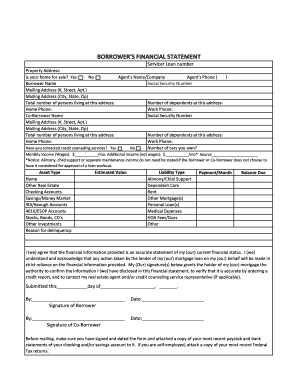

BORROWERS FINANCIAL STATEMENT Form

What is the Borrowers Financial Statement

The Borrowers Financial Statement is a crucial document used primarily in the lending process. It provides lenders with a comprehensive overview of a borrower's financial situation, including income, assets, liabilities, and expenses. This statement helps assess the borrower's ability to repay a loan and is often required for mortgages, personal loans, and business financing. By detailing financial health, it allows lenders to make informed decisions regarding creditworthiness.

Key Elements of the Borrowers Financial Statement

A complete Borrowers Financial Statement typically includes several key components:

- Personal Information: Name, address, and contact details.

- Income Details: Sources of income, including salary, bonuses, and any additional earnings.

- Assets: A list of valuable possessions such as real estate, vehicles, and savings accounts.

- Liabilities: Current debts, including mortgages, credit cards, and loans.

- Monthly Expenses: Regular outflows, such as rent, utilities, and other living costs.

These elements collectively provide a snapshot of the borrower's financial landscape, essential for lenders during the evaluation process.

Steps to Complete the Borrowers Financial Statement

Completing the Borrowers Financial Statement involves several steps to ensure accuracy and thoroughness:

- Gather Documentation: Collect all necessary financial documents, including pay stubs, bank statements, and tax returns.

- List Income Sources: Clearly outline all income sources, ensuring to include any additional earnings beyond regular salary.

- Detail Assets: Provide a comprehensive list of assets, including their estimated values.

- Identify Liabilities: Document all outstanding debts, specifying amounts owed and payment schedules.

- Calculate Monthly Expenses: Estimate monthly living costs to give a clear picture of financial obligations.

Following these steps will help create a complete and accurate Borrowers Financial Statement, facilitating the lending process.

How to Use the Borrowers Financial Statement

The Borrowers Financial Statement is utilized by lenders to evaluate a borrower's creditworthiness and financial stability. Here’s how to effectively use it:

- Loan Applications: Submit the statement with loan applications to provide lenders with a clear view of financial health.

- Financial Planning: Use the statement as a tool for personal financial management, identifying areas for improvement.

- Negotiation Tool: Present the statement during negotiations with lenders to secure better loan terms based on demonstrated financial responsibility.

By leveraging the Borrowers Financial Statement, borrowers can enhance their chances of obtaining favorable loan conditions.

Legal Use of the Borrowers Financial Statement

The Borrowers Financial Statement must be completed truthfully and accurately, as it is often a legally binding document. Misrepresentation of financial information can lead to serious consequences, including denial of loan applications or legal action for fraud. It is essential to understand the legal implications of the information provided and ensure compliance with all applicable laws and regulations.

How to Obtain the Borrowers Financial Statement

Obtaining a Borrowers Financial Statement can typically be done through the following methods:

- Online Templates: Many financial institutions and websites offer downloadable templates for the Borrowers Financial Statement.

- Financial Advisors: Consulting with a financial advisor can provide tailored assistance in creating a comprehensive statement.

- Banking Institutions: Some banks may provide their own versions of the Borrowers Financial Statement for their clients to fill out.

Ensuring that the correct format is used is important for meeting lender requirements.

Quick guide on how to complete borrowers financial statement

Complete BORROWERS FINANCIAL STATEMENT effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents rapidly without interruptions. Handle BORROWERS FINANCIAL STATEMENT on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign BORROWERS FINANCIAL STATEMENT with ease

- Obtain BORROWERS FINANCIAL STATEMENT and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Modify and eSign BORROWERS FINANCIAL STATEMENT and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrowers financial statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Borrowers Financial Statement?

A Borrowers Financial Statement is a document that outlines a borrower's financial situation, including assets, liabilities, income, and expenses. This statement is essential for lenders to assess a borrower's ability to repay a loan. By using airSlate SignNow, you can easily create, sign, and manage your Borrowers Financial Statement online.

-

How does airSlate SignNow enhance the process of preparing a Borrowers Financial Statement?

airSlate SignNow streamlines the preparation of a Borrowers Financial Statement by providing templates and easy-to-use tools for document creation. Our platform allows users to input financial data and instantly generate professional statements. With our eSigning capabilities, you can finalize your documents quickly and securely.

-

Are there any costs associated with using airSlate SignNow for a Borrowers Financial Statement?

Using airSlate SignNow comes with flexible pricing options tailored for different business needs. You can choose a plan that fits your budget while accessing powerful features to manage your Borrowers Financial Statement efficiently. Our cost-effective solution ensures you get the most value for your investment.

-

What features does airSlate SignNow offer for managing a Borrowers Financial Statement?

airSlate SignNow offers a range of features to manage Borrowers Financial Statements, including customizable templates, secure eSigning, and integration with other financial platforms. You can collaborate in real-time with your team or clients, ensuring that the statements are accurate and up-to-date. Our user-friendly interface makes the document management process seamless.

-

Can I integrate airSlate SignNow with other financial tools for my Borrowers Financial Statement?

Yes, airSlate SignNow seamlessly integrates with various financial tools, enhancing your ability to manage Borrowers Financial Statements. These integrations allow you to import financial data directly from your existing systems, reducing manual entry and improving accuracy. This connectivity empowers you to streamline your processes and save time.

-

How secure is airSlate SignNow for handling my Borrowers Financial Statement?

airSlate SignNow prioritizes the security of your documents, including Borrowers Financial Statements. We implement industry-standard encryption and security measures to protect your sensitive information. By using our platform, you can be confident that your financial data is handled with the utmost care and confidentiality.

-

What are the benefits of using airSlate SignNow for creating a Borrowers Financial Statement?

The benefits of using airSlate SignNow for your Borrowers Financial Statement include improved efficiency, enhanced accuracy, and reduced turnaround times. Our platform simplifies document management, allowing you to focus on your business. Additionally, the ease of eSigning reduces the hassle associated with physical paperwork.

Get more for BORROWERS FINANCIAL STATEMENT

Find out other BORROWERS FINANCIAL STATEMENT

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online