Application for Refund of Tax Paid on Undyed Diesel 2023-2026

What is the Application For Refund Of Tax Paid On Undyed Diesel

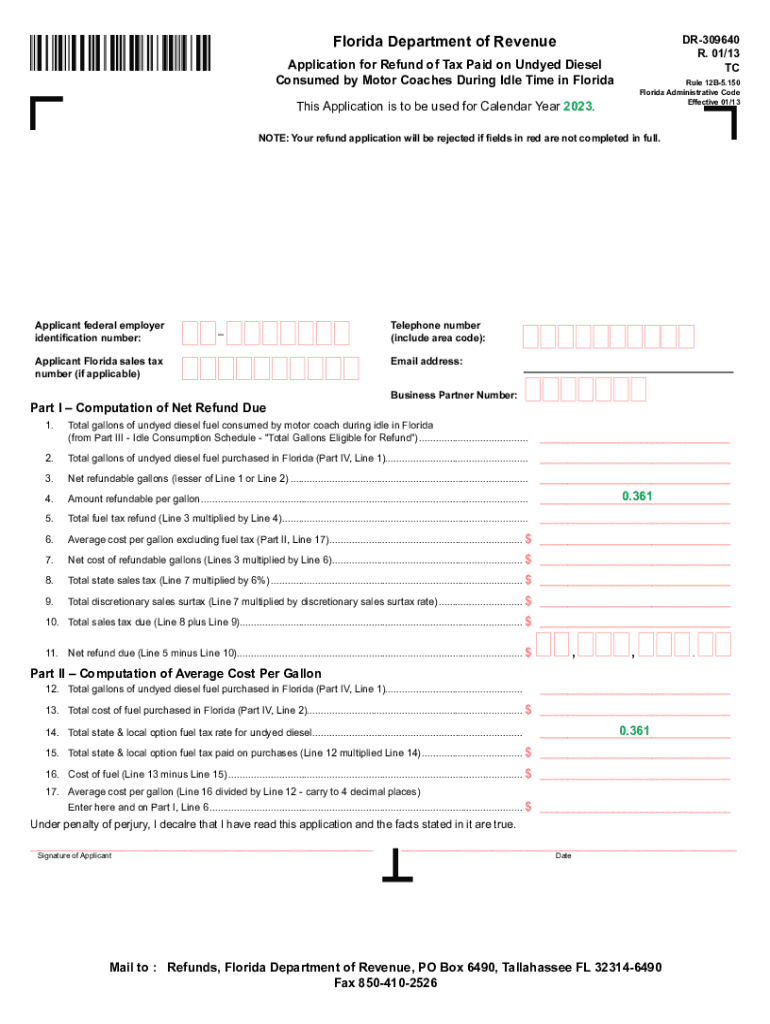

The Application For Refund Of Tax Paid On Undyed Diesel is a form used by businesses and individuals to request a refund for federal excise taxes paid on undyed diesel fuel. This tax is typically levied on diesel fuel used for taxable purposes, such as on-road vehicles. However, certain uses, like off-road agricultural or construction activities, may qualify for a refund. Understanding this form is essential for those who have overpaid or incorrectly paid taxes on undyed diesel fuel.

How to obtain the Application For Refund Of Tax Paid On Undyed Diesel

This application can be obtained directly from the Internal Revenue Service (IRS) website or through authorized tax professionals. The form is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, some tax software may include this form as part of their offerings, allowing users to complete it electronically.

Steps to complete the Application For Refund Of Tax Paid On Undyed Diesel

Completing the Application For Refund Of Tax Paid On Undyed Diesel involves several key steps:

- Gather necessary information, including your tax identification number and details about the diesel fuel purchased.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation, such as receipts and proof of tax payments.

- Review the application for accuracy before submission.

Required Documents

When submitting the Application For Refund Of Tax Paid On Undyed Diesel, specific documents must accompany the form. These typically include:

- Proof of payment of the excise tax, such as invoices or receipts.

- A copy of the completed application form.

- Any additional documentation requested by the IRS to support your claim.

Eligibility Criteria

To qualify for a refund using the Application For Refund Of Tax Paid On Undyed Diesel, applicants must meet certain eligibility criteria. Generally, the fuel must have been used for non-taxable purposes, such as off-road use in farming or construction. Additionally, applicants must have records demonstrating the amount of tax paid and the intended use of the fuel. It is essential to review IRS guidelines to ensure compliance with all requirements.

Form Submission Methods

The Application For Refund Of Tax Paid On Undyed Diesel can be submitted in various ways, including:

- Online submission through IRS-approved platforms, if available.

- Mailing the completed form and supporting documents to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the Application For Refund Of Tax Paid On Undyed Diesel. These guidelines outline the eligibility criteria, required documentation, and submission processes. It is crucial for applicants to familiarize themselves with these guidelines to avoid delays or rejections in their refund requests. Regularly checking the IRS website for updates can also be beneficial.

Quick guide on how to complete application for refund of tax paid on undyed diesel

Complete Application For Refund Of Tax Paid On Undyed Diesel seamlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to locate the correct document and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Handle Application For Refund Of Tax Paid On Undyed Diesel on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based tasks today.

The easiest way to edit and eSign Application For Refund Of Tax Paid On Undyed Diesel without hassle

- Obtain Application For Refund Of Tax Paid On Undyed Diesel and then click Get Form to get started.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your document, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For Refund Of Tax Paid On Undyed Diesel and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for refund of tax paid on undyed diesel

Create this form in 5 minutes!

How to create an eSignature for the application for refund of tax paid on undyed diesel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Refund Of Tax Paid On Undyed Diesel?

The Application For Refund Of Tax Paid On Undyed Diesel is a request form that allows individuals and businesses to claim refunds on taxes they have paid for undyed diesel fuel. Understanding this application helps ensure that you can take advantage of potential savings related to fuel expenses.

-

How can I fill out the Application For Refund Of Tax Paid On Undyed Diesel?

Filling out the Application For Refund Of Tax Paid On Undyed Diesel can be streamlined using airSlate SignNow. Our platform offers easy-to-use templates that guide you through each section, ensuring you capture all necessary information accurately.

-

What are the benefits of using airSlate SignNow for my tax refund application?

Using airSlate SignNow for your Application For Refund Of Tax Paid On Undyed Diesel provides a cost-effective solution to manage your documents. You can eSign forms securely, save time on paperwork, and store your files conveniently all in one place.

-

Is there a cost associated with using airSlate SignNow for tax applications?

Yes, while airSlate SignNow offers various pricing plans, the overall service remains affordable. This allows you to efficiently prepare and submit your Application For Refund Of Tax Paid On Undyed Diesel without breaking the bank.

-

Can airSlate SignNow integrate with other software for managing applications?

Absolutely! airSlate SignNow integrates seamlessly with various business tools to enhance your workflow. This means you can connect your tax refund application with your accounting or tax preparation software to simplify the process.

-

How long does it take to process the Application For Refund Of Tax Paid On Undyed Diesel?

Processing times can vary depending on your jurisdiction and the volume of applications received. Typically, once submitted correctly through airSlate SignNow, you should expect updates on your Application For Refund Of Tax Paid On Undyed Diesel within a few weeks.

-

What if I need help with my Application For Refund Of Tax Paid On Undyed Diesel?

If you require assistance with the Application For Refund Of Tax Paid On Undyed Diesel, airSlate SignNow offers customer support. Our team is ready to provide guidance and answer any questions during the eSigning process.

Get more for Application For Refund Of Tax Paid On Undyed Diesel

- Statement of contract individual form

- Control number sd 02 77 form

- Control number sd 020 78 form

- Parents to children with reservation of life form

- Petition for modification form sd dss state of south dakota

- Statement of contract corporation form

- Free south dakota quit claim deed form pdfword

- Surviving joint tenant with right of survivorship chooses to exercise hisher right to disclaim any form

Find out other Application For Refund Of Tax Paid On Undyed Diesel

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe