Affidavit of No Florida Estate Tax Due STATE of 2024-2026

Understanding the Affidavit of No Florida Estate Tax Due

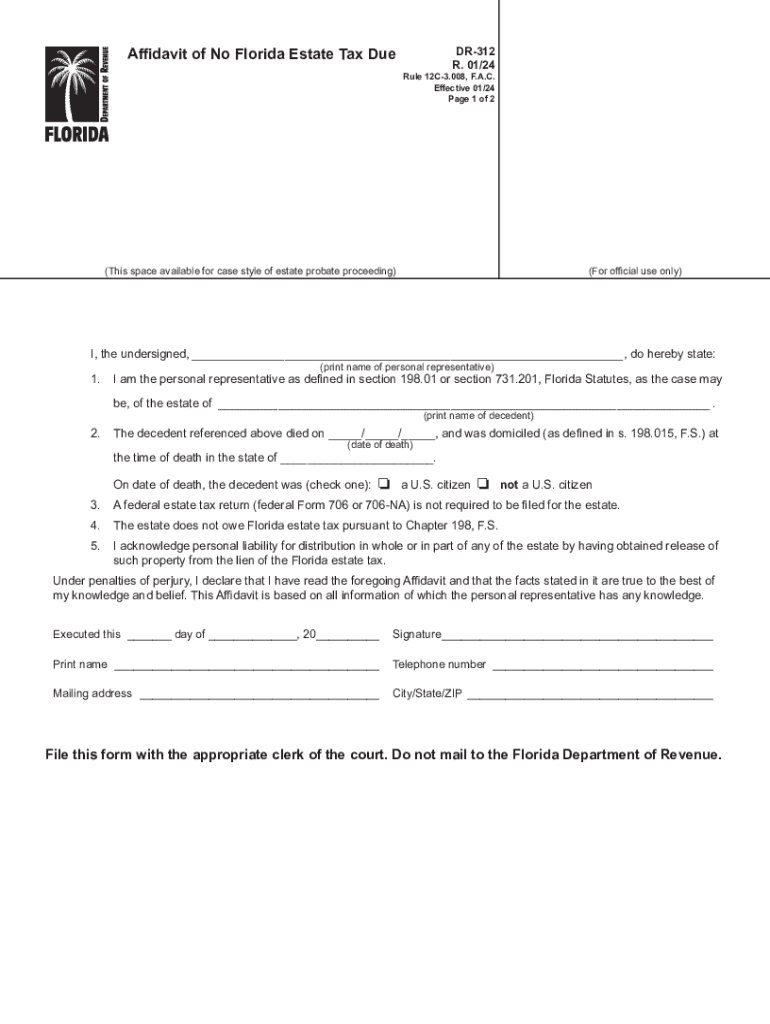

The Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida to confirm that no estate tax is owed on the estate of a deceased individual. This affidavit is typically required when settling an estate, particularly if the estate is below the threshold for estate tax liability. By submitting this affidavit, the personal representative of the estate can provide assurance to the court and beneficiaries that all tax obligations have been met.

Steps to Complete the Affidavit of No Florida Estate Tax Due

Completing the Affidavit of No Florida Estate Tax Due involves several key steps:

- Gather necessary information about the deceased, including full name, date of death, and details about the estate’s assets.

- Determine if the estate qualifies for the affidavit by assessing the total value of the estate against the state’s estate tax exemption threshold.

- Fill out the affidavit form accurately, ensuring all required fields are completed.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the appropriate court or agency as required.

Legal Use of the Affidavit of No Florida Estate Tax Due

The legal use of the Affidavit of No Florida Estate Tax Due is crucial in the estate settlement process. This document serves as proof that the estate is not subject to Florida estate tax, which can expedite the probate process. It is important to note that filing this affidavit does not exempt the estate from other taxes, such as income tax, and it must be filed in accordance with state laws to avoid penalties.

Required Documents for the Affidavit of No Florida Estate Tax Due

To successfully file the Affidavit of No Florida Estate Tax Due, certain documents are typically required:

- The completed affidavit form itself.

- A copy of the death certificate of the deceased individual.

- Documentation of the estate's assets and their valuations.

- Any previous tax returns related to the estate, if applicable.

Eligibility Criteria for Filing the Affidavit of No Florida Estate Tax Due

Eligibility to file the Affidavit of No Florida Estate Tax Due generally depends on the total value of the estate. If the estate’s value is below the exemption limit set by Florida law, the personal representative may file this affidavit. Additionally, the representative must ensure that all debts and obligations of the estate have been settled prior to filing.

Form Submission Methods for the Affidavit of No Florida Estate Tax Due

The Affidavit of No Florida Estate Tax Due can be submitted through various methods, depending on the requirements of the local court or agency. Common submission methods include:

- Online submission via the court’s electronic filing system, if available.

- Mailing the completed affidavit to the appropriate court.

- In-person submission at the local probate court office.

Quick guide on how to complete affidavit of no florida estate tax due state of

Complete Affidavit Of No Florida Estate Tax Due STATE OF easily on any device

Digital document management has gained traction among enterprises and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Affidavit Of No Florida Estate Tax Due STATE OF on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Affidavit Of No Florida Estate Tax Due STATE OF effortlessly

- Obtain Affidavit Of No Florida Estate Tax Due STATE OF and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Affidavit Of No Florida Estate Tax Due STATE OF and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct affidavit of no florida estate tax due state of

Create this form in 5 minutes!

How to create an eSignature for the affidavit of no florida estate tax due state of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 312 in relation to airSlate SignNow?

dr 312 refers to a specific feature within airSlate SignNow that enables users to efficiently manage document signing processes. This functionality streamlines the workflow, making it easier for businesses to send, sign, and track important documents.

-

How does dr 312 enhance document security?

With dr 312, airSlate SignNow utilizes advanced encryption and security protocols to protect your documents. This feature ensures that all eSignatures are secure and legally binding, giving businesses peace of mind when handling sensitive information.

-

What are the pricing options for airSlate SignNow and dr 312?

AirSlate SignNow offers various pricing plans that accommodate different business needs, including access to the dr 312 feature. These plans are designed to be cost-effective, ensuring that companies of all sizes can benefit from robust eSigning solutions.

-

Can I integrate dr 312 with other tools?

Yes, dr 312 allows for seamless integration with numerous applications, including CRM systems and cloud storage services. This helps businesses maintain an efficient workflow by centralizing document management within their existing software ecosystems.

-

What benefits does using dr 312 provide for my business?

Using dr 312 within airSlate SignNow offers signNow benefits, such as increased efficiency in document handling and reduced turnaround times for contracts. This feature also enhances collaboration among team members, ensuring everyone is on the same page throughout the process.

-

Is dr 312 compliant with eSignature laws?

Yes, dr 312 complies with various eSignature laws such as ESIGN and UETA, ensuring that your eSignatures are legally recognized. This compliance is crucial for businesses that require legally binding agreements, providing added assurance in your transactions.

-

How user-friendly is dr 312 for new users?

dr 312 is designed with user-friendliness in mind, making it accessible even to those who are not tech-savvy. The interface prompts users through each step, ensuring that anyone can efficiently send and sign documents without extensive training.

Get more for Affidavit Of No Florida Estate Tax Due STATE OF

Find out other Affidavit Of No Florida Estate Tax Due STATE OF

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet