PDF Affidavit of No Florida Estate Tax Due Florida Department of Revenue 2021

Understanding the Florida DR-312 Form

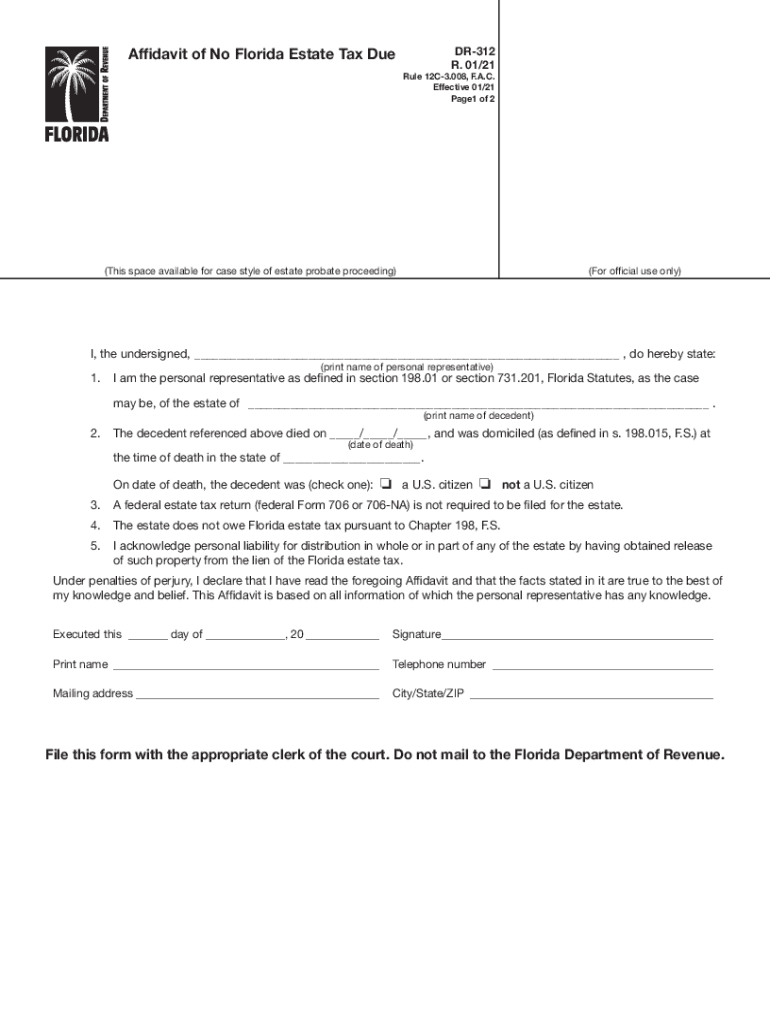

The Florida DR-312 form, officially known as the Affidavit of No Florida Estate Tax Due, is a crucial document for individuals handling estate matters in Florida. This form is primarily used to affirm that no estate tax is owed to the state of Florida upon the death of an individual. It is essential for the timely settlement of estates, especially when transferring property or assets to heirs. The form serves as a declaration to the Florida Department of Revenue, ensuring compliance with state tax obligations.

Steps to Complete the Florida DR-312 Form

Completing the Florida DR-312 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including the decedent's details, the date of death, and any relevant financial information. Next, accurately fill out all required fields on the form, ensuring that each entry is clear and legible. After completing the form, it must be signed by the appropriate parties, typically the personal representative of the estate. Finally, submit the form to the Florida Department of Revenue, either electronically or via mail, depending on the submission method chosen.

Legal Use of the Florida DR-312 Form

The legal use of the Florida DR-312 form is significant in estate administration. It provides legal assurance that no estate tax is owed, which can expedite the process of transferring assets to beneficiaries. This form is particularly important in situations where property is being sold or transferred, as it may be required by title companies and financial institutions. Ensuring that the DR-312 form is properly completed and submitted helps avoid potential legal disputes regarding estate taxes.

Key Elements of the Florida DR-312 Form

Several key elements are crucial to the Florida DR-312 form. These include the decedent's full name, Social Security number, date of death, and a declaration that no estate tax is owed. Additionally, the form requires the signature of the personal representative, affirming the truthfulness of the information provided. It is important to ensure that all sections are filled out completely, as incomplete forms may lead to delays in processing.

Obtaining the Florida DR-312 Form

The Florida DR-312 form can be obtained directly from the Florida Department of Revenue's website or through local county offices. It is available in a fillable PDF format, allowing users to complete the form electronically. This accessibility is particularly beneficial for those managing estates from a distance or who prefer digital documentation. Always ensure you are using the most current version of the form to comply with any updates in state regulations.

Filing Deadlines for the Florida DR-312 Form

Filing deadlines for the Florida DR-312 form are critical to ensure compliance with state regulations. Generally, the form should be submitted as part of the estate administration process, typically within a few months following the decedent's death. It is advisable to consult with a legal professional or the Florida Department of Revenue for specific deadlines related to your situation, as delays in filing can result in penalties or complications in settling the estate.

Quick guide on how to complete pdf affidavit of no florida estate tax due florida department of revenue

Effortlessly Prepare PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue on Any Device

Online document management has gained signNow traction among businesses and individuals alike. It presents a stellar eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven procedure today.

The Easiest Way to Edit and eSign PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue with Ease

- Locate PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Select signNow parts of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your updates.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue to ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf affidavit of no florida estate tax due florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf affidavit of no florida estate tax due florida department of revenue

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is dr 312 and how does it work with airSlate SignNow?

dr 312 is an innovative solution that integrates seamlessly with airSlate SignNow, allowing users to streamline their document signing process. With dr 312, you can enhance the security and efficiency of document workflows, making it easier than ever to manage electronic signatures.

-

How does pricing for dr 312 compare to other eSignature solutions?

Pricing for dr 312 is competitive, offering a cost-effective approach to managing eSignatures through airSlate SignNow. Users can benefit from affordable plans that scale with their business needs, without sacrificing any key features or integrations.

-

What are the key features of dr 312 in airSlate SignNow?

dr 312 boasts a variety of powerful features, such as advanced document tracking, multiple signature options, and customizable templates. These features allow users to optimize their document management processes, making signing and sharing documents faster and more secure.

-

Can dr 312 integrate with other software platforms?

Yes, dr 312 offers extensive integration capabilities with various popular software platforms. This flexibility allows businesses to incorporate airSlate SignNow into their existing tech stack, enhancing productivity and streamlining operations.

-

What benefits can I expect from using dr 312 with airSlate SignNow?

By using dr 312 with airSlate SignNow, you can expect improved efficiency and faster turnaround times for document signing. This combination empowers your team to focus on their core tasks, ultimately improving productivity and client satisfaction.

-

Is dr 312 suitable for small businesses?

Absolutely, dr 312 is specifically designed to be accessible for businesses of all sizes, including small businesses. Its user-friendly interface and flexible pricing make it an ideal solution for small teams seeking efficient eSigning capabilities through airSlate SignNow.

-

How secure is the dr 312 eSignature process?

The dr 312 eSignature process is highly secure, featuring industry-standard encryption and compliance with legal regulations. airSlate SignNow prioritizes the security of your documents, ensuring that your sensitive information remains protected throughout the signing process.

Get more for PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue

Find out other PDF Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF