Il Rate Tax Income 2019-2026

Understanding the IL Rate Tax Income

The IL Rate Tax Income refers to the income tax rates applicable to residents and non-residents earning income in Illinois. This tax structure is crucial for individuals and businesses to understand, as it affects how much tax is owed based on income levels. The rates can vary depending on the type of income, such as wages, dividends, or capital gains. For instance, Illinois has a flat income tax rate, which means that all taxpayers pay the same percentage regardless of their income bracket.

How to Use the IL Rate Tax Income

Using the IL Rate Tax Income involves calculating your taxable income and applying the appropriate tax rate. Taxpayers should first determine their total income from all sources, including wages, investments, and other earnings. Once the total income is established, deductions and exemptions can be applied to arrive at the taxable income. The final step is to multiply the taxable income by the IL rate tax percentage to determine the total tax liability for the year.

Steps to Complete the IL Rate Tax Income Calculation

Completing the IL Rate Tax Income calculation involves several key steps:

- Gather all income documents, including W-2s and 1099s.

- Calculate total income from all sources.

- Identify and apply any eligible deductions or exemptions.

- Determine the taxable income by subtracting deductions from total income.

- Apply the IL tax rate to the taxable income to find the total tax owed.

Required Documents for IL Rate Tax Income Filing

When filing for the IL Rate Tax Income, specific documents are necessary to ensure accurate reporting. Essential documents include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Proof of any deductions, such as mortgage interest statements or receipts for charitable contributions.

- Records of any other income sources, including investment income.

Filing Deadlines for IL Rate Tax Income

Filing deadlines for the IL Rate Tax Income typically align with federal tax deadlines. Generally, individual taxpayers must file their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines, especially in light of potential extensions or adjustments made by the state.

Penalties for Non-Compliance with IL Rate Tax Income Regulations

Failure to comply with IL Rate Tax Income regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which can accrue if the tax return is submitted after the deadline.

- Late payment penalties for any taxes owed that are not paid on time.

- Interest on unpaid taxes, which compounds over time until the balance is settled.

Quick guide on how to complete il rate tax income

Prepare Il Rate Tax Income seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents quickly without delays. Manage Il Rate Tax Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Il Rate Tax Income effortlessly

- Find Il Rate Tax Income and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or mask sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Il Rate Tax Income and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il rate tax income

Create this form in 5 minutes!

How to create an eSignature for the il rate tax income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

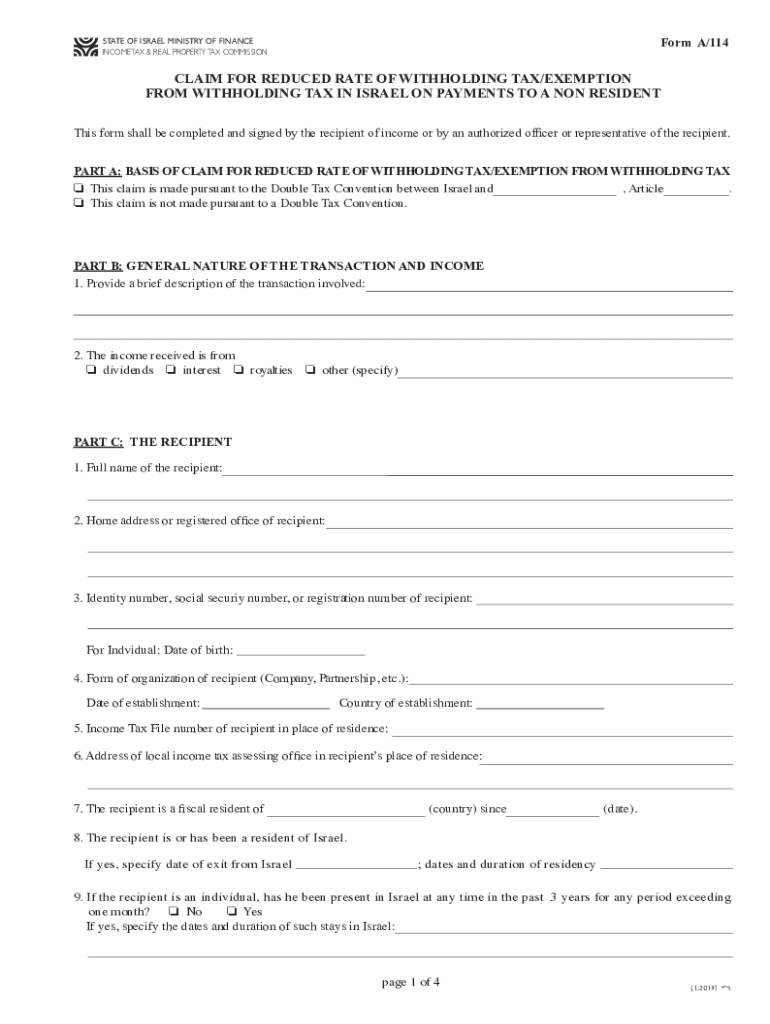

What is a 114 form and how is it used in business transactions?

A 114 form is a specific document used for various business transactions, often related to finance or compliance. It serves as a formal request or declaration, necessary for accurate record-keeping and regulatory purposes. Understanding how to properly fill out and submit a 114 form is crucial for ensuring that your business operates smoothly.

-

How can airSlate SignNow help me with completing a 114 form?

airSlate SignNow provides an intuitive platform for easily completing and eSigning a 114 form. With features that allow you to fill out forms digitally, you can streamline the process and reduce errors. The platform ensures that all your signatures and necessary information are secure and compliant.

-

What is the pricing structure for using airSlate SignNow for a 114 form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you need a simple plan for occasional use or a comprehensive solution for regular operations involving a 114 form, there’s an option for you. Visit our pricing page to find the plan that best fits your needs.

-

Are there any advanced features in airSlate SignNow when handling a 114 form?

Yes, airSlate SignNow includes advanced features such as automated workflows, templates, and mobile compatibility, which are beneficial when handling a 114 form. These features not only save time but also enhance accuracy, ensuring compliance and streamlined processes. You can also track the status of your forms in real-time.

-

What benefits does airSlate SignNow offer for electronic signing of a 114 form?

Using airSlate SignNow for electronic signing of a 114 form comes with numerous benefits, including increased efficiency and reduced turnaround time. E-signatures are legally binding and help in maintaining a clear audit trail. Plus, the platform is user-friendly, making it accessible for all users regardless of tech proficiency.

-

Can I integrate airSlate SignNow with other applications for managing a 114 form?

Absolutely! airSlate SignNow supports integration with various applications and platforms, allowing you to manage a 114 form alongside other business tools you already use. This seamless integration enhances productivity and makes it easier to maintain organized workflows.

-

Is airSlate SignNow secure for handling sensitive 114 forms?

Yes, airSlate SignNow prioritizes security, ensuring that all your transactions, including the handling of a 114 form, are protected. The platform employs advanced encryption and compliance with legal standards, so you can trust that your sensitive information remains confidential and secure.

Get more for Il Rate Tax Income

Find out other Il Rate Tax Income

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now