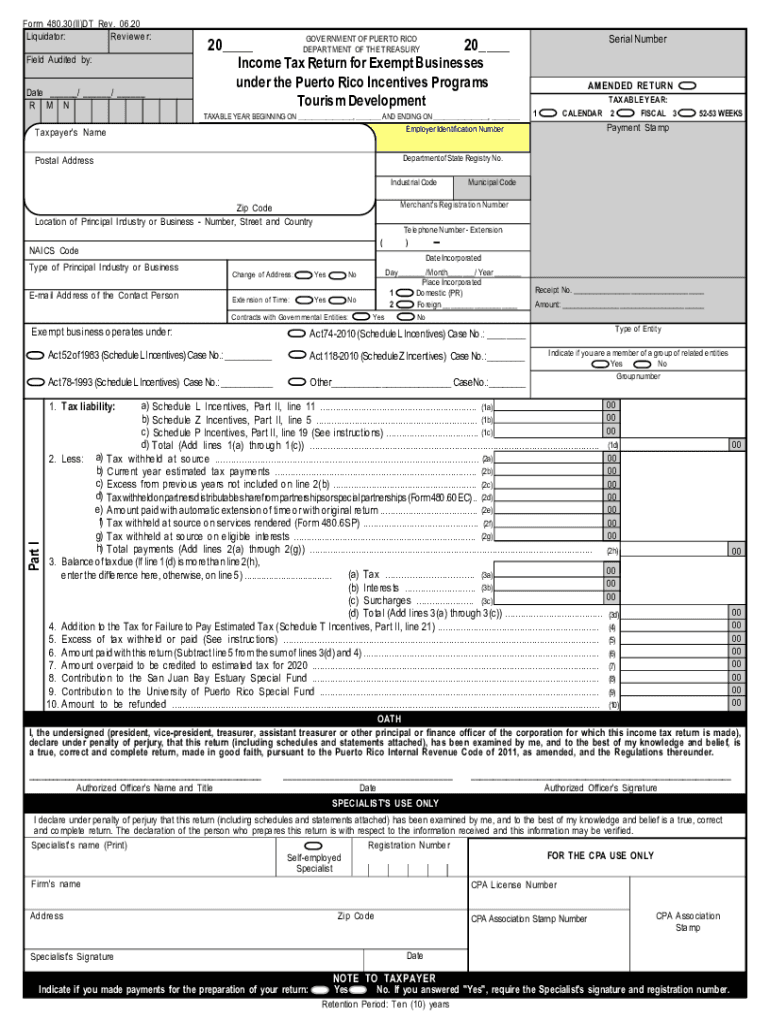

DT480 30II 2020

What is the Form 480?

The Form 480, also known as the Puerto Rico tax form, is a crucial document used for reporting income and calculating taxes owed by individuals and businesses in Puerto Rico. This form is essential for ensuring compliance with local tax laws and regulations. It is primarily utilized by residents and entities earning income within Puerto Rico, making it a vital part of the tax filing process.

Steps to Complete the Form 480

Completing the Form 480 involves several key steps to ensure accuracy and compliance:

- Gather Necessary Documents: Collect all relevant financial documents, including income statements, previous tax returns, and any applicable deductions.

- Fill Out Personal Information: Provide your name, address, and Social Security number or Employer Identification Number (EIN).

- Report Income: Accurately list all sources of income, including wages, dividends, and any other earnings.

- Calculate Deductions: Identify and apply any deductions you qualify for, which can help reduce your taxable income.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Legal Use of the Form 480

The Form 480 is legally recognized in Puerto Rico as a valid means of reporting income and fulfilling tax obligations. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. Compliance with local tax laws is essential, as failure to file or inaccuracies can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 480 is critical for avoiding penalties. Typically, the form must be submitted by the end of April each year. However, specific deadlines may vary based on individual circumstances or changes in tax regulations. It is advisable to stay informed about any updates from the Puerto Rico Department of Treasury.

Form Submission Methods

The Form 480 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers opt to file electronically through authorized platforms, which can streamline the process.

- Mail Submission: Completed forms can be mailed to the appropriate tax authority, ensuring they are sent well before the deadline.

- In-Person Submission: Taxpayers may also choose to submit their forms in person at designated tax offices for direct assistance.

Examples of Using the Form 480

The Form 480 is utilized in various scenarios, including:

- Individuals reporting wages and salaries earned in Puerto Rico.

- Businesses calculating their tax liabilities based on income generated within the territory.

- Self-employed individuals documenting their earnings and expenses to determine net income.

Quick guide on how to complete dt48030ii

Easily Prepare DT480 30II on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle DT480 30II on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign DT480 30II Effortlessly

- Find DT480 30II and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign DT480 30II to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dt48030ii

Create this form in 5 minutes!

How to create an eSignature for the dt48030ii

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is form 480 and how can airSlate SignNow assist with it?

Form 480 is a specific document required for certain tax reporting purposes. airSlate SignNow simplifies the process of completing and signing form 480 by providing an intuitive platform for eSigning and collaborative document management. Our solution ensures that you can secure your signatures and have an organized approach to tracking your forms.

-

How much does it cost to utilize airSlate SignNow for form 480?

Pricing for airSlate SignNow varies based on the features you need, starting from a basic plan for small teams to more comprehensive packages for larger organizations. Each plan offers the tools necessary to manage form 480 efficiently and cost-effectively. You can explore our pricing page for detailed options and choose the best fit for your business.

-

What features does airSlate SignNow offer for managing form 480?

airSlate SignNow comes packed with features tailored for managing documents like form 480, including eSignature capabilities, document templates, and advanced tracking. These tools enhance collaboration and improve the speed with which you can prepare and file essential documents. Our platform is designed to make the management of form 480 seamless.

-

Is airSlate SignNow secure when handling form 480?

Absolutely! airSlate SignNow prioritizes security with top-notch encryption and compliant practices to protect your sensitive information, including form 480. We ensure that all transactions and storage of documents within our platform meet industry standards, so you can have peace of mind while handling your forms.

-

Can I integrate airSlate SignNow with other applications for form 480?

Yes, airSlate SignNow offers integration options with various applications such as Google Drive, Dropbox, and CRM systems. This functionality allows for a more streamlined process when dealing with form 480, as you can easily import, export, and manage your documents across platforms. Our integrations are designed to enhance your workflow and save you time.

-

What are the benefits of using airSlate SignNow for form 480?

Using airSlate SignNow for form 480 offers several benefits, including time savings, improved accuracy, and reduced paperwork. The eSigning feature allows you to process your forms quickly and from anywhere, enhancing convenience. Additionally, the automated workflows minimize errors and ensure that your documents are signed and filed promptly.

-

How does airSlate SignNow improve the completion process of form 480?

airSlate SignNow streamlines the completion of form 480 by providing a user-friendly interface that simplifies document preparation and eSigning. Our platform allows users to fill out forms digitally, track changes, and ensure compliance with legal standards. This efficiency reduces the headaches often associated with paper forms and traditional signing methods.

Get more for DT480 30II

- How to fill sworn affidavit form

- Union bank dd form pdf download 509597881

- Printable bladder diary template form

- Montana polst form pdf

- Diwali word search printable form

- Issa nutrition final exam answers form

- First aid kit usage log form

- Firerescue richmond cawp contentuploadsrichmond fire rescue mobile food truck inspection application form

Find out other DT480 30II

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast