Arkansas Income Tax Forms by Tax Year E File Your Taxes 2022

What is the Arkansas Income Tax Form AR4?

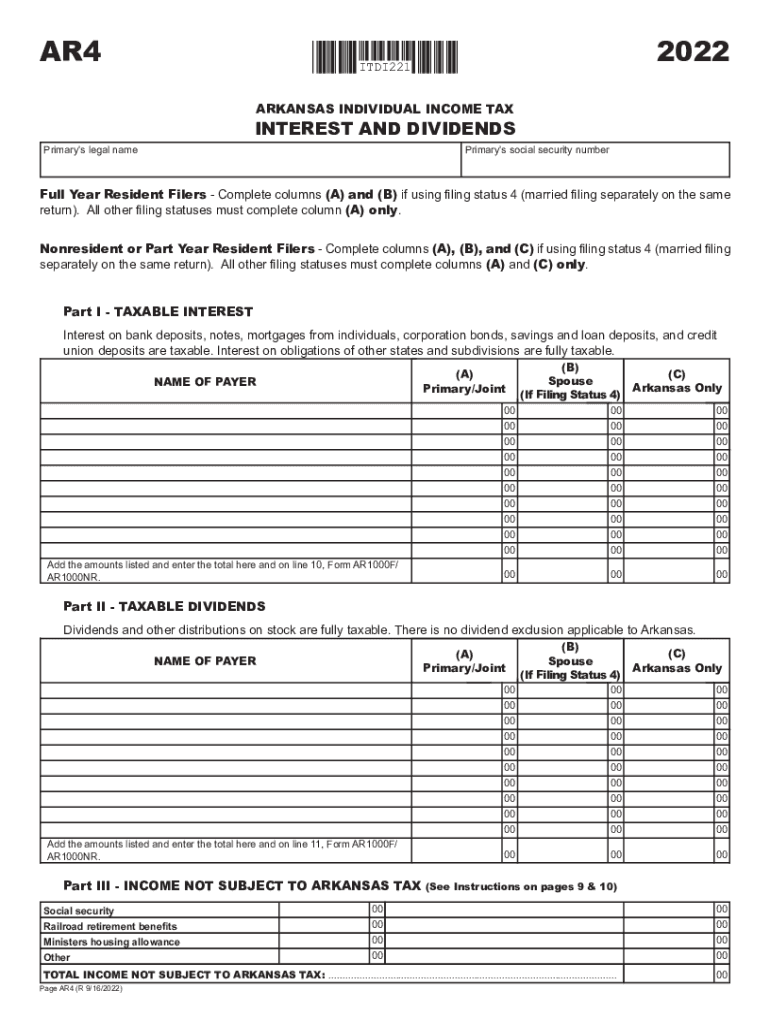

The Arkansas Income Tax Form AR4 is a crucial document used by residents to report their income and calculate their tax liability for the state of Arkansas. Specifically designed for individuals and businesses, the AR4 form is essential for declaring dividends and interest income, particularly for the tax year 2023. Understanding the purpose and requirements of this form is vital for accurate tax filing and compliance with state regulations.

Steps to Complete the Arkansas Income Tax Form AR4

Completing the Arkansas AR4 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any records of dividends or interest income. Next, fill out the form with your personal information, including your Social Security number and filing status. Carefully report your income, ensuring that all figures are accurate and reflect your financial situation for the year. After completing the form, review it for any errors before submitting it to the Arkansas Department of Finance and Administration.

Legal Use of the Arkansas Income Tax Form AR4

The Arkansas AR4 form serves as a legally binding document when filed correctly. It is essential to adhere to all state guidelines and regulations when completing this form. Electronic signatures are accepted, provided they comply with the ESIGN and UETA laws, which govern electronic transactions in the United States. Utilizing a reliable eSignature solution can enhance the legal validity of your submission, ensuring that it meets all necessary requirements.

Filing Deadlines for the Arkansas Income Tax Form AR4

Filing deadlines for the Arkansas AR4 form are typically aligned with federal tax deadlines. For most taxpayers, the deadline to submit the AR4 form is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to filing deadlines to avoid penalties and ensure timely submission.

Required Documents for the Arkansas Income Tax Form AR4

To complete the Arkansas AR4 form accurately, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any interest or dividend income

- Records of any other income sources

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all income is reported correctly.

Form Submission Methods for the Arkansas Income Tax Form AR4

The Arkansas AR4 form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using approved e-filing services, which often streamline the process and reduce errors. Alternatively, individuals may choose to mail a paper copy of the completed form to the Arkansas Department of Finance and Administration. In-person submissions are also an option for those who prefer face-to-face assistance.

Quick guide on how to complete arkansas income tax forms by tax year e file your taxes

Easily Prepare Arkansas Income Tax Forms By Tax Year E File Your Taxes on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents swiftly and efficiently. Manage Arkansas Income Tax Forms By Tax Year E File Your Taxes on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Arkansas Income Tax Forms By Tax Year E File Your Taxes

- Locate Arkansas Income Tax Forms By Tax Year E File Your Taxes and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details carefully and then click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Edit and electronically sign Arkansas Income Tax Forms By Tax Year E File Your Taxes while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas income tax forms by tax year e file your taxes

Create this form in 5 minutes!

How to create an eSignature for the arkansas income tax forms by tax year e file your taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR4 tax form and who needs it?

The AR4 tax form is used by certain taxpayers to report income and calculate their tax liabilities. Individuals and businesses that meet certain thresholds must file this form annually. Understanding its requirements is essential for accurate tax filing.

-

How can airSlate SignNow help with AR4 tax form submissions?

AirSlate SignNow simplifies the process of submitting the AR4 tax form by allowing you to eSign documents securely and quickly. Our platform provides templates that could include the AR4 tax form for your convenience. This ensures you meet deadlines without hassle.

-

Is there a cost to use airSlate SignNow for AR4 tax form signing?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, starting at a competitive rate. This affordability makes it a cost-effective solution for businesses needing to manage AR4 tax form submissions efficiently. We also offer a free trial to explore the features.

-

What features does airSlate SignNow offer for managing AR4 tax forms?

AirSlate SignNow includes features like document templates, eSignature integration, and customizable workflows that make managing the AR4 tax form straightforward. Our platform also provides tracking capabilities to monitor the status of your submissions, ensuring nothing is overlooked.

-

Can I integrate airSlate SignNow with other accounting software for AR4 tax form management?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, allowing for easy management of the AR4 tax form alongside your financial documents. This integration boosts productivity and enhances data accuracy.

-

How secure is airSlate SignNow for eSigning the AR4 tax form?

AirSlate SignNow prioritizes security, using advanced encryption protocols to protect your sensitive information when eSigning the AR4 tax form. Compliance with industry standards ensures that your documents remain safe and confidential throughout the signing process.

-

What benefits do I gain by using airSlate SignNow for my AR4 tax form?

Using airSlate SignNow for your AR4 tax form allows for a streamlined signing process that saves time and reduces paperwork. Additionally, our user-friendly interface ensures that anyone, regardless of tech-savviness, can easily navigate the document workflow.

Get more for Arkansas Income Tax Forms By Tax Year E File Your Taxes

- Legal last will and testament form for widow or widower with minor children texas

- Legal last will form for a widow or widower with no children texas

- Legal last will and testament form for a widow or widower with adult and minor children texas

- Legal last will and testament form for divorced and remarried person with mine yours and ours children texas

- Legal last will and testament form with all property to trust called a pour over will texas

- Written revocation of will texas form

- Texas persons form

- Texas beneficiaries form

Find out other Arkansas Income Tax Forms By Tax Year E File Your Taxes

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate