05 163 Texas Franchise Tax Annual No Tax Due Information Report 2023-2026

What is the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

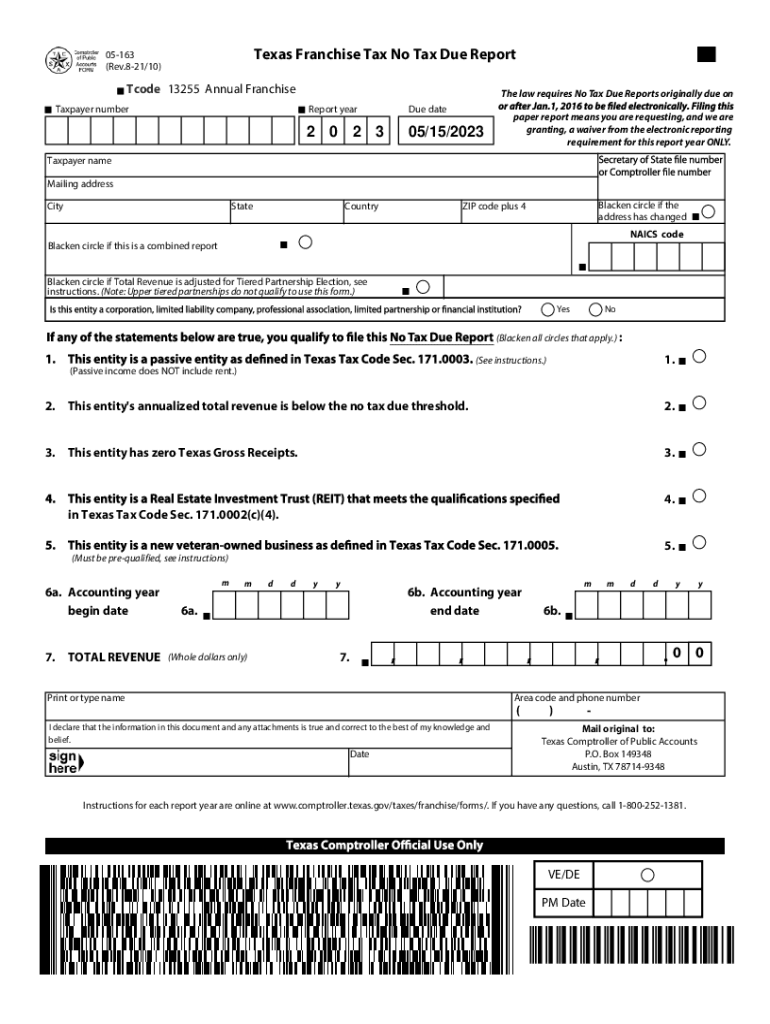

The 05 163 Texas Franchise Tax Annual No Tax Due Information Report is a specific form that businesses in Texas must file to indicate that they have no franchise tax due for a given year. This report is essential for maintaining compliance with Texas tax regulations. It is typically required for entities that have not generated enough revenue to owe taxes or are exempt from the franchise tax altogether. Filing this report helps ensure that businesses are recognized by the Texas Comptroller’s office as compliant and up-to-date with their tax obligations.

Steps to complete the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

Completing the 05 163 report involves several straightforward steps:

- Gather necessary information, including your business's name, address, and Texas taxpayer identification number.

- Determine your eligibility to file the No Tax Due report based on your revenue and business type.

- Access the form online through the Texas Comptroller’s website or obtain a physical copy.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form by the designated filing deadline, either electronically or by mail.

How to obtain the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

The 05 163 report can be obtained through the Texas Comptroller’s website, where it is available for download in PDF format. Businesses can also request a physical copy by contacting the Texas Comptroller’s office directly at. It is important to ensure you are using the correct version of the form for the applicable tax year to avoid any compliance issues.

Legal use of the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

The 05 163 report serves a legal purpose by documenting a business's status regarding franchise tax obligations. Filing this report is a requirement under Texas law for entities that qualify as having no tax due. It protects businesses from potential penalties and ensures they remain in good standing with the state. Additionally, having this report on file can be beneficial for businesses when applying for loans or contracts, as it demonstrates compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 05 163 Texas Franchise Tax Annual No Tax Due Information Report typically align with the annual franchise tax filing period. Generally, the report must be submitted by May 15 of each year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Businesses should keep track of these important dates to ensure timely filing and avoid penalties.

Key elements of the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

The key elements of the 05 163 report include:

- Business name and address

- Texas taxpayer identification number

- Confirmation of no tax due status

- Signature of an authorized representative

- Date of submission

Each of these elements is crucial for the form's validity and ensures that the Texas Comptroller’s office has accurate records of the business's tax status.

Quick guide on how to complete 05 163 texas franchise tax annual no tax due information report

Complete 05 163 Texas Franchise Tax Annual No Tax Due Information Report effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage 05 163 Texas Franchise Tax Annual No Tax Due Information Report on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 05 163 Texas Franchise Tax Annual No Tax Due Information Report effortlessly

- Find 05 163 Texas Franchise Tax Annual No Tax Due Information Report and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form: by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign 05 163 Texas Franchise Tax Annual No Tax Due Information Report and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 163 texas franchise tax annual no tax due information report

Create this form in 5 minutes!

How to create an eSignature for the 05 163 texas franchise tax annual no tax due information report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tx 05 163 form and how can I use airSlate SignNow to fill it out?

The tx 05 163 form is a vital document used for specific state requirements. With airSlate SignNow, you can easily fill out the tx 05 163 form using our intuitive interface that allows for quick data entry and signature collection, streamlining your documentation process.

-

What are the pricing options for using airSlate SignNow to manage my tx 05 163 form?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs. Whether you’re a small business or a large enterprise, you can choose a plan that provides the best value for managing documents like the tx 05 163 form without overspending.

-

Can airSlate SignNow integrate with other tools for managing the tx 05 163 form?

Yes, airSlate SignNow offers seamless integrations with a variety of other applications, including CRMs and cloud storage solutions. This means you can easily manage your tx 05 163 form alongside other documents and data within your preferred work ecosystem.

-

What features does airSlate SignNow provide for handling the tx 05 163 form?

airSlate SignNow includes features like document templates, real-time collaboration, and automated reminders to ensure your tx 05 163 form is completed efficiently. These tools enhance productivity and help you stay organized throughout the signing process.

-

Is airSlate SignNow secure for storing and signing the tx 05 163 form?

Absolutely, airSlate SignNow employs industry-standard encryption and security protocols to protect your documents, including the tx 05 163 form. You can have peace of mind knowing that your sensitive information is safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the tx 05 163 form?

Using airSlate SignNow for the tx 05 163 form offers numerous benefits, such as reducing the time spent on paperwork and improving accuracy with electronic signatures. Additionally, it allows for quick access and easy sharing, enhancing overall workflow efficiency.

-

How can I get support for using the tx 05 163 form in airSlate SignNow?

airSlate SignNow provides robust customer support to assist you with any questions regarding the tx 05 163 form. You can access a comprehensive help center, live chat features, and email support to ensure you get the help you need promptly.

Get more for 05 163 Texas Franchise Tax Annual No Tax Due Information Report

- State zip principal have made constituted and appointed and by these form

- Insert powers here form

- Louisiana property form

- Judicial district court for the parish of form

- Receipt release and indemnity agreement form

- State of louisiana versus willie j ellison jr state of form

- Petition for confirmation of natural tutrix form

- Tutorship of form

Find out other 05 163 Texas Franchise Tax Annual No Tax Due Information Report

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship