Et 85 2014

What is the ET 85?

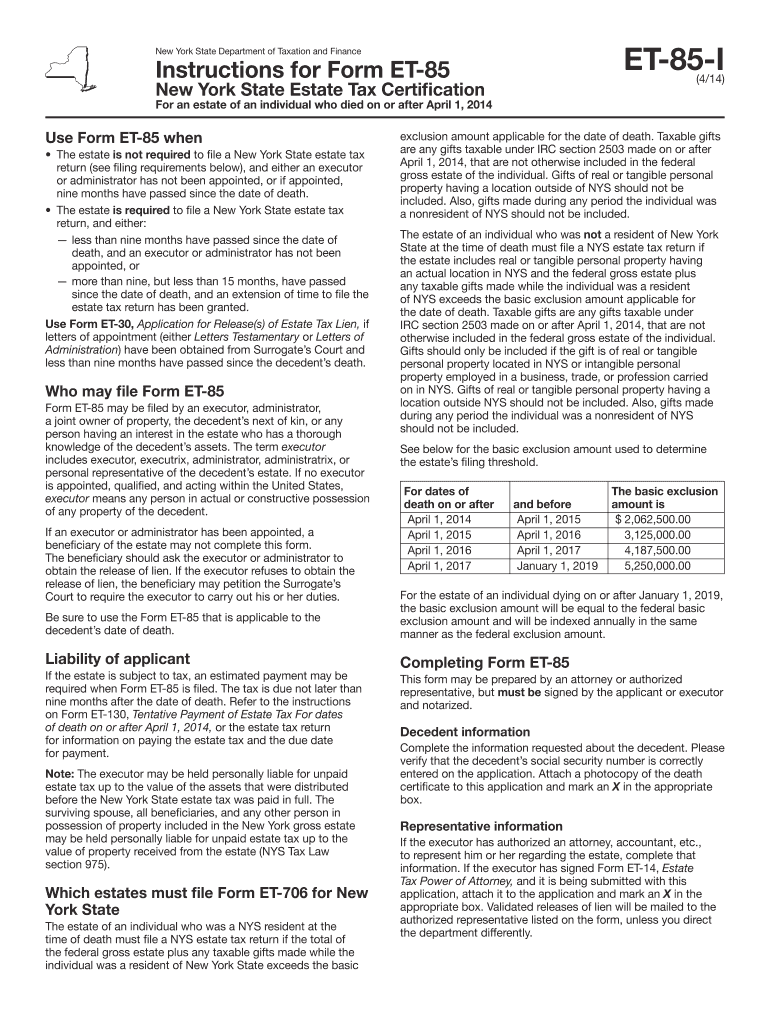

The ET 85 is a New York State tax form used primarily for reporting estate tax information. This form is essential for individuals or estates that meet specific criteria under New York tax laws. The ET 85 allows for the declaration of the date of death and the total value of the estate, which is necessary for calculating any estate taxes owed to the state. Understanding the purpose of the ET 85 is crucial for compliance with New York tax regulations.

How to Use the ET 85

Using the ET 85 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to the estate, including the date of death and asset valuations. Next, fill out the form with the required information, ensuring that all entries are correct and complete. After completing the form, it must be signed and dated by the executor or administrator of the estate. Finally, submit the ET 85 to the appropriate New York State tax authority, either electronically or by mail, depending on the submission method chosen.

Steps to Complete the ET 85

Completing the ET 85 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, such as the death certificate and asset valuations.

- Fill in the decedent's information, including name and date of death.

- List all assets and their corresponding values accurately.

- Calculate the total value of the estate and any applicable deductions.

- Sign and date the form, ensuring the signature is from the authorized representative.

- Submit the completed form to the New York State tax authority.

Legal Use of the ET 85

The ET 85 must be used in accordance with New York State laws governing estate taxes. It is legally binding and serves as an official declaration of the estate's value. Proper use of the ET 85 ensures compliance with state regulations, helping to avoid penalties or legal issues related to estate tax filings. It is essential for executors or administrators to understand the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the ET 85 are critical for compliance. The form must typically be submitted within nine months of the decedent's date of death. Failure to meet this deadline can result in penalties or interest on unpaid taxes. It is advisable to keep track of important dates related to the estate to ensure timely filing and avoid complications.

Required Documents

To complete the ET 85, several documents are required to support the information provided. These may include:

- Death certificate of the decedent.

- Valuations of all assets included in the estate.

- Documentation of any debts or liabilities of the estate.

- Previous tax returns, if applicable, to establish a tax history.

Having these documents readily available will facilitate a smoother filing process.

Quick guide on how to complete et 85 2014 2018 form

Your assistance manual on how to prepare your Et 85

If you’re curious about how to finalize and submit your Et 85, here are a few straightforward recommendations to simplify the tax submission process.

To begin, simply register your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, create, and finalize your income tax forms with ease. With its editor, you can navigate between text, checkboxes, and eSignatures, and revert to update answers as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and intuitive sharing options.

Follow these steps to complete your Et 85 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to acquire any IRS tax form; explore different versions and schedules.

- Click Get form to access your Et 85 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and fix any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct et 85 2014 2018 form

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How can I claim for the 85% state quota in the NEET 2018 if I had only filled one state in the NEET form?

Complete the requirements for the state counselling and you will be good to go

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the et 85 2014 2018 form

How to make an eSignature for the Et 85 2014 2018 Form online

How to make an eSignature for the Et 85 2014 2018 Form in Google Chrome

How to make an electronic signature for signing the Et 85 2014 2018 Form in Gmail

How to create an electronic signature for the Et 85 2014 2018 Form straight from your smartphone

How to generate an electronic signature for the Et 85 2014 2018 Form on iOS devices

How to make an eSignature for the Et 85 2014 2018 Form on Android devices

People also ask

-

What is the Et 85 feature in airSlate SignNow?

The Et 85 feature in airSlate SignNow allows users to easily create, send, and sign documents electronically. This feature streamlines the signing process, making it efficient and user-friendly for both senders and recipients.

-

How does Et 85 improve document management?

With Et 85 in airSlate SignNow, businesses can enhance their document management by automating workflows and tracking document statuses. This feature helps eliminate paperwork clutter and ensures that all documents are organized and easily accessible.

-

What are the pricing options for using Et 85?

airSlate SignNow offers various pricing plans that include the Et 85 feature, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide additional features as your needs grow.

-

Can I integrate Et 85 with other software?

Yes, Et 85 is designed to integrate seamlessly with a wide range of software applications. This includes popular tools such as CRM systems, project management software, and cloud storage solutions, enhancing your overall workflow.

-

What benefits does Et 85 offer for remote teams?

Et 85 in airSlate SignNow is particularly beneficial for remote teams as it enables them to collaborate on documents from anywhere. The e-signature capabilities ensure that all team members can sign and approve documents quickly, facilitating efficient communication.

-

Is Et 85 secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security, and the Et 85 feature includes robust encryption and compliance with industry standards. This ensures that your sensitive documents are protected during the signing process.

-

How easy is it to use Et 85 for new users?

Et 85 is designed with user-friendliness in mind, making it accessible even for those who are not tech-savvy. The intuitive interface guides users through the document signing process, ensuring a smooth experience from start to finish.

Get more for Et 85

- Veterinary health certificate for export form

- Stevens plantation residential owners association form

- Host success planner thank you for hosting a jamberry party form

- Vermont state police alarms form

- Authorizationrelaese of information reed senate

- Basic photography agreement form

- Regulated industries kansas city mo 64106 fill out ampamp sign form

- St louis city high school transcript request infolake org form

Find out other Et 85

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form