Are You a Bona Fide Resident of Puerto Rico? Get Ready 2023-2026

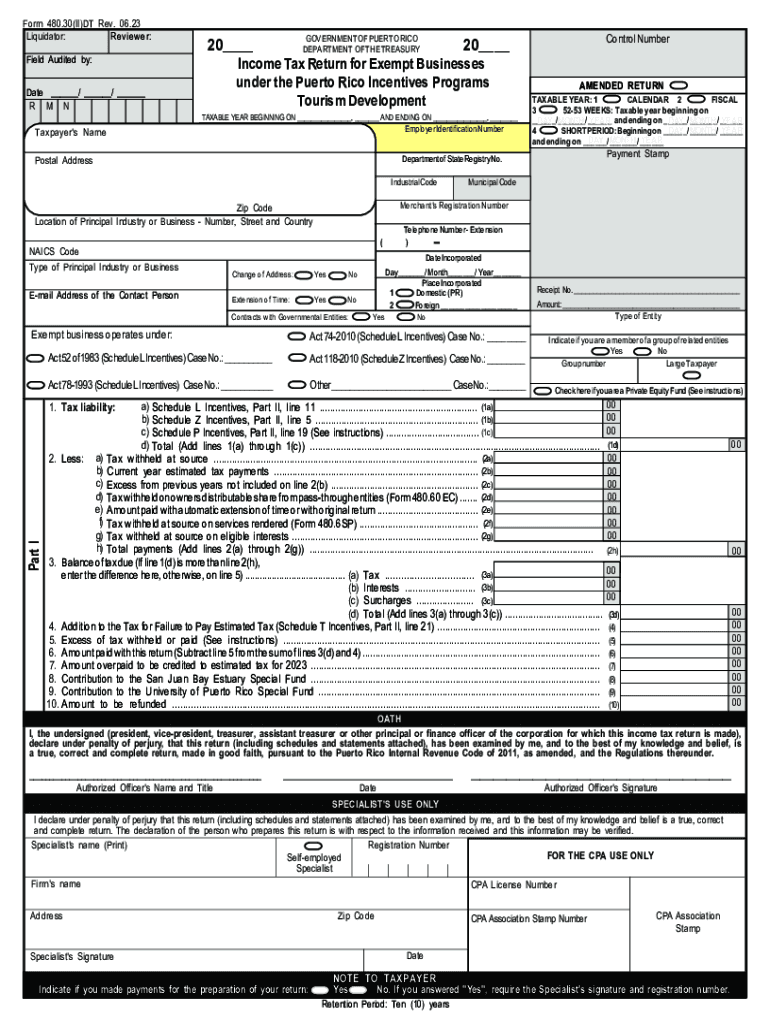

Understanding the Puerto Rico 480 Form

The Puerto Rico 480 form, also known as Form 480, is a crucial document used for reporting income earned within Puerto Rico. It is primarily utilized by individuals and businesses to declare their income and calculate their tax obligations. This form is essential for residents and non-residents who have income sourced from Puerto Rico. Understanding its purpose and requirements can help ensure compliance with local tax laws.

Steps to Complete the Puerto Rico 480 Form

Completing the Puerto Rico 480 form involves several key steps:

- Gather necessary documents, including income statements and any relevant financial records.

- Fill out the personal information section, ensuring accuracy in your name, address, and identification number.

- Report all sources of income, including wages, dividends, and rental income.

- Calculate deductions and credits applicable to your situation, which may reduce your overall tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Puerto Rico 480 form is essential to avoid penalties. The standard deadline for submission is typically April 15 of the following year, aligning with the federal tax filing deadline. However, specific circumstances may lead to different deadlines, such as extensions for certain taxpayers. It is crucial to stay informed about any changes to these dates, especially in light of local tax regulations.

Required Documents for Submission

To successfully complete and submit the Puerto Rico 480 form, you will need several documents:

- W-2 forms or other income statements from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any deductions or credits you plan to claim.

- Identification documents, such as a Social Security number or Puerto Rico tax ID.

Eligibility Criteria for Filing

Eligibility to file the Puerto Rico 480 form depends on various factors, including residency status and the source of income. Generally, individuals who are bona fide residents of Puerto Rico or those who earn income from Puerto Rican sources must file this form. Additionally, specific income thresholds may apply, determining whether you are required to file based on your total income for the year.

Penalties for Non-Compliance

Failure to file the Puerto Rico 480 form by the deadline can result in significant penalties. These may include fines and interest on any unpaid taxes. It is important to understand the implications of non-compliance, as the Puerto Rican Treasury Department actively enforces tax regulations. Ensuring timely and accurate filing can help avoid these consequences.

Quick guide on how to complete are you a bona fide resident of puerto rico get ready

Complete Are You A Bona Fide Resident Of Puerto Rico? Get Ready effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Are You A Bona Fide Resident Of Puerto Rico? Get Ready on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and electronically sign Are You A Bona Fide Resident Of Puerto Rico? Get Ready without effort

- Locate Are You A Bona Fide Resident Of Puerto Rico? Get Ready and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or obscure sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, annoying form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign Are You A Bona Fide Resident Of Puerto Rico? Get Ready and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct are you a bona fide resident of puerto rico get ready

Create this form in 5 minutes!

How to create an eSignature for the are you a bona fide resident of puerto rico get ready

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is formulario 480 Puerto Rico and why do I need it?

Formulario 480 Puerto Rico is a tax form required for certain income reporting in Puerto Rico. If you are a business or individual earning income, you may need to file this form to comply with local tax regulations. Utilizing airSlate SignNow can streamline the eSigning process for this form.

-

How does airSlate SignNow simplify the completion of formulario 480 Puerto Rico?

airSlate SignNow provides an easy-to-use platform that allows you to fill out and eSign formulario 480 Puerto Rico quickly and efficiently. With its intuitive interface, you can complete the form without any hassle. This not only saves time but also ensures that your submission is accurate and compliant.

-

Is airSlate SignNow a cost-effective solution for handling formulario 480 Puerto Rico?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing all your document signing needs, including formulario 480 Puerto Rico. With competitive pricing plans, you can efficiently handle your forms without sacrificing quality. By minimizing paperwork and reducing processing time, the platform delivers great value for businesses.

-

Can I integrate airSlate SignNow with other tools I use for formulario 480 Puerto Rico?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easier to manage your documents alongside your existing tools. Whether you use accounting software or project management tools, including formulario 480 Puerto Rico in your workflow is simple and efficient.

-

What features does airSlate SignNow offer for formulario 480 Puerto Rico?

airSlate SignNow includes essential features such as document templates, automatic reminders, and secure eSigning for formulario 480 Puerto Rico. These tools help ensure that your forms are completed and submitted on time while maintaining compliance. Additionally, you can track the status of your document in real-time.

-

How secure is airSlate SignNow when handling formulario 480 Puerto Rico?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption technology to protect sensitive information in formulario 480 Puerto Rico and other documents. You can rest assured knowing that your data is safe and confidential throughout the signing process.

-

Is there a mobile app for airSlate SignNow to manage formulario 480 Puerto Rico?

Yes, airSlate SignNow offers a mobile application that allows you to manage formulario 480 Puerto Rico from anywhere. This flexibility enables you to complete, send, and eSign documents on the go. The mobile app maintains all the features you need for a smooth document management experience.

Get more for Are You A Bona Fide Resident Of Puerto Rico? Get Ready

Find out other Are You A Bona Fide Resident Of Puerto Rico? Get Ready

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer