Estate Tax Forms and Instructions Department of Taxation and Finance 2014

What is the Estate Tax Forms And Instructions Department Of Taxation And Finance

The Estate Tax Forms and Instructions from the Department of Taxation and Finance are essential documents used to report and calculate estate taxes owed by the estate of a deceased individual. These forms provide a structured way for executors or administrators to disclose information about the deceased's assets, liabilities, and any applicable deductions. Understanding these forms is crucial for ensuring compliance with state tax laws and for the accurate assessment of estate tax obligations.

How to use the Estate Tax Forms And Instructions Department Of Taxation And Finance

Using the Estate Tax Forms and Instructions involves several steps. First, gather all necessary information regarding the deceased's estate, including asset valuations and debts. Next, download the appropriate forms from the Department of Taxation and Finance website or obtain them directly from a local office. Carefully follow the provided instructions to fill out each section accurately. Once completed, the forms must be signed and submitted according to the specified submission methods, ensuring all required documentation is included to avoid delays.

Steps to complete the Estate Tax Forms And Instructions Department Of Taxation And Finance

Completing the Estate Tax Forms requires a systematic approach. Start by collecting the following documents:

- Death certificate of the deceased.

- List of all assets, including real estate, bank accounts, and investments.

- Documentation of debts and liabilities.

- Any prior tax returns or estate planning documents.

Once you have gathered this information, proceed with these steps:

- Download the estate tax forms from the Department of Taxation and Finance.

- Fill out the forms, ensuring all information is accurate and complete.

- Review the forms for any omissions or errors.

- Sign the forms where required.

- Submit the completed forms along with any necessary attachments by the deadline.

Legal use of the Estate Tax Forms And Instructions Department Of Taxation And Finance

The legal use of the Estate Tax Forms is critical for compliance with state tax laws. These forms must be completed accurately and submitted within the specified timeframe to avoid penalties. The information provided on these forms is used by the state to assess the estate's tax liability. Executors or administrators are legally responsible for ensuring that the forms are filled out correctly and that all required documentation is submitted to support the reported values.

Filing Deadlines / Important Dates

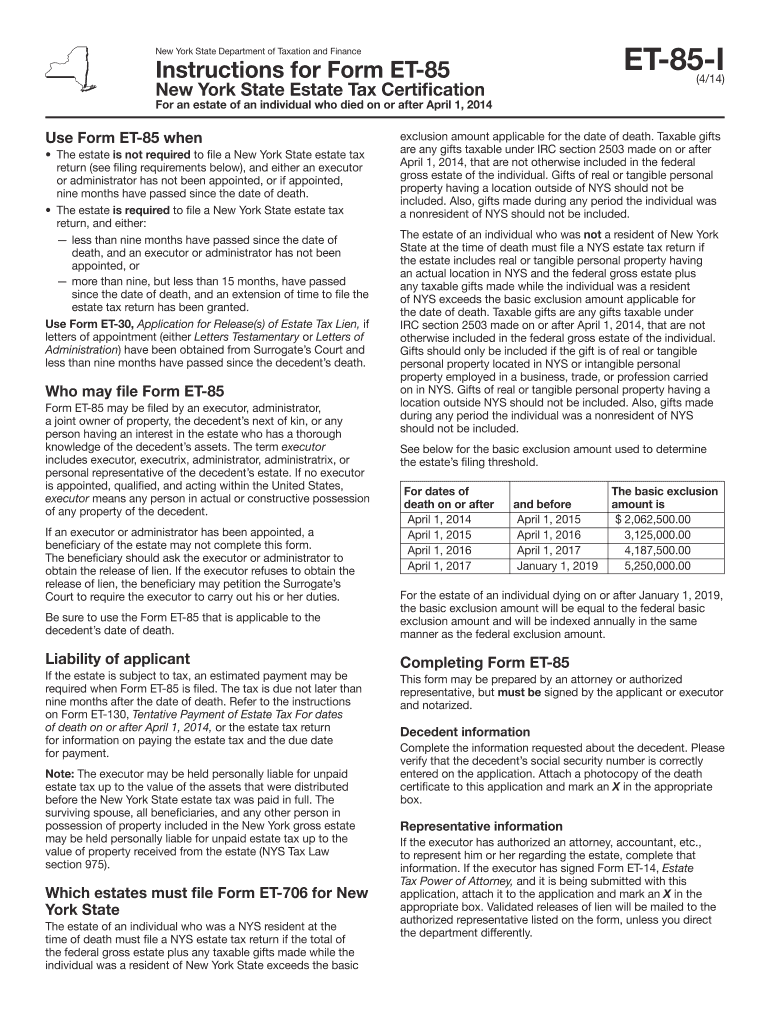

Filing deadlines for the Estate Tax Forms are established by the Department of Taxation and Finance and can vary by state. Typically, these forms must be filed within nine months of the date of death of the individual. It is essential to be aware of these deadlines to avoid late fees and penalties. Executors should also monitor for any changes in deadlines or requirements announced by the state, especially during extraordinary circumstances like natural disasters or public health emergencies.

Required Documents

When completing the Estate Tax Forms, several documents are required to support the information provided. These may include:

- Death certificate of the deceased.

- Inventory of assets and liabilities.

- Appraisals of real estate and other significant assets.

- Previous tax returns if applicable.

- Documentation of any debts owed by the deceased.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is reported accurately.

Quick guide on how to complete estate tax forms and instructions department of taxation and finance

Your assistance manual on how to prepare your Estate Tax Forms And Instructions Department Of Taxation And Finance

If you’re curious about how to finalize and submit your Estate Tax Forms And Instructions Department Of Taxation And Finance, here are some brief guidelines to simplify tax declaration.

To begin, you just need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an intuitive and powerful document solution that allows you to modify, create, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and you can revisit to modify answers when necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Estate Tax Forms And Instructions Department Of Taxation And Finance in just a few minutes:

- Establish your account and commence working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; explore through versions and schedules.

- Click Get form to access your Estate Tax Forms And Instructions Department Of Taxation And Finance in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to electronically file your taxes using airSlate SignNow. Please keep in mind that submitting on paper can increase the likelihood of return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct estate tax forms and instructions department of taxation and finance

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

Where can I learn the essentials of NY state sales tax reporting? Does the Department of Finance and taxation provide any learning materials?

This is not specifically about sales tax reporting but you might find useful information and some interesting links in this NY Sales Tax Guide.Hope this helps!

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

Create this form in 5 minutes!

How to create an eSignature for the estate tax forms and instructions department of taxation and finance

How to generate an electronic signature for the Estate Tax Forms And Instructions Department Of Taxation And Finance online

How to make an eSignature for your Estate Tax Forms And Instructions Department Of Taxation And Finance in Chrome

How to generate an eSignature for signing the Estate Tax Forms And Instructions Department Of Taxation And Finance in Gmail

How to create an electronic signature for the Estate Tax Forms And Instructions Department Of Taxation And Finance right from your mobile device

How to create an electronic signature for the Estate Tax Forms And Instructions Department Of Taxation And Finance on iOS

How to make an electronic signature for the Estate Tax Forms And Instructions Department Of Taxation And Finance on Android

People also ask

-

What are the Estate Tax Forms And Instructions Department Of Taxation And Finance?

The Estate Tax Forms And Instructions Department Of Taxation And Finance provide the necessary documentation and guidelines for filing estate tax in compliance with state laws. These forms are essential for ensuring that all tax obligations are met accurately and on time.

-

How can airSlate SignNow assist with filling out Estate Tax Forms And Instructions Department Of Taxation And Finance?

airSlate SignNow simplifies the process of completing Estate Tax Forms And Instructions Department Of Taxation And Finance by allowing users to electronically fill, sign, and send documents securely. This enhances efficiency and ensures that all forms are prepared correctly.

-

Is there a cost associated with using airSlate SignNow for Estate Tax Forms And Instructions Department Of Taxation And Finance?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. Our cost-effective solution allows you to manage and eSign your Estate Tax Forms And Instructions Department Of Taxation And Finance without breaking the bank.

-

What features does airSlate SignNow offer for managing Estate Tax Forms And Instructions Department Of Taxation And Finance?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and advanced eSignature capabilities specifically designed for handling Estate Tax Forms And Instructions Department Of Taxation And Finance. These tools streamline the entire documentation process.

-

Can I integrate airSlate SignNow with other software for my Estate Tax Forms And Instructions Department Of Taxation And Finance?

Absolutely! airSlate SignNow offers seamless integration with various software solutions, making it easier to manage your Estate Tax Forms And Instructions Department Of Taxation And Finance alongside your existing business tools. This enhances productivity and saves time.

-

What are the benefits of using airSlate SignNow for Estate Tax Forms And Instructions Department Of Taxation And Finance?

Using airSlate SignNow for Estate Tax Forms And Instructions Department Of Taxation And Finance provides a user-friendly experience with features designed to improve accuracy and efficiency. It reduces paperwork and helps ensure compliance with state regulations.

-

How secure is airSlate SignNow when handling Estate Tax Forms And Instructions Department Of Taxation And Finance?

airSlate SignNow prioritizes security with robust encryption and authentication measures to protect your sensitive data. This ensures that your Estate Tax Forms And Instructions Department Of Taxation And Finance are safe from unauthorized access.

Get more for Estate Tax Forms And Instructions Department Of Taxation And Finance

- Lead paint test form thermal windows inc

- Enterprise system access request form memorial healthcare

- Form 102p dhh louisiana new dhh louisiana

- School health questionnaire form

- Sub contractor sheet referee form

- Roseberry39s funeral home funeral cost work sheet form

- Application for license to serve fermented form

- Application for review petition for variancestate form

Find out other Estate Tax Forms And Instructions Department Of Taxation And Finance

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template