Form ET 85 New York State Estate Tax Certification Revised 720 2020-2026

What is the Form ET 85 New York State Estate Tax Certification Revised 720

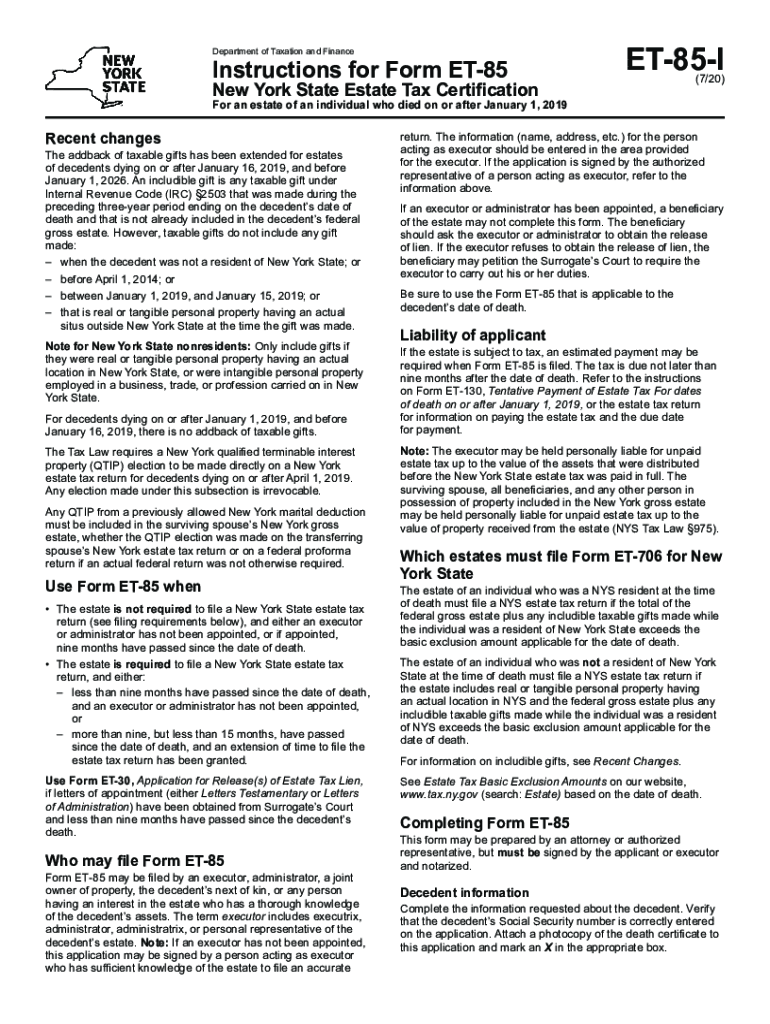

The Form ET 85 is a crucial document used in New York State to certify that an estate has settled its tax obligations. This form is specifically designed for estates that are subject to the New York State estate tax. The ET 85 serves as a declaration that all required estate taxes have been paid or that the estate is exempt from such taxes. Understanding the purpose of this form is essential for executors and administrators managing estates to ensure compliance with state regulations.

How to use the Form ET 85 New York State Estate Tax Certification Revised 720

To effectively use the Form ET 85, one must first gather all necessary information regarding the estate, including asset valuations and tax payments. The form requires detailed information about the decedent, the executor, and the estate's financial status. Once completed, the ET 85 must be submitted to the New York State Department of Taxation and Finance. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Form ET 85 New York State Estate Tax Certification Revised 720

Completing the Form ET 85 involves several steps:

- Gather all relevant estate information, including asset values and tax payment records.

- Fill out the form with accurate details about the decedent and the estate.

- Review the form for completeness and accuracy.

- Submit the completed form to the appropriate state department.

Following these steps ensures that the estate tax certification process is smooth and compliant with New York State laws.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form ET 85. Typically, the form must be filed within nine months of the decedent's date of death. However, if an estate tax return is required, the ET 85 should be submitted concurrently with that return. Missing these deadlines can result in penalties and interest, making timely filing crucial for estate administrators.

Required Documents

When preparing to file the Form ET 85, certain documents are necessary to support the certification process. These may include:

- The decedent's death certificate.

- Documentation of all assets and liabilities of the estate.

- Proof of payment of any estate taxes owed.

- Any relevant tax returns related to the estate.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Penalties for Non-Compliance

Failure to file the Form ET 85 or to pay the required estate taxes can result in significant penalties. New York State imposes fines and interest on unpaid taxes, which can accumulate over time. Additionally, non-compliance may lead to legal complications for the estate executor or administrator. It is vital to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete form et 85 new york state estate tax certification revised 720

Complete Form ET 85 New York State Estate Tax Certification Revised 720 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form ET 85 New York State Estate Tax Certification Revised 720 on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to edit and eSign Form ET 85 New York State Estate Tax Certification Revised 720 effortlessly

- Locate Form ET 85 New York State Estate Tax Certification Revised 720 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Draw attention to important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to finalize your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Form ET 85 New York State Estate Tax Certification Revised 720 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form et 85 new york state estate tax certification revised 720

Create this form in 5 minutes!

How to create an eSignature for the form et 85 new york state estate tax certification revised 720

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is the New York State estate tax certification ET 85 due date?

The New York State estate tax certification ET 85 due date is crucial for estate executors as it determines when the necessary estate tax documentation must be filed. Typically, this date falls nine months after the date of death. However, it's important to check for specific legal updates or changes that may affect this timeline.

-

How can airSlate SignNow help with the New York State estate tax certification ET 85 process?

airSlate SignNow streamlines the process of preparing and signing documents required for the New York State estate tax certification ET 85. With our platform, you can easily eSign and send essential documents, ensuring that you're able to meet deadlines without hassle or delays.

-

What features does airSlate SignNow offer that relate to estate tax documentation?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure document storage. These features are particularly beneficial for handling documentation related to the New York State estate tax certification ET 85 due date, helping users stay organized and compliant.

-

Is airSlate SignNow cost-effective for submitting estate tax certifications?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses dealing with estate tax certifications. The pricing plans are competitive, and the savings in time and paper usage can greatly benefit those preparing for the New York State estate tax certification ET 85 due date.

-

Can I integrate airSlate SignNow with other applications for estate planning?

Absolutely! airSlate SignNow offers seamless integrations with various tools and applications that cater to estate planning needs. This benefit ensures that all documents related to the New York State estate tax certification ET 85 due date can be managed efficiently from a single platform.

-

What are the benefits of using airSlate SignNow for estate tax certifications?

The primary benefits of using airSlate SignNow include improved efficiency, enhanced security, and reduced paperwork. By utilizing our eSignature solutions, users can handle the New York State estate tax certification ET 85 due date with confidence and ease, minimizing the risk of errors or delays.

-

How does airSlate SignNow ensure the security of my estate tax documents?

airSlate SignNow prioritizes the security of your documents with top-level encryption and compliance with industry standards. This security is incredibly important when dealing with sensitive information related to the New York State estate tax certification ET 85 due date.

Get more for Form ET 85 New York State Estate Tax Certification Revised 720

- Storage business package alabama form

- Child care services package alabama form

- Special or limited power of attorney for real estate sales transaction by seller alabama form

- Closing estate transaction form

- Limited power of attorney where you specify powers with sample powers included alabama form

- Limited power of attorney for stock transactions and corporate powers alabama form

- Special durable power of attorney for bank account matters alabama form

- Alabama small business startup package alabama form

Find out other Form ET 85 New York State Estate Tax Certification Revised 720

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now