Printable Arkansas Form AR4 Interest and Dividend Schedule 2020

What is the Printable Arkansas Form AR4 Interest And Dividend Schedule

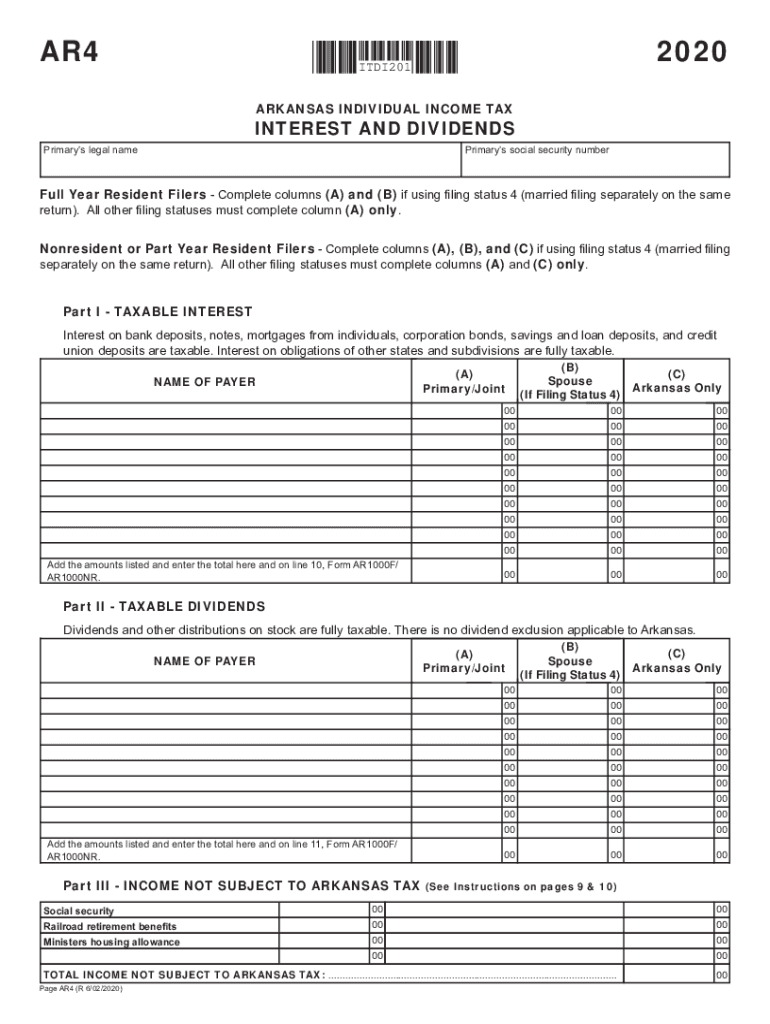

The Printable Arkansas Form AR4 Interest And Dividend Schedule is a tax form used by residents of Arkansas to report interest and dividend income. This form is essential for taxpayers who have received income from sources such as bank accounts, investments, or other financial instruments. The information reported on this form is used to calculate the total taxable income for the state tax return. It is crucial for ensuring compliance with Arkansas tax laws and for accurately determining tax liabilities.

How to use the Printable Arkansas Form AR4 Interest And Dividend Schedule

Using the Printable Arkansas Form AR4 requires careful attention to detail. Taxpayers must first gather all relevant financial documents that detail their interest and dividend income. Once the necessary information is collected, individuals can download the form from the appropriate state resources. After filling out the form, it should be attached to the Arkansas state tax return. It is important to ensure that all entries are accurate to avoid potential issues with the state tax authority.

Steps to complete the Printable Arkansas Form AR4 Interest And Dividend Schedule

Completing the Printable Arkansas Form AR4 involves several key steps:

- Gather all documentation related to interest and dividend income.

- Download the form from the official Arkansas state website.

- Fill in personal information, including name, address, and Social Security number.

- Report each source of income, including the amount received from interest and dividends.

- Double-check all entries for accuracy.

- Attach the completed form to your Arkansas state tax return.

Legal use of the Printable Arkansas Form AR4 Interest And Dividend Schedule

The Printable Arkansas Form AR4 is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to understand that any inaccuracies or omissions can lead to penalties or audits by the Arkansas Department of Finance and Administration. Proper use of this form ensures compliance with state tax laws and helps avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Arkansas Form AR4 typically align with the annual state tax return deadlines. Taxpayers should be aware that the due date for filing is usually April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing dates to ensure timely submission.

Key elements of the Printable Arkansas Form AR4 Interest And Dividend Schedule

Key elements of the Printable Arkansas Form AR4 include sections for reporting various types of interest and dividend income. Taxpayers must provide details such as the name of the payer, the amount received, and any applicable withholding taxes. Additionally, the form includes instructions on how to calculate the total income from these sources, ensuring that all income is accurately reported.

Quick guide on how to complete printable 2020 arkansas form ar4 interest and dividend schedule

Complete Printable Arkansas Form AR4 Interest And Dividend Schedule seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Printable Arkansas Form AR4 Interest And Dividend Schedule on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Printable Arkansas Form AR4 Interest And Dividend Schedule effortlessly

- Obtain Printable Arkansas Form AR4 Interest And Dividend Schedule and click on Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Identify important sections of the documents or redact sensitive information using tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require new document copies to be printed out. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign Printable Arkansas Form AR4 Interest And Dividend Schedule and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 arkansas form ar4 interest and dividend schedule

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arkansas form ar4 interest and dividend schedule

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is an AR4 form and how does it work with airSlate SignNow?

An AR4 form is a specific document used for certain tax and regulatory purposes. With airSlate SignNow, users can easily upload, complete, and eSign AR4 forms in a secure and efficient manner, simplifying the process of document management and compliance.

-

How can I create an AR4 form using airSlate SignNow?

Creating an AR4 form with airSlate SignNow is straightforward. Simply log in to your account, select the document template or start from scratch, and use our intuitive editing tools to customize your AR4 form before sharing it for eSignature.

-

Is there a cost associated with using airSlate SignNow for AR4 forms?

Yes, airSlate SignNow offers a cost-effective pricing model that includes various plans suited for different business needs. Depending on the features you require for handling AR4 forms, you can choose a plan that fits your budget, ensuring great value for your investment.

-

What features does airSlate SignNow provide for handling AR4 forms?

airSlate SignNow provides numerous features for managing AR4 forms, including customizable templates, secure sharing options, and real-time tracking of document status. Additionally, our platform supports automated workflows that signNowly reduce processing time for AR4 forms.

-

Can I integrate airSlate SignNow with other applications when working with AR4 forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, such as CRM systems, cloud storage services, and other productivity tools. This allows users to streamline their workflow and enhance the efficiency of working with AR4 forms.

-

What are the benefits of using airSlate SignNow for AR4 forms?

Using airSlate SignNow for AR4 forms offers signNow benefits, including improved efficiency, reduced paperwork, and enhanced security for sensitive information. Additionally, the platform enables easy collaboration among team members, improving overall productivity.

-

Is airSlate SignNow secure for submitting AR4 forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your AR4 forms are protected with advanced encryption and secure storage solutions. You can confidently submit and share your documents, knowing they are safe from unauthorized access.

Get more for Printable Arkansas Form AR4 Interest And Dividend Schedule

- Client center client center accounts users add edit and form

- Umbrella insurance application form

- Rbc hospital form

- Medical information form 511e toronto district school board

- Medical imaging tests labs ampamp imaging st michaels form

- Alberta declaration form

- Any brandon university applicant may designate a proxy to act on their behalf during the admissions form

- Page 1 biographical applytexas sample application form

Find out other Printable Arkansas Form AR4 Interest And Dividend Schedule

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF