No Tax Due Information Report Franchise Tax 2021

What is the No Tax Due Information Report Franchise Tax

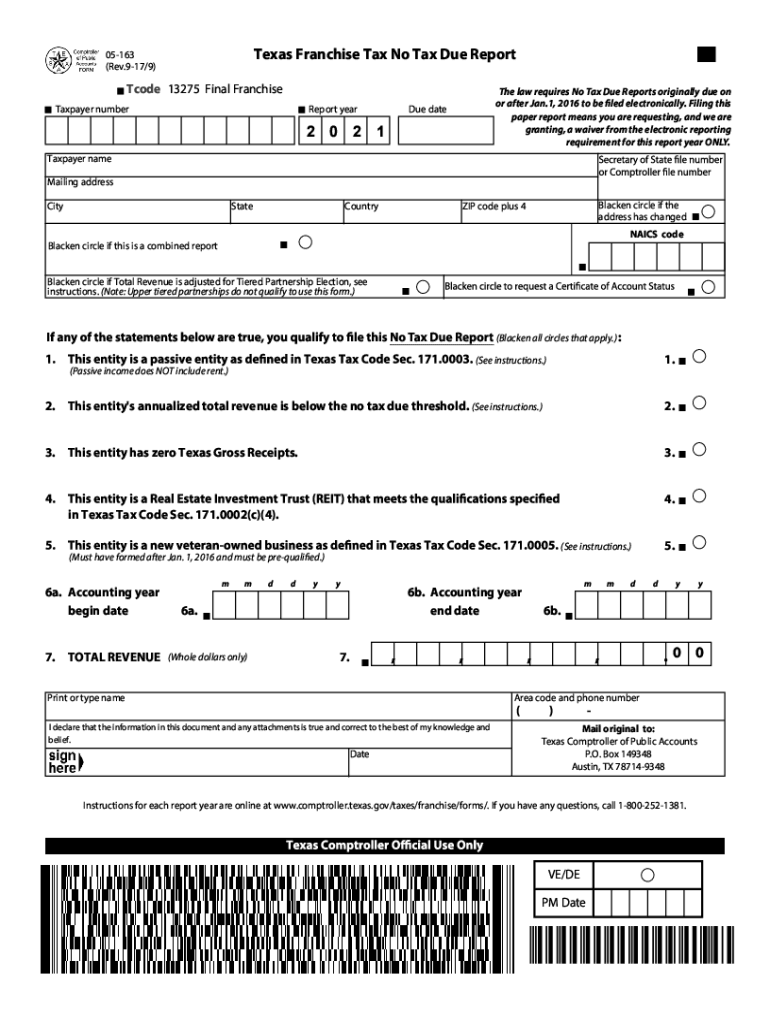

The No Tax Due Information Report Franchise Tax, commonly referred to as form 05, is a document required by the Texas Comptroller of Public Accounts. This report is specifically designed for businesses that are not liable for franchise taxes due to their revenue falling below a certain threshold. The report serves as a formal declaration that the business has no tax due for the reporting period, thus ensuring compliance with state tax regulations.

How to use the No Tax Due Information Report Franchise Tax

To utilize the No Tax Due Information Report Franchise Tax effectively, businesses must first determine their eligibility based on revenue thresholds set by the Texas Comptroller. If eligible, the form should be completed accurately, reflecting the business's financial status. It is essential to submit this report by the specified deadline to avoid penalties. The report can be filed electronically or via mail, depending on the preference of the business and the guidelines provided by the Comptroller's office.

Steps to complete the No Tax Due Information Report Franchise Tax

Completing the No Tax Due Information Report involves several key steps:

- Gather necessary financial information to confirm that your business meets the no tax due criteria.

- Obtain the correct version of the form 05 from the Texas Comptroller's website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, adhering to the filing deadlines.

Legal use of the No Tax Due Information Report Franchise Tax

The No Tax Due Information Report Franchise Tax is legally binding when completed and submitted in accordance with Texas state law. It is crucial for businesses to ensure that the information provided is truthful and accurate, as any discrepancies could lead to penalties or legal issues. The form serves as a protective measure for businesses, confirming their compliance with tax obligations and preventing unnecessary audits.

Filing Deadlines / Important Dates

Filing deadlines for the No Tax Due Information Report Franchise Tax are typically aligned with the annual franchise tax reporting schedule. Businesses must be aware of these dates to ensure timely submission. Generally, the report is due on May 15 of each year, but it is advisable to check with the Texas Comptroller for any changes or specific deadlines that may apply to your business.

Who Issues the Form

The No Tax Due Information Report Franchise Tax is issued by the Texas Comptroller of Public Accounts. This state agency is responsible for overseeing tax collection and compliance in Texas. Businesses can obtain the form directly from the Comptroller's official website, where they can also find additional resources and guidance on completing the report.

Quick guide on how to complete no tax due information report franchise tax

Manage No Tax Due Information Report Franchise Tax effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and without hassle. Handle No Tax Due Information Report Franchise Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign No Tax Due Information Report Franchise Tax without any effort

- Locate No Tax Due Information Report Franchise Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using specialized tools provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign No Tax Due Information Report Franchise Tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct no tax due information report franchise tax

Create this form in 5 minutes!

How to create an eSignature for the no tax due information report franchise tax

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the significance of the number 05 163 2019 in relation to airSlate SignNow?

The number 05 163 2019 is often associated with key updates and features released by airSlate SignNow during that time. This date marks a pivotal moment in our evolution, showcasing our commitment to enhancing document management and eSignature solutions. Customers can trust that our upgrades continually support their business needs.

-

How does the pricing model of airSlate SignNow relate to the 05 163 2019 update?

Following the 05 163 2019 update, airSlate SignNow has refined its pricing model to offer even more value. We aim to provide an affordable solution that fits varying business sizes and needs. Our transparent pricing structures ensure that customers can easily choose the plan that best suits their requirements.

-

What features were introduced with the airSlate SignNow 05 163 2019 release?

The 05 163 2019 release of airSlate SignNow introduced advanced features such as enhanced templates and improved user interface designs. These innovations streamline the signing process and enhance user experience signNowly. Customers benefit from faster workflows and improved efficiency when managing documents.

-

How can I integrate airSlate SignNow into my existing workflow post 05 163 2019?

After the 05 163 2019 update, airSlate SignNow offers seamless integrations with numerous third-party applications. This means you can easily connect our platform with tools your business already uses. Integration is straightforward and ensures a smooth transition, allowing you to enhance productivity instantly.

-

What are the benefits of using airSlate SignNow, especially with reference to 05 163 2019?

The 05 163 2019 updates have greatly amplified the benefits of using airSlate SignNow, notably in efficiency and security. By choosing airSlate SignNow, businesses can ensure reliable and secure document signing processes. This empowers teams to focus more on productivity rather than paperwork.

-

Can airSlate SignNow assist businesses with compliance issues post 05 163 2019?

Yes, airSlate SignNow is designed to assist businesses in addressing compliance issues effectively, especially since the enhancements made during the 05 163 2019 release. Our platform complies with major eSignature laws and regulations, giving customers peace of mind. This allows businesses to navigate compliance requirements smoothly.

-

What customer support options are available for users since the 05 163 2019 update?

Since the 05 163 2019 update, airSlate SignNow has improved its customer support options signNowly. Users have access to 24/7 support through various channels, including chat, email, and phone, ensuring prompt resolution of any queries. Our dedicated support team is always ready to assist customers in maximizing their experience.

Get more for No Tax Due Information Report Franchise Tax

Find out other No Tax Due Information Report Franchise Tax

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe