PDF Texas Franchise Tax Final No Tax Due Information Report 2022

What is the PDF Texas Franchise Tax Final No Tax Due Information Report

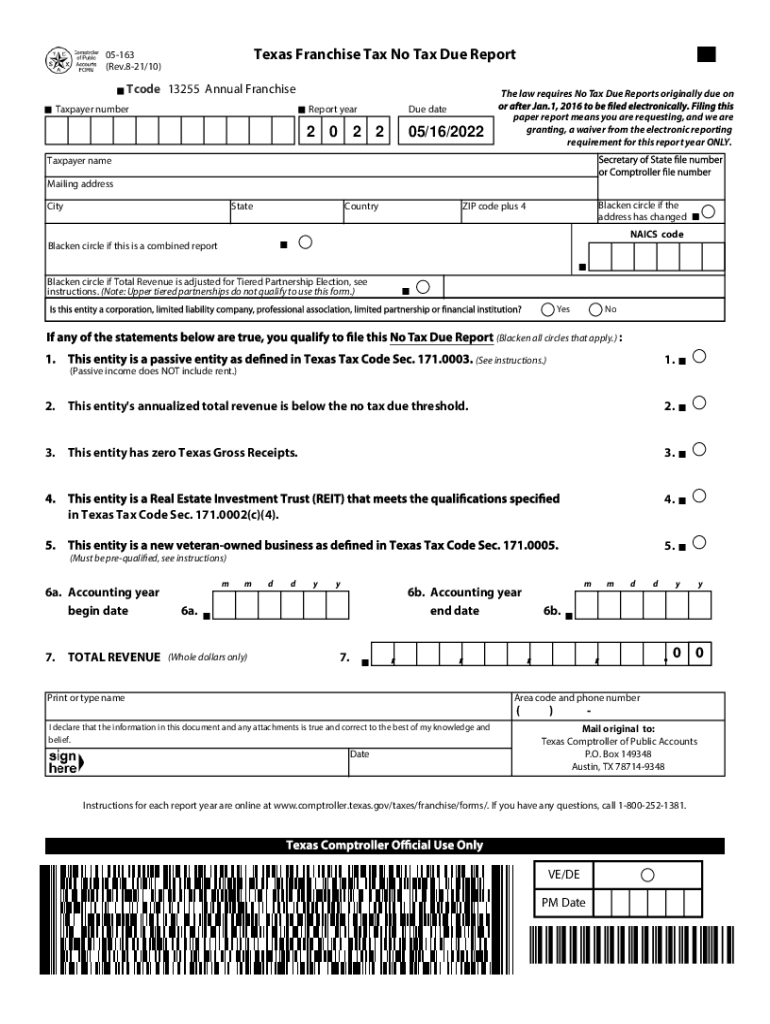

The PDF Texas Franchise Tax Final No Tax Due Information Report is an official document issued by the Texas Comptroller's office. This report serves as confirmation that a business entity has no franchise tax due for a specified period. It is particularly important for entities that are no longer in operation or have not generated revenue that would subject them to franchise tax obligations. The report can be requested by various business types, including corporations, limited liability companies (LLCs), and partnerships.

How to obtain the PDF Texas Franchise Tax Final No Tax Due Information Report

To obtain the PDF Texas Franchise Tax Final No Tax Due Information Report, businesses must first ensure that they meet the eligibility criteria. This typically involves confirming that the entity has no outstanding franchise tax obligations. The report can be requested online through the Texas Comptroller's website, where users can fill out the necessary forms. Alternatively, businesses may also request the report via mail or in person at designated Comptroller offices.

Steps to complete the PDF Texas Franchise Tax Final No Tax Due Information Report

Completing the PDF Texas Franchise Tax Final No Tax Due Information Report involves several key steps:

- Gather necessary information about the business entity, including its legal name, taxpayer identification number, and any relevant financial data.

- Access the official form from the Texas Comptroller's website or through authorized sources.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the completed form for accuracy and compliance with Texas regulations.

- Submit the form electronically or via mail, depending on the chosen submission method.

Legal use of the PDF Texas Franchise Tax Final No Tax Due Information Report

The PDF Texas Franchise Tax Final No Tax Due Information Report holds legal significance as it serves as proof that a business entity has fulfilled its tax obligations. This document can be vital for various legal and financial transactions, including closing business accounts, applying for loans, or during audits. It is essential for businesses to maintain this report as part of their official records to demonstrate compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the Texas Franchise Tax Final No Tax Due Information Report when required can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action from the Texas Comptroller's office. It is crucial for entities to understand their filing obligations and ensure timely submission to avoid these consequences.

Eligibility Criteria

Eligibility for the PDF Texas Franchise Tax Final No Tax Due Information Report generally requires that the business entity has not conducted any taxable business in Texas during the reporting period. Additionally, entities must not have any outstanding franchise tax liabilities. Specific eligibility criteria may vary based on the type of business entity, so it is advisable to consult the Texas Comptroller's guidelines for detailed requirements.

Quick guide on how to complete pdf 2022 texas franchise tax final no tax due information report

Complete PDF Texas Franchise Tax Final No Tax Due Information Report effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without hold-ups. Handle PDF Texas Franchise Tax Final No Tax Due Information Report on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign PDF Texas Franchise Tax Final No Tax Due Information Report with ease

- Obtain PDF Texas Franchise Tax Final No Tax Due Information Report and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign PDF Texas Franchise Tax Final No Tax Due Information Report and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2022 texas franchise tax final no tax due information report

Create this form in 5 minutes!

How to create an eSignature for the pdf 2022 texas franchise tax final no tax due information report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas franchise tax no tax due threshold?

The Texas franchise tax no tax due threshold refers to the revenue limit set by the state, below which businesses are not required to pay franchise tax. As of the latest updates, businesses earning less than $1.23 million are considered to have 'no tax due.' This information is crucial for Texas business owners looking to understand their tax obligations.

-

How can airSlate SignNow help with franchise tax documentation?

airSlate SignNow simplifies the process of managing and signing franchise tax documents through its user-friendly platform. With features like electronic signatures and document storage, businesses can efficiently gather necessary paperwork related to the Texas franchise tax no tax due status. This helps ensure compliance while saving time and reducing paper waste.

-

Is airSlate SignNow cost-effective for small businesses managing Texas franchise tax?

Yes, airSlate SignNow offers budget-friendly pricing plans tailored for small businesses, making it a cost-effective solution for managing Texas franchise tax documents. The clear pricing structure without hidden fees helps businesses see the value while maintaining their compliance with the Texas franchise tax no tax due guidelines.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides robust features such as customizable templates, in-app payment processing, and advanced tracking capabilities. These features not only enhance the signing experience but also facilitate easier management of documents related to Texas franchise tax no tax due filings, ensuring businesses stay organized and efficient.

-

Can airSlate SignNow integrate with my accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, enabling smooth data transfer and document management. By connecting with your accounting system, managing your records related to the Texas franchise tax no tax due becomes effortless and streamlined.

-

How secure is airSlate SignNow for my sensitive tax documents?

Security is a top priority for airSlate SignNow; the platform utilizes advanced encryption and security protocols to protect sensitive documents. This ensures that all transactions and documents related to your Texas franchise tax no tax due filings are handled safely and securely, giving users peace of mind.

-

Does airSlate SignNow provide support for understanding Texas franchise tax regulations?

Yes, airSlate SignNow offers resources and customer support to help users navigate the complexities of Texas franchise tax regulations, including the no tax due provision. Their knowledgeable support team is ready to assist you with any inquiries, ensuring you make the most out of your document management solutions.

Get more for PDF Texas Franchise Tax Final No Tax Due Information Report

- Notice of default for past due payments in connection with contract for deed massachusetts form

- Final notice of default for past due payments in connection with contract for deed massachusetts form

- Assignment of contract for deed by seller massachusetts form

- Notice of assignment of contract for deed massachusetts form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement massachusetts form

- Buyers home inspection checklist massachusetts form

- Sellers information for appraiser provided to buyer massachusetts

- Fill out and submit a personal history statement pdf capcog form

Find out other PDF Texas Franchise Tax Final No Tax Due Information Report

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast