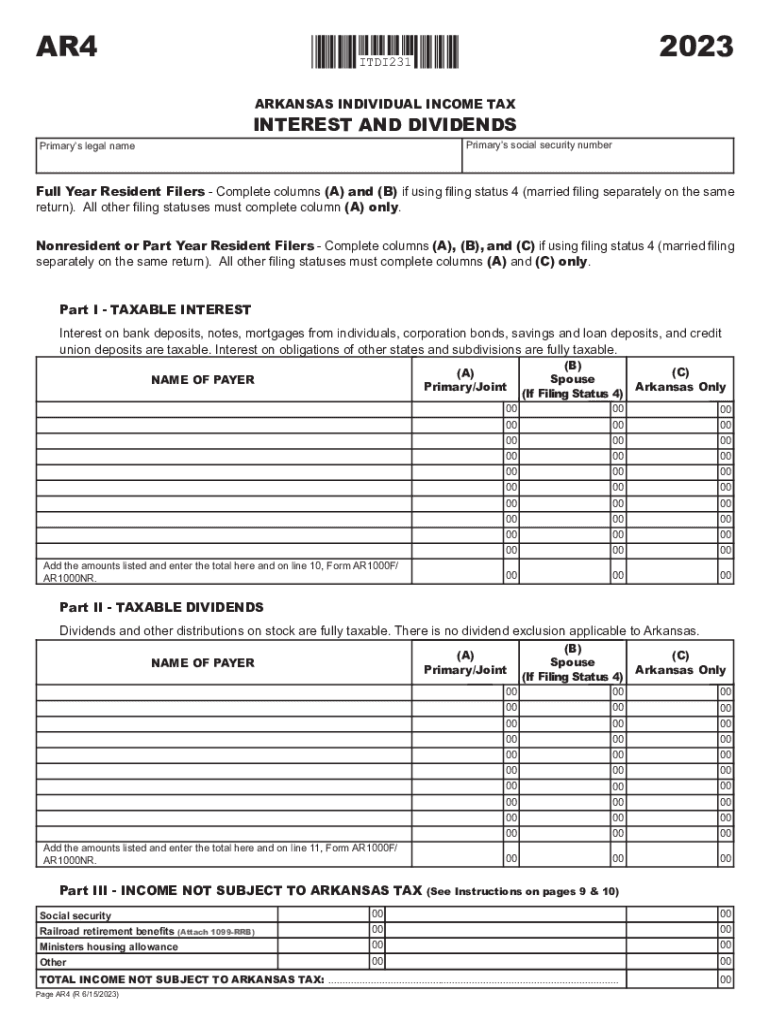

The AR4 form is a crucial document used for reporting tax information in the United States. It is typically associated with state tax obligations and is essential for individuals and businesses to ensure compliance with local tax laws. The form collects various financial details that help determine tax liabilities and eligibility for credits or deductions. Understanding the purpose and requirements of the AR4 form is vital for accurate tax reporting.

Steps to Complete the AR4 Form

Completing the AR4 form involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary financial documents, including income statements, previous tax returns, and any relevant deductions.

- Fill Out Personal Information: Enter your name, address, and Social Security number or taxpayer identification number at the top of the form.

- Report Income: Accurately report all sources of income, including wages, self-employment income, and investment earnings.

- Claim Deductions: Identify and claim any applicable deductions to reduce your taxable income.

- Review and Sign: Carefully review the completed form for accuracy and sign it before submission.

Legal Use of the AR4 Form

The AR4 form must be used in accordance with state tax laws. It is legally binding and serves as an official record of your income and tax obligations. Failing to complete or submit the form accurately can result in penalties or legal repercussions. It is essential to understand the specific legal requirements associated with the AR4 form in your state to avoid any compliance issues.

Filing Deadlines for the AR4 Form

Filing deadlines for the AR4 form vary by state, but generally, it is due on or before April fifteenth of the following tax year. It is important to check your state’s specific deadlines to ensure timely submission. Late submissions may incur penalties or interest on any taxes owed, making it crucial to stay informed about filing timelines.

Who Issues the AR4 Form

The AR4 form is typically issued by the state’s Department of Revenue or Taxation. This department is responsible for administering tax laws and ensuring compliance among taxpayers. If you have questions or need assistance regarding the AR4 form, contacting your state’s tax authority can provide valuable guidance and support.

Examples of Using the AR4 Form

There are various scenarios in which individuals and businesses may need to use the AR4 form. For instance, a self-employed individual must report their income and expenses accurately to determine their tax liability. Similarly, small businesses may use the AR4 form to report their earnings and claim deductions for business-related expenses. Understanding how to apply the AR4 form in different contexts can enhance compliance and optimize tax outcomes.

Quick guide on how to complete tax tables department of finance and administration

Effortlessly create Tax Tables Department Of Finance And Administration on any platform

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Tax Tables Department Of Finance And Administration on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Tax Tables Department Of Finance And Administration effortlessly

- Locate Tax Tables Department Of Finance And Administration and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

No more lost or misplaced files, tedious form searching, or errors requiring you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Tables Department Of Finance And Administration to guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax tables department of finance and administration

Create this form in 5 minutes!

How to create an eSignature for the tax tables department of finance and administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR4 form and how does airSlate SignNow help with it?

The AR4 form is a vital document used for various purposes, including tax reporting. airSlate SignNow simplifies the process of completing, sending, and eSigning the AR4 form, ensuring that all parties can access it easily and securely. With our platform, you'll save time and reduce errors while managing your documentation.

-

Is there a cost associated with using airSlate SignNow for the AR4 form?

Yes, airSlate SignNow offers a subscription-based pricing model that makes it cost-effective for businesses of all sizes. Depending on your needs, you can choose from several plans that provide varying levels of features to manage documents like the AR4 form. Sign up for a free trial to see how our platform can fit your budget.

-

What features does airSlate SignNow provide for managing the AR4 form?

Our platform includes features such as customizable templates, automated workflows, and secure storage, all of which are perfect for the AR4 form. Additionally, eSigning capabilities enable users to securely sign documents from anywhere, streamlining the process signNowly. These features enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other tools to manage the AR4 form?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and Microsoft Office. This allows you to seamlessly manage the AR4 form alongside your existing workflows and applications, providing a holistic approach to document management.

-

How secure is airSlate SignNow for handling the AR4 form?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption protocols and authentication measures to protect your AR4 form and other documents. Your data's privacy and integrity are paramount, ensuring that your sensitive information remains secure at all times.

-

What are the benefits of using airSlate SignNow for the AR4 form?

Using airSlate SignNow for the AR4 form offers numerous benefits, including improved efficiency and reduced turnaround time. Our user-friendly interface makes it easy to fill out, send, and receive signed documents quickly. Moreover, the platform helps eliminate paper waste and reduces operational costs.

-

Is it easy to edit the AR4 form using airSlate SignNow?

Yes, editing the AR4 form is straightforward with airSlate SignNow's intuitive interface. Users can make changes directly, ensuring that all information is accurate before sending it out for signatures. The ease of making edits enhances accuracy and keeps your documentation up to date.

Get more for Tax Tables Department Of Finance And Administration

- May be formed and governed only as a nonprofit corporation under the boc and not as a for profit

- Fillable online form 205 general information certificate of

- In the circuit court of county arkansas form

- Community property without rights of survivorship form

- Individiual to individual form

- Affidavit regarding a change of name department form

- A corporation organized under the laws of the state of as form

- Life estate from husband and wife two form

Find out other Tax Tables Department Of Finance And Administration

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement